Michael Saylor, chairman of MicroStrategy and certainly one of Bitcoin’s most outspoken company champions, has as soon as once more underscored his perception within the cryptocurrency’s long-term potential—this time with knowledge to again it up.

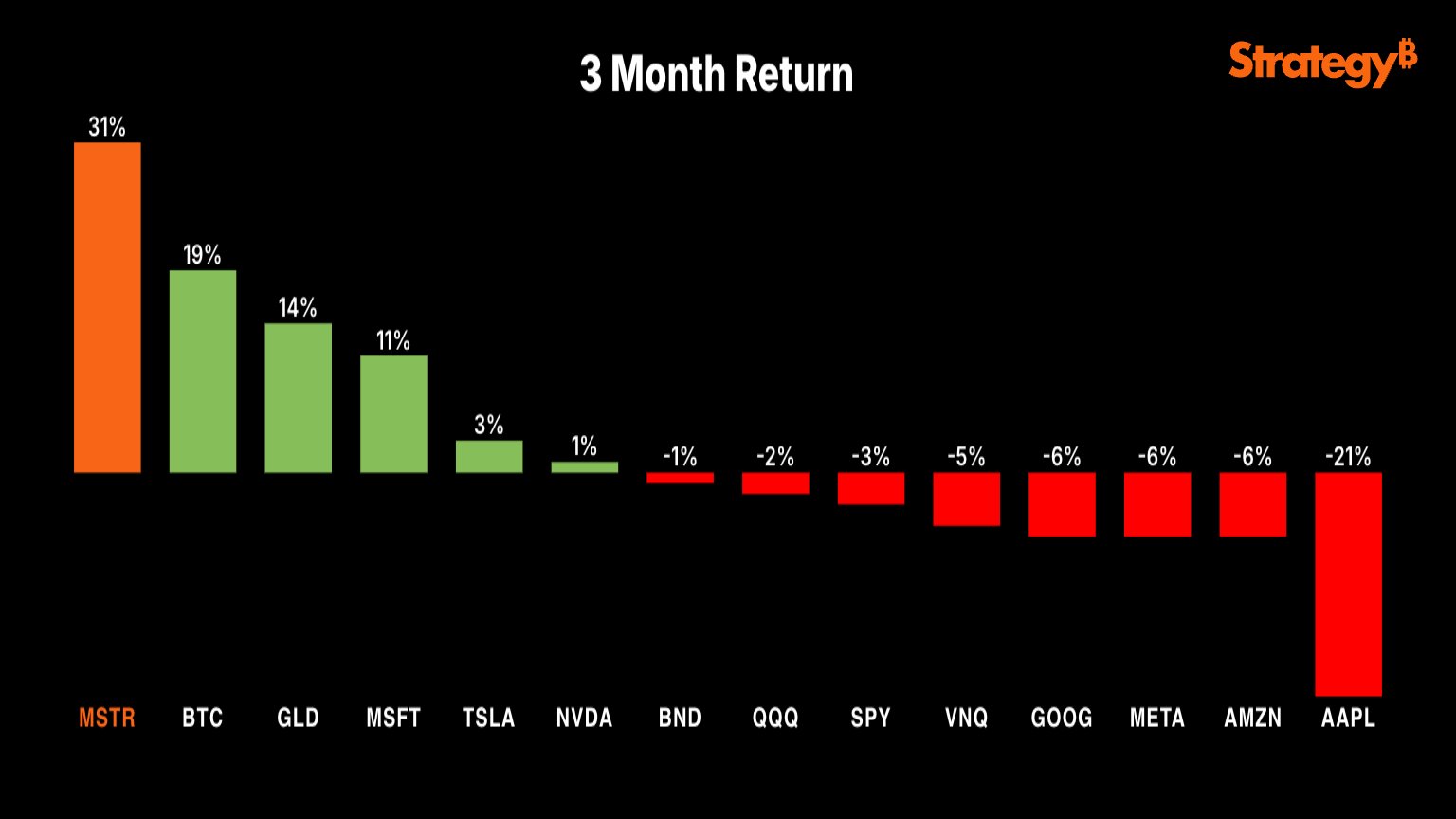

In a submit shared on Could 24 through X, Saylor revealed up to date efficiency metrics evaluating prime property over the previous three months and one yr. The standout? His personal firm. MicroStrategy’s inventory surged 31% in three months and 139% over the previous yr, outpacing even Bitcoin’s 58% annual acquire. Different property like Tesla, gold, and Meta adopted, whereas giants like Apple and Google lagged behind or posted losses.

The outperformance is not any coincidence. With over 576,000 BTC on its books, MicroStrategy capabilities as a high-leverage Bitcoin proxy. The corporate’s aggressive shopping for—typically funded via debt—has tied its market valuation to Bitcoin’s actions, making MSTR a go-to selection for traders in search of amplified BTC publicity.

However Saylor’s message went past numbers. In latest interviews and social posts, he argued that purchasing Bitcoin—even at all-time highs—stays a sensible long-term transfer. He pointed to historic four-year holding knowledge exhibiting constant profitability, no matter market timing. For Saylor, Bitcoin’s energy lies in its resilience in opposition to inflation and fiat foreign money decay.

He additionally warned of a coming shift: as soon as banks and enormous establishments formally embrace Bitcoin, the window for on a regular basis traders might shut. As regulatory inexperienced lights emerge, Saylor predicts demand will surge—presumably outpacing provide and making BTC far much less accessible to the general public.

“Time available in the market beats timing the market,” Saylor wrote, signaling that the very best time to purchase Bitcoin might all the time be now.