- Ethereum hits $3,125 with whales accumulating closely and trade provide at decade lows.

- Institutional ETH inflows hit $205M final week as ETF buzz and Pectra upgrades gasoline demand.

- Merchants keep cautious as hedge funds construct shorts, however long-term holders hold stacking ETH.

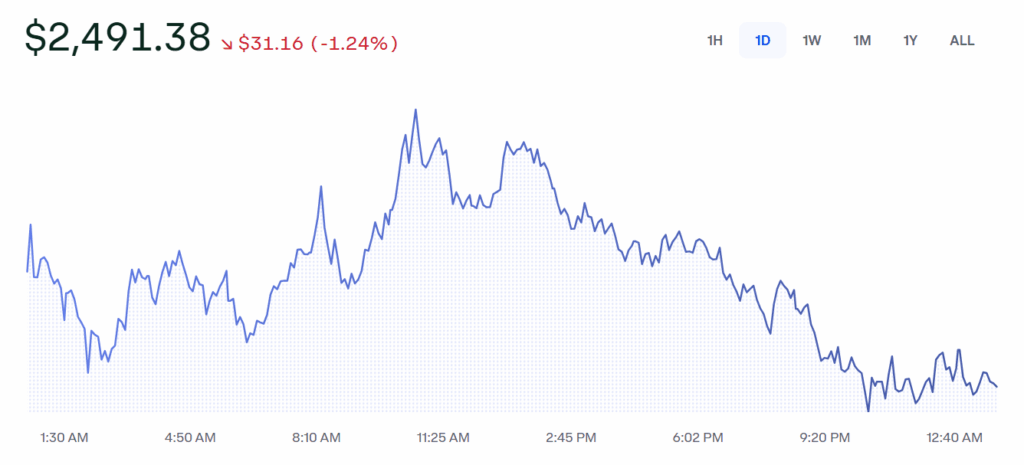

Ethereum‘s value simply pushed as much as round $3,125—roughly a 2.3% climb from the day earlier than. This bounce extends final week’s rally, which actually took off after the Pectra improve rolled out. On-chain alerts are flashing inexperienced too, with merchants pointing to a transparent shift in capital rotation. ETH is outpacing many altcoins recently, and that’s not going unnoticed.

Whale Exercise and Shrinking Alternate Provide

Buying and selling quantity surged almost 19%, now sitting round $12.4 billion—an indication the market’s heating up. Santiment information reveals that solely 4.9% of all ETH continues to be parked on exchanges, which is the bottom it’s been in 10 years. That’s a serious accumulation sign. The truth is, wallets holding over 10,000 ETH have snapped up an extra 450,000 tokens since late April. That type of shopping for stress often doesn’t go ignored.

Funds Circulation In, Eyes on ETF Choice

ETH-focused funding merchandise noticed a powerful $205 million influx final week, making it the most important amongst crypto property. And in response to SoSoValue, U.S. spot Ether ETFs noticed $30 million in internet inflows this previous month. BlackRock’s ETH fund now holds round $2.9 billion in property. The Pectra improve performed a component on this enhance—it raised validator staking limits and introduced account abstraction, which is pushing exercise throughout Ethereum’s Layer-2s.

Blended Alerts from Hedge Funds

Nonetheless, not everybody’s satisfied the rally sticks. FXStreet says hedge funds are leaning into quick bets on ETH, probably bracing for a pullback or working delta-neutral setups. In the meantime, on-chain watchers say long-term holders have been stacking all Might. CryptoRank reviews that over 1,000,000 ETH has exited exchanges prior to now 30 days. “Persons are selecting to carry, not flip,” the platform stated.

Broader Market Tailwinds Lend Help

Zooming out, ETH’s rally is using the identical wave lifting U.S. tech shares. The NASDAQ’s up about 1.3%, and buyers appear to be respiration simpler because of easing commerce tensions and robust earnings reviews. Add in Ethereum’s deep liquidity, upcoming ETF catalysts, and staking yields, and also you’ve obtained a recipe for bullish sentiment. Nonetheless, merchants say watch the macro setting—momentum would possibly shift, however for now, Ether’s sitting on fairly stable floor.