- Institutional Accumulation: Regardless of SOL being down 5% and buying and selling under $180, institutional buyers are staking closely, with over 65% of the provision locked and Q1 income hitting $1.2B.

- Bearish Technicals: The Ichimoku Cloud, BBTrend (-4.31), and a possible EMA dying cross all sign short-term weak spot and attainable additional draw back.

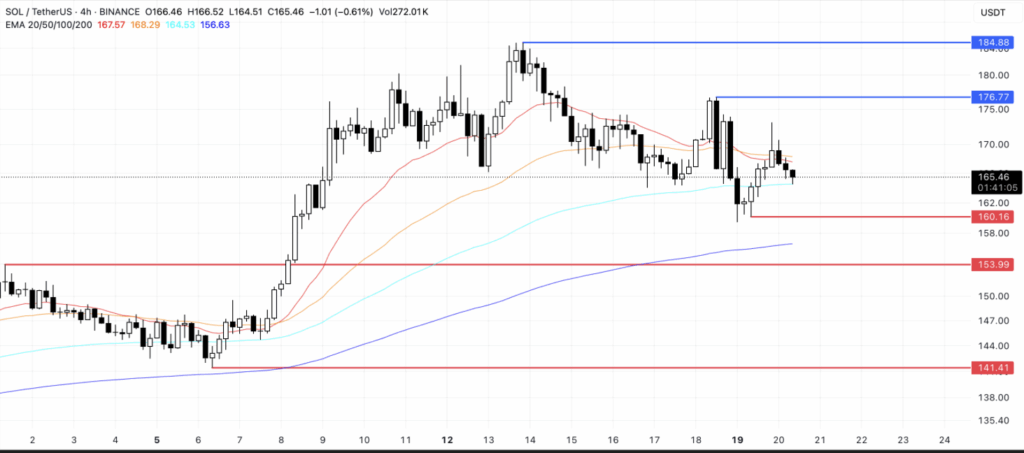

- Key Ranges: If SOL drops under $160, it may slide to $141; if it breaks above $176.77, a rally towards $184.88 would possibly observe.

Solana (SOL) has been drifting — down about 5% over the previous week and staying below $180 for six straight days. However right here’s the twist: establishments are quietly piling in, staking enormous chunks of SOL whereas retail sentiment stays lukewarm. Seems to be like the large gamers may be prepping for the following altseason.

Institutional Cash Flows In, However Charts Nonetheless Look Shaky

Regardless of weaker volumes within the altcoin area, heavy hitters have been accumulating SOL. Staking ranges? Over 65% of the entire provide is now locked up. And Solana apps racked up $1.2 billion in income in Q1 2025 — the very best in a yr.

On-chain flows look stable, and the ecosystem’s increasing — however the technical image is… effectively, combined at greatest.

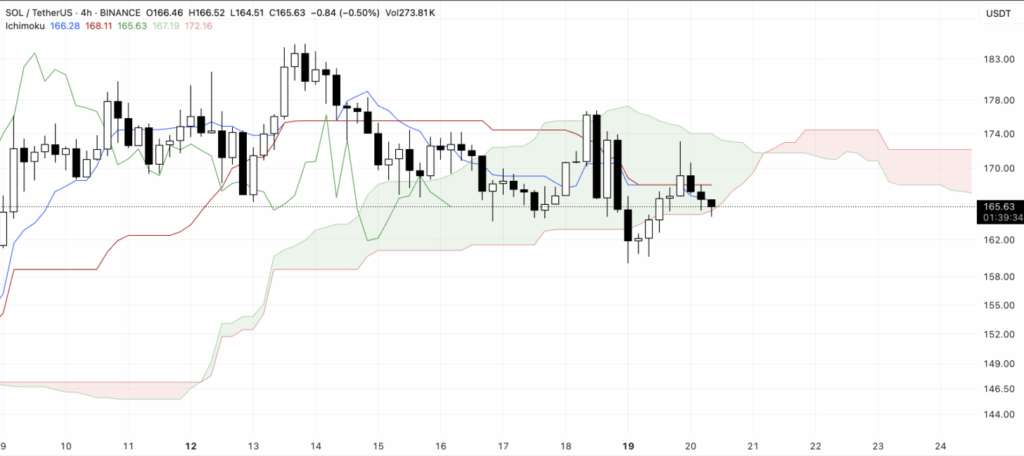

Ichimoku Cloud: Impartial to Bearish

Wanting on the Ichimoku Cloud, SOL’s value is sort of simply hanging out contained in the cloud — signaling indecision. The blue Tenkan-sen is sitting under the pink Kijun-sen, an indication of short-term weak spot. The Chikou Span? It’s tangled in latest value motion — not useful.

The cloud forward turns pink and flat, pointing to resistance and extra sideways or downward motion except SOL breaks out exhausting.

BBTrend: Nonetheless Bearish

BBTrend is sitting at -4.31 — its third day within the pink. That’s not nice. It’s been hovering round -4, which alerts sustained bearish stress. The BBTrend tracks value motion relative to Bollinger Band width, and something under 0 leans bearish.

With no upside growth in sight, the indicator suggests consolidation and even one other leg down — except one thing huge snaps the pattern.

Loss of life Cross Incoming?

EMA strains are about to cross, and never in a great way. A dying cross could possibly be forming, which occurs when the short-term EMA dips under the long-term — a traditional bearish warning.

If SOL breaks under $160, subsequent stops could possibly be $153.99 and even $141 if promoting stress ramps up. On the flip facet, if bulls present up, look ahead to a transfer above $176.77. Which may open the door to $184.88.

Ultimate Thought

Lengthy-term fundamentals? Nonetheless wanting sturdy. However proper now, value motion’s telling a unique story. It’s a ready recreation — and a breakout both means may flip the script quick.