Bitcoin not too long ago broke above the $111,000 mark, setting a brand new all-time excessive. Nevertheless, knowledge throughout main exchanges means that merchants are rising more and more cautious of a sustained rally.

CoinGlass knowledge point out that over 53% of Bitcoin positions are presently brief, which means a majority of merchants are betting on a worth drop. Against this, simply 47.43% of energetic positions are lengthy.

Most Merchants Flip Bearish Regardless of Bitcoin’s Current All-Time Excessive

The sample is mirrored on Binance, the place brief trades make up 54.05% of open curiosity, in comparison with 45.95% for longs.

This rising tilt towards shorts displays mounting skepticism available in the market, regardless of Bitcoin reaching new highs.

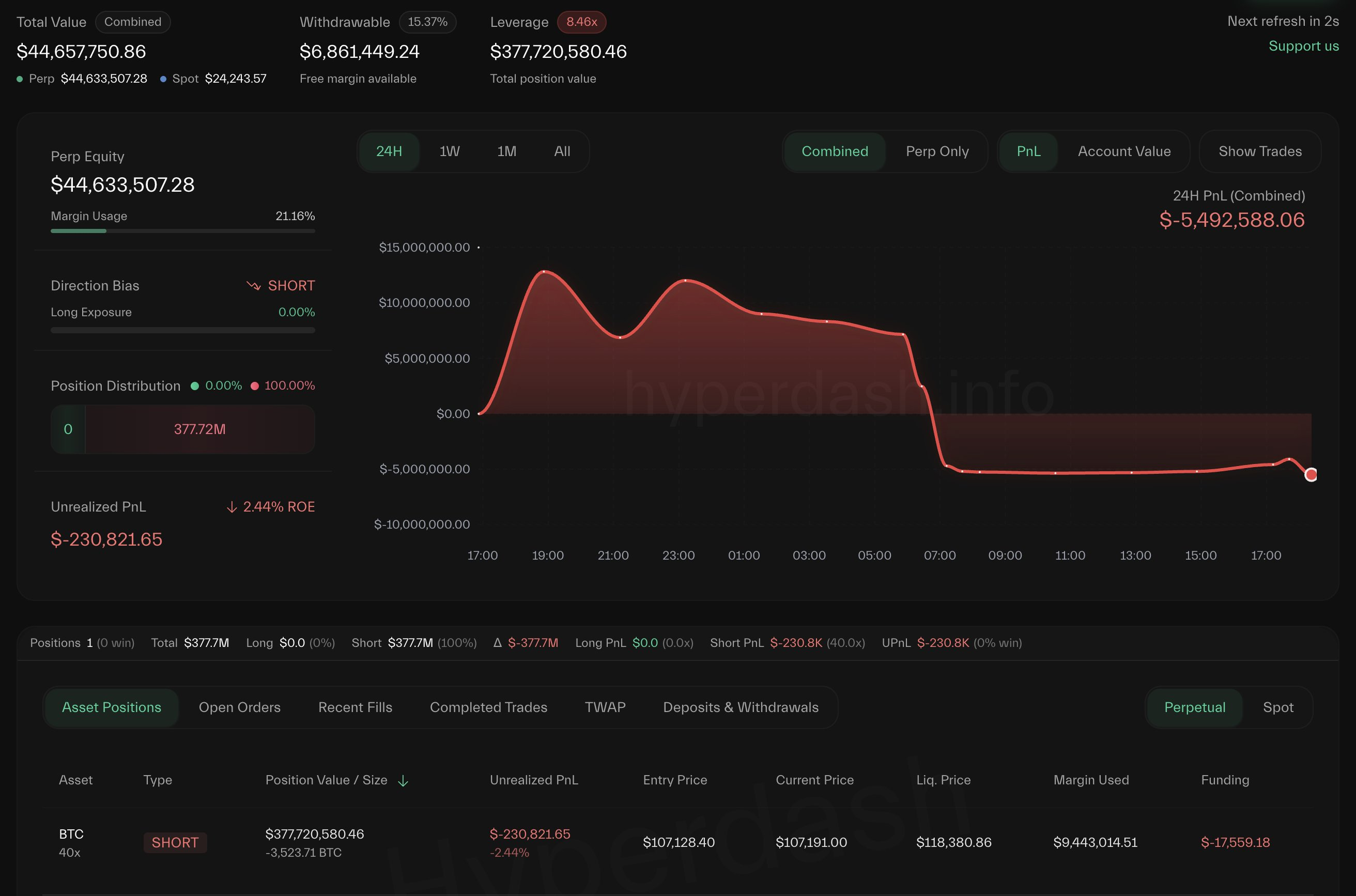

The sentiment shift is bolstered by the newest transfer from distinguished crypto whale James Wynn, who reversed his bullish stance after a multi-million greenback loss.

Wynn had beforehand maintained an aggressively leveraged 40x lengthy place price round $1.25 billion however exited after Bitcoin’s worth dipped from $109,000 to roughly $107,107.

The dealer closed his lengthy publicity at a lack of $13.39 million, with liquidation unfolding in below an hour on Could 25.

He has since opened a brief place of three,523 BTC—valued at roughly $377 million—at an entry worth of $107,128. The brand new commerce carries a liquidation threshold close to $118,380.

Market analysts have instructed that Wynn’s pivot displays broader indicators of exhaustion within the present bull cycle.

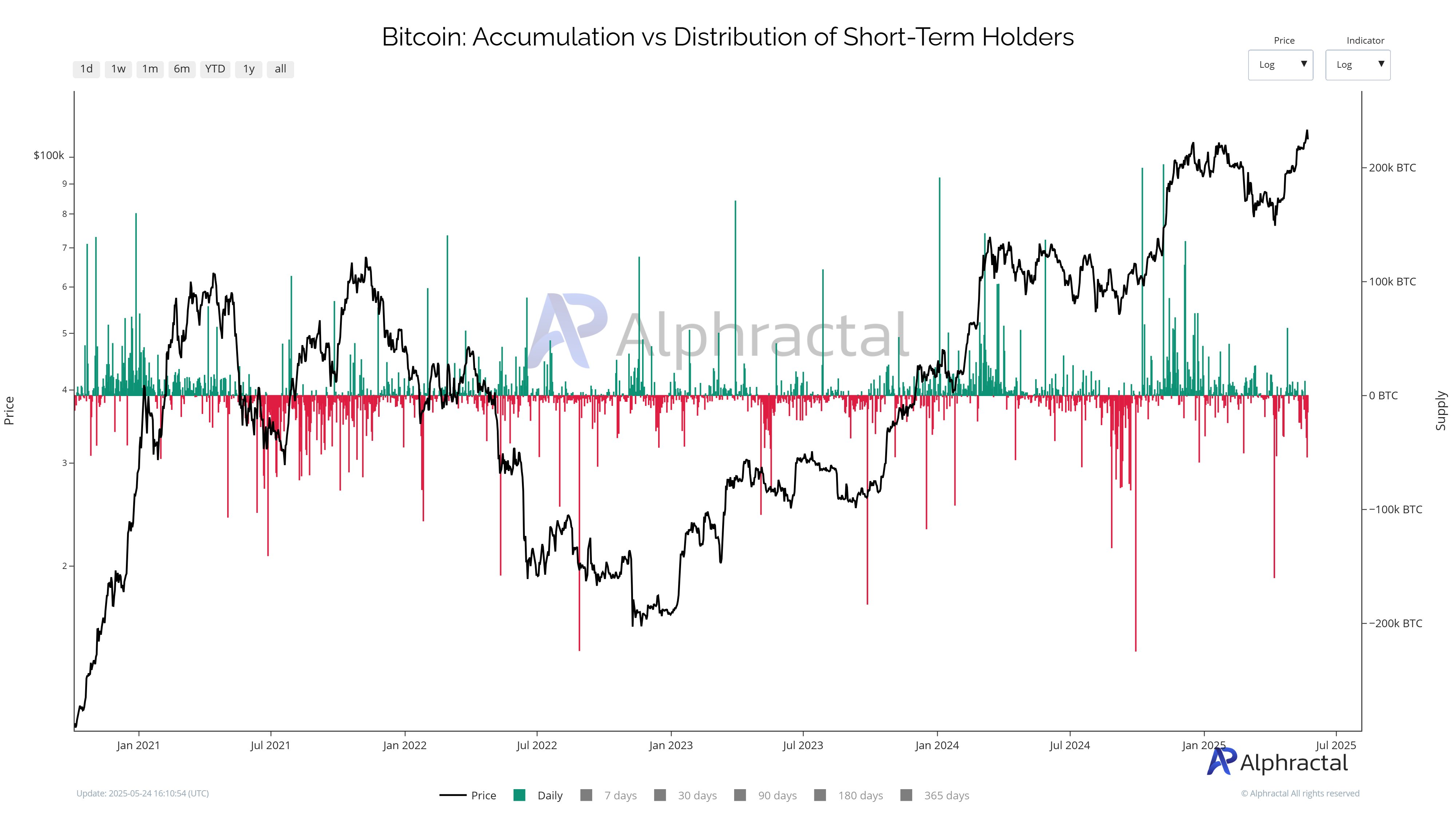

In keeping with blockchain analytics agency Alhpractal, short-term holders (STHs) have begun distributing cash. Traditionally, a decline in STH provide usually indicators that Bitcoin is approaching an area high.

The agency famous that the Quick-Time period Holder Realized Worth presently stands at $94,500, which is the final sturdy assist earlier than losses set in.

In distinction, long-term holders (LTHs) stay agency, with their realized worth climbing to $33,000—highlighting a widening behavioral hole.

Alphractal said that whereas Bitcoin beforehand hit file highs below related situations in 2021, it warned that the present cycle could also be nearing exhaustion.

It added that a number of macro indicators and historic halving tendencies level to a potential correction after October 2025.

Disclaimer

In adherence to the Belief Mission pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nevertheless, readers are suggested to confirm details independently and seek the advice of with an expert earlier than making any choices based mostly on this content material. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.