- Dormant whales reawakened, transferring 3,500 ETH into Kraken — hinting at doable profit-taking as ETH consolidates close to $2,800.

- Spot and derivatives information present blended alerts: inflows rising, however market sentiment stays cautious; 64% of merchants are lengthy, elevating liquidation danger.

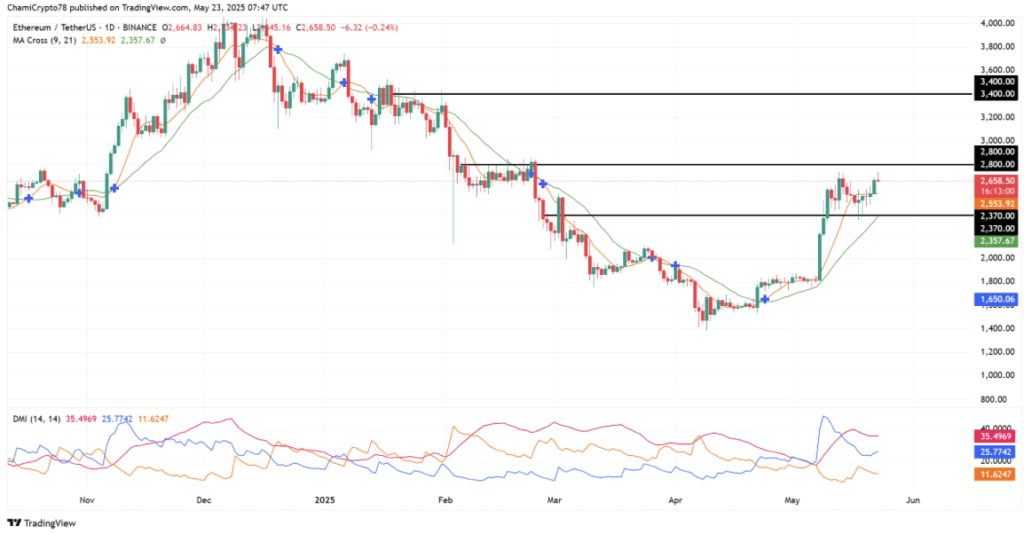

- Technical setup favors bulls if ETH holds above EMAs; a breakout previous $2,800 might open the door to $3,400 — however extra whale promoting might stall momentum.

Two long-silent Ethereum (ETH) whales simply popped again onto the radar, stirring up some buzz after dropping 3,500 ETH — price over $9.3 million — into Kraken. One of many wallets hadn’t moved in 4 years. The opposite? Quiet for about ten months.

Outdated Cash, New Strikes

These transfers are elevating eyebrows as a result of when outdated wallets get up, it typically means they’re cashing out or transferring to distribute. Mixed, the whales nonetheless management 13,600+ ETH, so this may occasionally simply be the beginning. And the timing? Kinda spicy — ETH is at the moment consolidating slightly below some main resistance.

Whales Are Energetic Once more

Over the previous week, inflows from massive holders jumped 50.89%, whereas outflows surged 80.46%. Nonetheless, on a month-to-month foundation, outflows are down barely (-5.74%) and down much more over 90 days (-17.45%). Mainly, extra ETH is heading towards exchanges than leaving, hinting that some whales could also be prepping to promote.

Spot Stream Says… Not A lot

spot change move, we’re seeing a little bit of a tug-of-war. On Might 23, about $832 million flowed in, and round $840 million flowed out. That sort of stability doesn’t inform us a lot — simply that the market’s nonetheless figuring itself out.

Even with all this whale exercise, merchants appear break up. Consumers and sellers are circling one another, ready for one thing to tip the dimensions.

Derivatives Lean Bullish — However Dangerous

On Binance, 64.32% of ETH/USDT merchants are lengthy. The long-to-short ratio’s sitting at 1.80, displaying optimism — however perhaps an excessive amount of. If momentum fades, these longs might get wiped quick.

Can ETH Crack $2,800?

Proper now, ETH is floating round $2,658. It’s nonetheless above the 9-day EMA ($2,553) and the 21-day EMA ($2,357), which is an efficient short-term signal. Resistance is agency at $2,800. Assist’s down close to $2,370.

If it breaks above $2,800 cleanly, we might see a run to $3,400. The DMI agrees — the ADX is 35.49 (which suggests the pattern is robust), and the +DI is effectively above the -DI, favoring bulls.

However right here’s the catch: extra whale deposits might freak the market out, enhance volatility, and kill the rally.

Ultimate Thought

ETH’s at a crossroads. Technicals look good, however whale habits is unpredictable. A breakout or a breakdown? That’s nonetheless up within the air — and it’d all come down as to if these huge wallets maintain transferring cash into exchanges.