On-chain knowledge reveals the Ethereum Provide on Exchanges has plunged to a brand new all-time low as traders have continued to withdraw ETH.

Ethereum Provide On Exchanges Has Continued Its Downtrend Just lately

In a brand new submit on X, the on-chain analytics agency Santiment has mentioned concerning the newest pattern within the Provide on Exchanges for Ethereum. The “Provide on Exchanges” refers to an indicator that measures, as its identify already suggests, the proportion of the overall ETH provide that’s at the moment sitting within the wallets connected to centralized exchanges.

When the worth of this metric rises, it means the traders are depositing a web variety of tokens to those platforms. As one of many essential the explanation why holders might switch their cash to exchanges is for selling-related functions, this sort of pattern can have a bearish affect on the coin’s worth.

Alternatively, the indicator taking place implies that provide is leaving the exchanges. Usually, traders withdraw their cash into self-custodial wallets once they plan to carry them in the long run, so such a pattern will be bullish for the cryptocurrency.

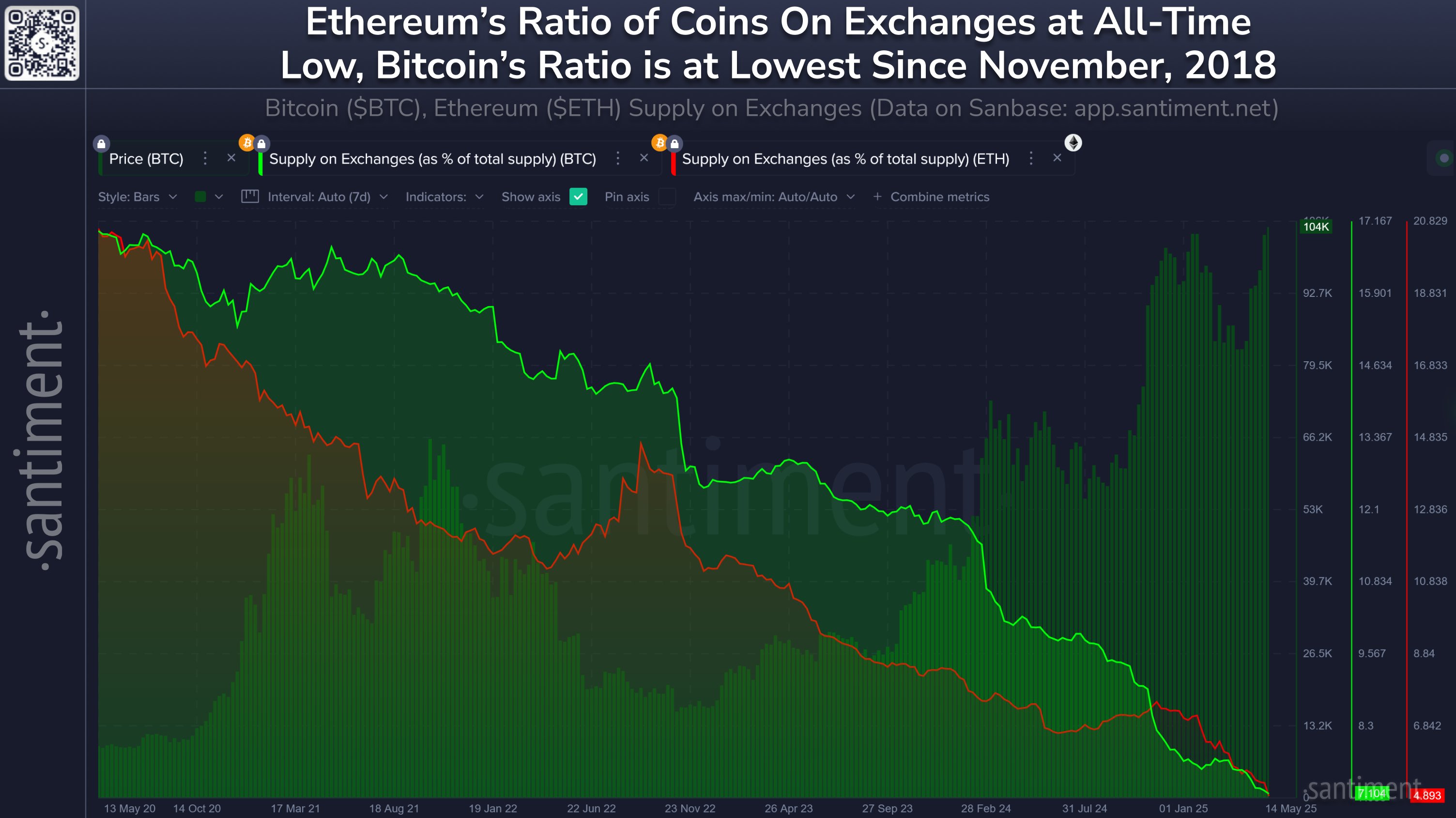

Now, right here is the chart shared by the analytics agency that reveals the pattern within the Provide on Exchanges for Ethereum over the previous couple of years:

The worth of the metric seems to have been following a downward trajectory for some time now | Supply: Santiment on X

As displayed within the above graph, the Ethereum Provide on Exchanges has been exhibiting a long-term downtrend, however there have been intervals of non permanent deviation.

One such section got here across the time of the bull run towards the top of 2024, a possible signal that some traders determined to exit from ETH throughout the worthwhile alternative.

Within the months because the peak, although, the indicator has gone again to the downward trajectory, suggesting that holders have resumed their accumulation. Immediately, the metric is sitting at 4.9%, which is the bottom worth ever recorded.

In the identical chart, Santiment has additionally connected the information for the Provide on Exchanges of Bitcoin. It will seem that the primary cryptocurrency has additionally seen a pattern of web outflows throughout the previous couple of years and in contrast to ETH, there haven’t been any notable situations of deviation.

Over the previous 5 years, traders have withdrawn 1.7 million BTC from exchanges. This decline has taken the metric’s worth to 7.1%, which is the bottom since November 2018. In the identical interval, ETH holders have taken out 15.3 million tokens of the asset from these platforms.

One thing to remember is that whereas exchanges performed a central function available in the market years in the past, that’s not strictly the case. The emergence of the exchange-traded funds (ETFs) means there’s now one other main gateway into the sector, so change outflows might not carry fairly the identical affect as earlier than anymore.

ETH Value

On the time of writing, Ethereum is floating round $2,500, down greater than 2% within the final week.

Appears like the worth of the coin hasn't moved a lot just lately | Supply: ETHUSDT on TradingView

Featured picture from Dall-E, Santiment.web, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our staff of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.