Altcoin Season expectations are fading as current indicators level to weakening momentum. Whereas FTX’s upcoming $5 billion reimbursement on Might 30 may inject contemporary liquidity into the market, capital is shifting again into Bitcoin.

BTC dominance has rebounded, and the ETH/BTC ratio has declined, each suggesting altcoins are shedding power. The Altcoin Season Index has dropped to 25, confirming that Bitcoin stays firmly in management for now.

FTX’s $5 Billion Reimbursement Might Gas June Altseason — However Momentum Is Fading

FTX will distribute over $5 billion to permitted collectors on Might 30, marking one of many largest single-day payouts in crypto chapter historical past.

Many analysts imagine this sudden liquidity injection may reignite altcoin momentum in June, as recipients could look to reinvest out there.

That optimism briefly aligned with market construction—between Might 7 and Might 13, Bitcoin dominance dropped sharply from 65.5% to below 62.2%, a virtually 5% decline that fueled hypothesis that an altcoin season was underway.

Nevertheless, that sentiment has since cooled: from Might 14 to Might 20, BTC dominance climbed again 3%, reversing a lot of the prior week’s shift and suggesting capital is rotating again into Bitcoin.

One other key sign, the ETH/BTC ratio, tells an identical story. Between Might 7 and Might 13, Ethereum gained considerably towards Bitcoin, with the ratio climbing virtually 38%, additional amplifying the idea {that a} broader altcoin breakout was starting.

However within the following week—Might 14 to Might 20—that very same ratio dropped 8.7%, indicating weakening relative power for ETH and dampening altseason expectations.

These shifts recommend that whereas the FTX payout could inject contemporary capital, the altcoin season narrative is shedding momentum—a minimum of for now.

Altcoin Momentum Fades as Index Hits 25 — Will FTX Liquidity Change That?

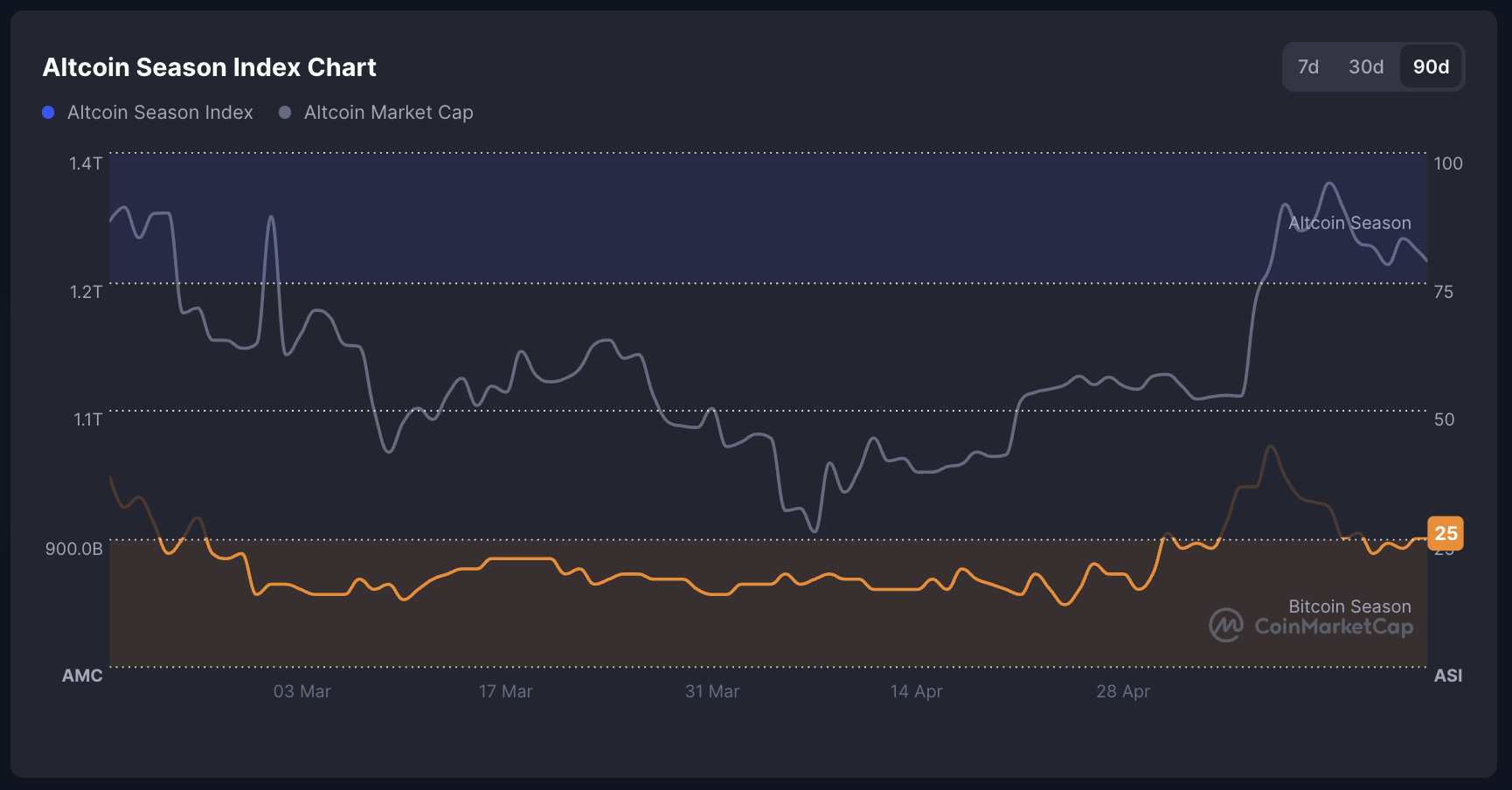

The whole crypto market cap, excluding Bitcoin, is presently at $1.17 trillion, up from $1.01 trillion on Might 7 however down sharply from $1.26 trillion on Might 13.

This pattern means that whereas altcoins noticed a quick wave of inflows in early Might, the momentum has weakened, with almost $90 billion exiting the house in only one week. The pullback highlights a scarcity of sustained confidence in a full-scale altcoin rally.

Nevertheless, the upcoming $5 billion liquidity injection from FTX repayments on Might 30 may restore the capital altcoins have to reignite momentum and presumably spark an altcoin season in June.

In the meantime, the Altcoin Season Index, tracked by CoinMarketCap, has dropped from 43 on Might 9 to 25—formally getting into Bitcoin Season territory.

The index measures how most of the prime 100 cash (excluding stablecoins and wrapped property) have outperformed Bitcoin over the past 90 days. A rating above 75 indicators Altcoin Season, whereas under 25 signifies Bitcoin dominance.

With solely 1 / 4 of prime cash outperforming BTC, the index confirms that Bitcoin is presently again in management, although the upcoming liquidity surge may nonetheless flip the pattern.

Disclaimer

In step with the Belief Venture pointers, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. All the time conduct your personal analysis and seek the advice of with an expert earlier than making any monetary selections. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.