The most recent on-chain information reveals that Bitcoin (BTC) has damaged its all-time excessive (ATH) in realized capitalization for the fourth consecutive week. Concurrently, each Bitcoin whales and spot exchange-traded funds (ETFs) are steadily rising their holdings – indicating rising investor confidence.

Bitcoin Realized Capitalization Hits New ATH

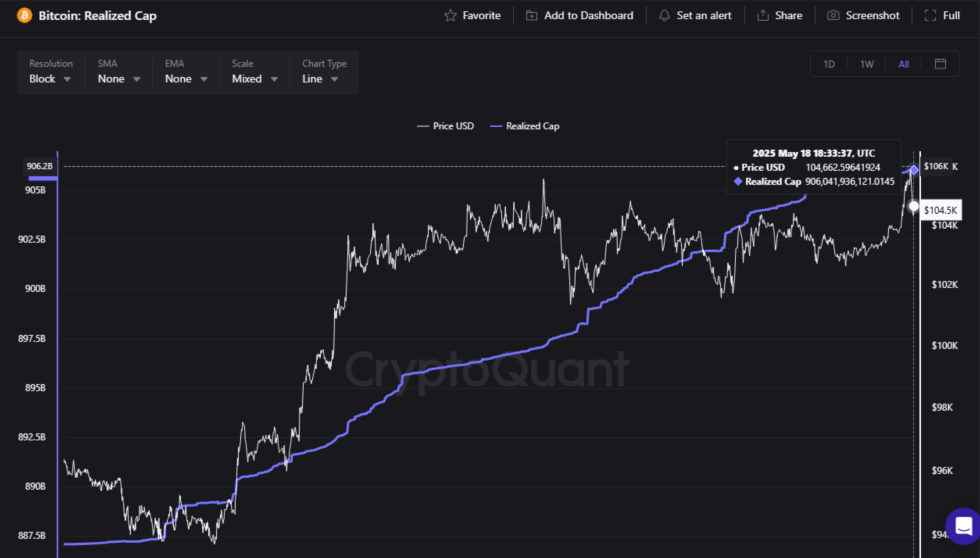

Based on a current CryptoQuant Quicktake submit by contributor Carmelo_Aleman, Bitcoin’s realized capitalization has surpassed its earlier report, reaching over $906 billion as of Could 18, 2025. This milestone marks the fourth straight week by which this key on-chain metric has hit a brand new excessive.

For the uninitiated, Bitcoin’s realized capitalization is the entire worth of all BTC in circulation, calculated primarily based on the worth every coin final moved slightly than the present market value. This metric affords a extra correct reflection of true capital influx and investor conviction, excluding dormant or misplaced cash.

Carmelo notes that BTC has been consolidating close to the day by day resistance degree of $104,731 for almost 10 days. Throughout this part, the main cryptocurrency has continued to build up capital, probably gearing up for a major breakout.

If BTC can breach this resistance, the following main hurdle lies at $107,757. Clearing this degree might open the door to a contemporary all-time excessive, supported by a number of bullish on-chain indicators. Carmelo provides:

On Could 8, when this range-bound part started, the entire worth of all UTXOs was $891,642,358, which means that in simply 10 days, new Bitcoin investments have added $14,399,578, reflecting a 1.61% enhance in Realized Capitalization.

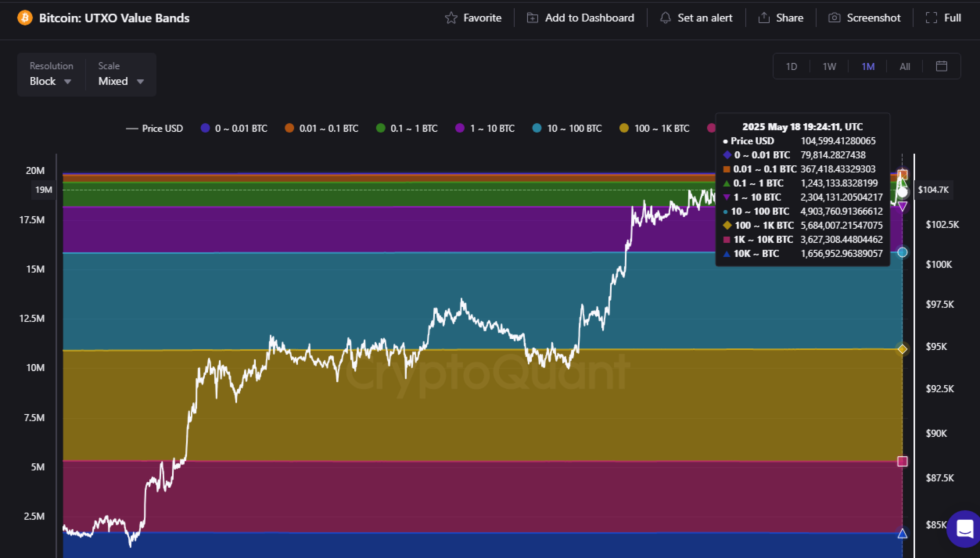

Based on Bitcoin UTXO Worth Bands, essentially the most important accumulation over the previous 10 days has come from wallets holding 100 to 1,000 BTC. These wallets elevated their collective holdings from 5.56 million BTC to five.68 million BTC, representing a 2.20% acquire throughout this era.

Amongst ETFs, BlackRock’s IBIT spot ETF stands out as the one main fund to extend its BTC publicity. Its holdings rose from 621,600 BTC to 631,902 BTC, a 1.66% enhance. In distinction, most different ETFs have both taken income or held their positions regular.

BTC Heading To $120,000?

As Bitcoin trades simply 5.1% under its present ATH, analysts are speculating on potential upside targets for this market cycle. One mannequin, the Wyckoff Accumulation sample, suggests BTC might high out close to $120,000.

Additional supporting this bullish narrative is the truth that almost 100,000 BTC has been withdrawn from exchanges over the previous three weeks – usually an indication of long-term accumulation and lowered promoting strain. At press time, BTC trades at $103,450, down 1.2% prior to now 24 hours.

Featured Picture from Unsplash.com, charts from CryptoQuant and TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our staff of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.