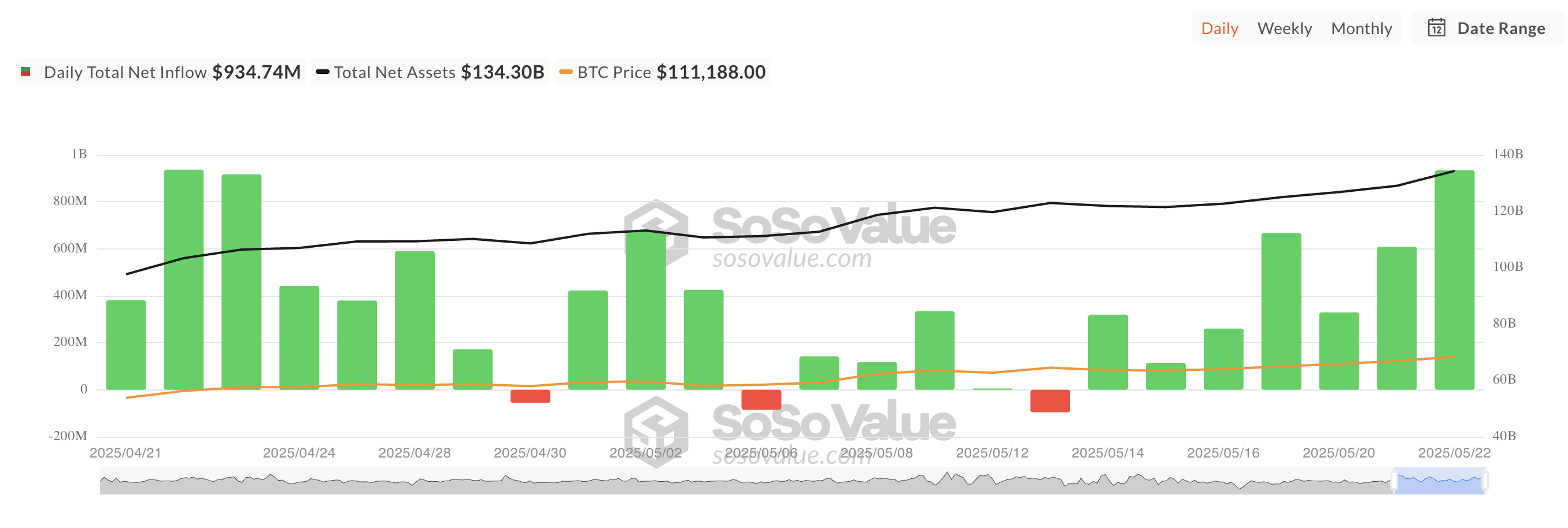

Main coin Bitcoin prolonged its rally yesterday, reaching a brand new all-time excessive of $111,968. The worth efficiency triggered a wave of investor enthusiasm, driving greater than $900 million in capital influx into spot Bitcoin ETFs.

This marked the most important single-day influx since April 22.

$934 Million Flood into Bitcoin ETFs in a Day

Yesterday, inflows into BTC-backed funds totaled $934.74 million, its highest single-day influx since April 22. In accordance with SosoValue, it additionally marked the seventh consecutive day of optimistic inflows, signaling a robust resurgence in institutional confidence this week.

BTC’s optimistic worth efficiency this week has acted as a catalyst for the renewed curiosity in ETFs. The sustained inflows counsel that traders usually are not simply responding to short-term momentum however are additionally gaining confidence within the asset’s long-term potential.

On Thursday, BlackRock’s ETF IBIT recorded the most important day by day internet influx, totaling $877.18 million, bringing its complete cumulative internet inflows to $47.55 billion.

That day, Constancy’s ETF FBTC witnessed the second-highest internet influx, attracting $48.66 million. The ETF’s complete historic internet inflows now stand at $11.88 billion.

BTC Pulls Again Barely as Merchants Lock In Positive aspects

BTC presently trades at $110,752, noting a modest 1% decline over the previous 24 hours. The slight pullback follows yesterday’s surge to a brand new all-time excessive and seems to be largely pushed by a wave of profit-taking.

With the coin climbing to a brand new all-time excessive, many short-term merchants seized the chance to lock in features, prompting the continuing worth dip.

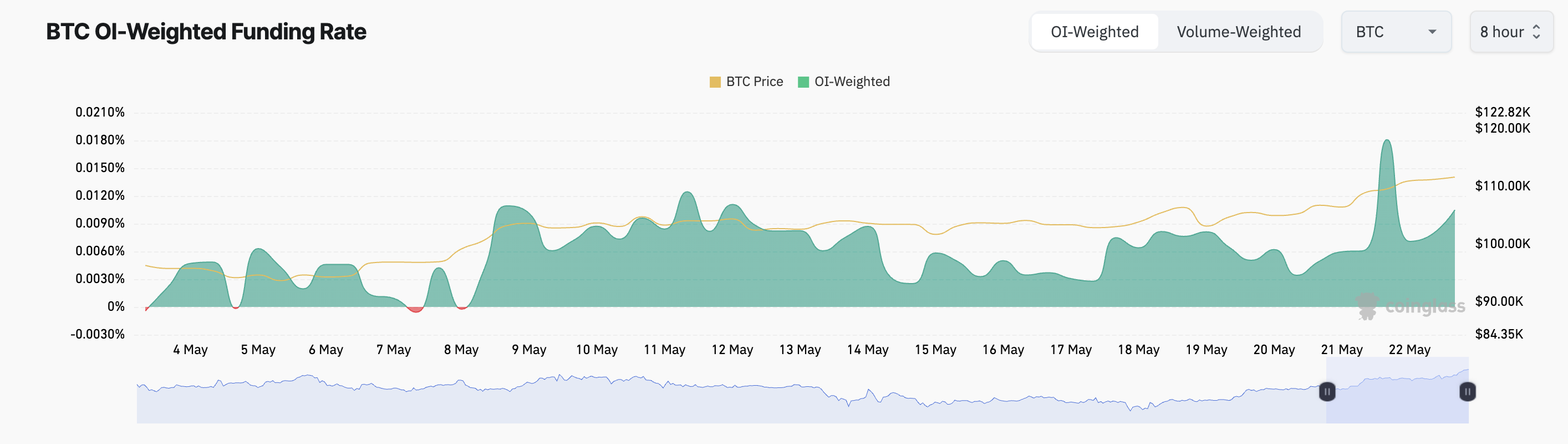

Nevertheless, regardless of the temporary pullback, futures market members show sturdy resilience and bullish conviction. That is mirrored in BTC’s constantly optimistic funding price, indicating that merchants are nonetheless keen to pay a premium to carry lengthy positions. At press time, that is at 0.0105%.

The sustained demand for leverage means that market members anticipate additional upside, reinforcing the idea that the current dip is a wholesome consolidation relatively than a bearish shift in pattern.

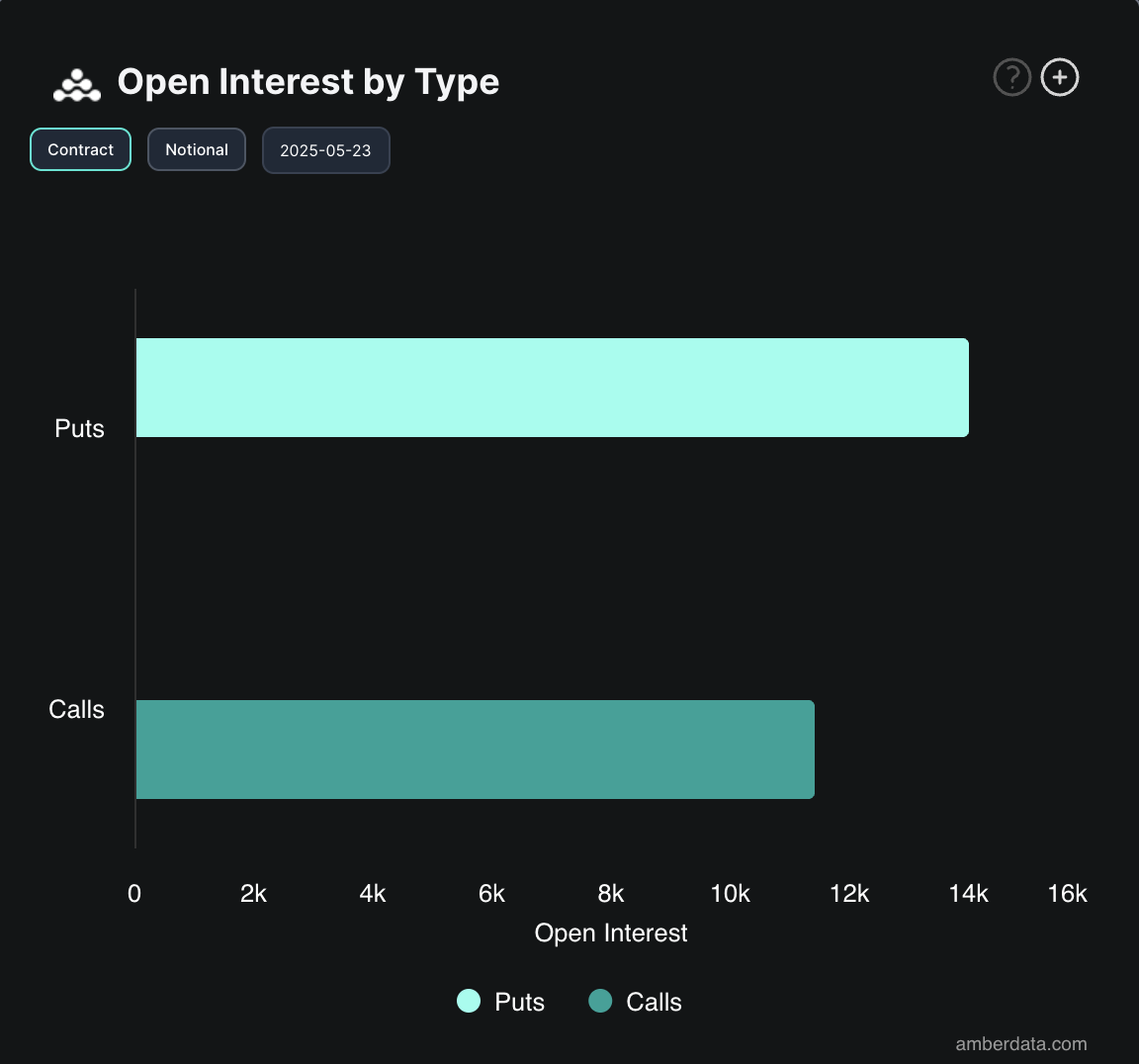

Nevertheless, a sentiment test on the choices market paints a extra cautious image. On-chain knowledge reveals a better quantity of put choices than calls as we speak, indicating that many traders are positioning for draw back danger or partaking in hedging exercise.

These developments current a scenario the place short-term warning coexists with longer-term institutional optimism.

Disclaimer

In step with the Belief Challenge tips, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. At all times conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.