As Bitcoin continues to interrupt information and attain its all-time excessive (ATH), a brand new wave of funding is rising. This time, it’s not simply from funding funds or particular person buyers. Conventional firms throughout numerous sectors are additionally leaping in.

From training, healthcare, and housing building to cybersecurity, companies giant and small around the globe are racing to build up Bitcoin. They view it as a strategic asset reserve, marking a serious shift in firms’ notion of cryptocurrencies.

Bitcoin Accumulation Throughout Industries in Could

Genius Group, a publicly listed training firm, not too long ago introduced a 40% improve in its Bitcoin reserves. This transfer reinforces its long-term dedication to digital property. In the meantime, Basel Medical Group, a Singapore-based healthcare firm, shocked the market by saying a $1 billion Bitcoin buy.

These strikes present that Bitcoin is not unique to tech or funding corporations. It’s now reaching into historically unrelated sectors.

In Europe, H100 Group grew to become the primary publicly traded firm in Sweden to undertake a Bitcoin reserve technique. It made an preliminary funding of 5 million NOK to buy 4.39 BTC. Equally, Blockchain Group—Europe’s first firm to carry Bitcoin reserves—not too long ago added 227 BTC to its treasury, bringing its whole holdings to 847 BTC. This solidifies its pioneering position within the area.

“Europe stacking sats on the company degree,” Nic, CEO & Co-founder of Coin Bureau, commented on the information.

These actions spotlight the rising acceptance of Bitcoin as a strategic asset, particularly as its worth reaches new heights.

Manufacturing and Retail Corporations Be part of the Motion

Manufacturing and cybersecurity firms are additionally getting concerned. BOXABL, a modular dwelling producer, has declared Bitcoin a reserve asset. This transfer alerts the development trade’s shift towards digital finance. On the similar time, JZXN, a publicly listed US electrical automobile retailer, has permitted a plan to buy 1,000 BTC inside the subsequent yr.

The participation of firms from seemingly unrelated industries, like automotive and housing, reveals that Bitcoin is changing into a well-liked selection for company portfolio diversification.

A number of Web3-related firms additionally moved to construct Bitcoin reserves in Could after it reached a brand new ATH. SecureTech, a cybersecurity agency, introduced its reserve technique. Roxom International raised $17.9 million to fund its Bitcoin reserve and develop its media community.

These efforts replicate a robust ambition to mix digital property with progressive enterprise fashions.

Bitcoin Turns into a Macro Asset with a Restricted Provide

Latest reviews from BeInCrypto recommend that retail buyers have been largely absent throughout this newest rally. Nevertheless, the flood of firm Bitcoin acquisition bulletins signifies a wave of institutional FOMO (worry of lacking out).

Technique is without doubt one of the firms main this development. As Bitcoin hit new highs, the worth of its BTC holdings surged to $64 billion. However they haven’t stopped. The corporate not too long ago introduced plans to lift one other $2.1 billion to proceed its Bitcoin-buying technique.

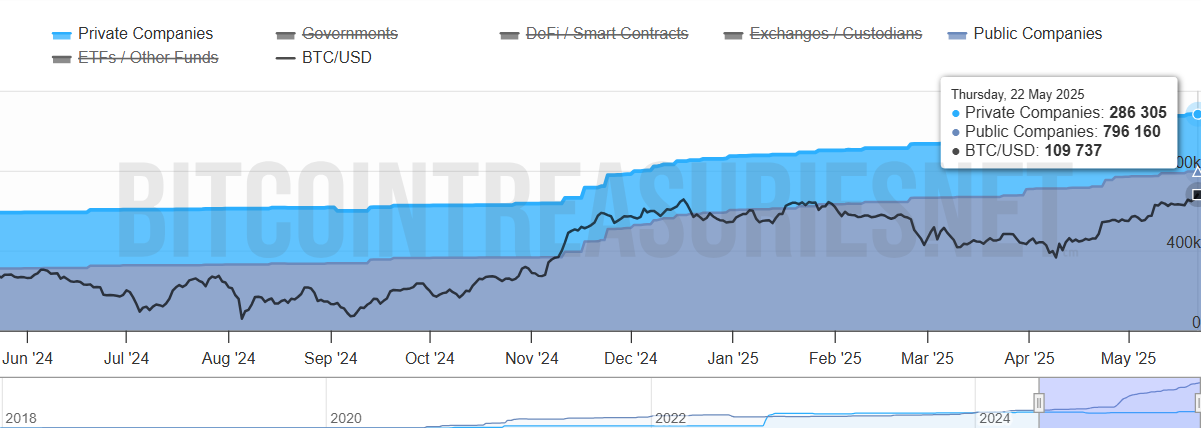

Information from Bitcoin Treasuries reveals that non-public and public firms now maintain over 1 million BTC—greater than 5.4% of the circulating provide. In the meantime, Bitcoin’s provide stays mounted, and the variety of firms accumulating it continues to develop every month.

“Bitcoin breaking by means of $110,000 displays the brand new actuality: it’s not a fringe asset—it’s a macro instrument, ETF inflows, sovereign curiosity, and structurally restricted provide are driving institutional demand at scale. For funds sitting on money in a low-yield world, Bitcoin is beginning to look much less like a threat and extra like a benchmark.” mentioned Mike Cahill, CEO of Douro Labs, in an interview with BeInCrypto.

This development proves that Bitcoin is gaining institutional belief in 2025. It’s not dismissed as a monetary bubble. As an alternative, it’s being acknowledged as a strategic asset of the long run.

Disclaimer

In adherence to the Belief Venture pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nevertheless, readers are suggested to confirm details independently and seek the advice of with an expert earlier than making any selections primarily based on this content material. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.