Hedera (HBAR) is down 10.5% over the past seven days, as technical and spinoff indicators level to rising weak point. Futures quantity has fallen beneath $100 million for 5 straight days, signaling a pointy decline in speculative curiosity in comparison with March’s $1.3 billion peak.

Regardless of traditionally monitoring Bitcoin’s strikes intently, HBAR has underperformed throughout BTC’s latest rally, gaining simply 0.75% prior to now 30 days. With EMA strains nonetheless bearish and worth nearing vital help at $0.18, HBAR faces a key check that might outline its route heading into June.

HBAR Futures Quantity Falls Beneath $100 Million – What Does it Imply?

HBAR futures quantity has dropped to $96.5 million and has remained below the $100 million mark for the previous 5 consecutive days, marking a pointy distinction to the elevated ranges seen earlier this 12 months.

Again on March 1, futures quantity peaked at $1.3 billion, however since then, each quantity and open curiosity have steadily declined.

HBAR futures enable merchants to invest on the token’s future worth, and their exercise usually displays broader sentiment and threat urge for food from each retail and institutional individuals.

The latest drop factors to waning speculative curiosity, probably signaling warning or lack of conviction in Hedera’s short-term worth route.

With the 7-day EMA of HBAR futures quantity now at its lowest in three months, the information suggests present worth motion could also be more and more pushed by spot demand quite than leveraged positioning.

This shift in market construction might imply decreased volatility and a extra natural worth development within the close to time period. Nevertheless, with no rebound in derivatives exercise, any upward strikes might lack the momentum usually offered by aggressive speculative inflows.

Hedera Lags Behind BTC Rally—Will It Catch Up in June?

Traditionally, HBAR worth has proven a robust optimistic correlation with Bitcoin (BTC), usually amplifying the broader market’s strikes.

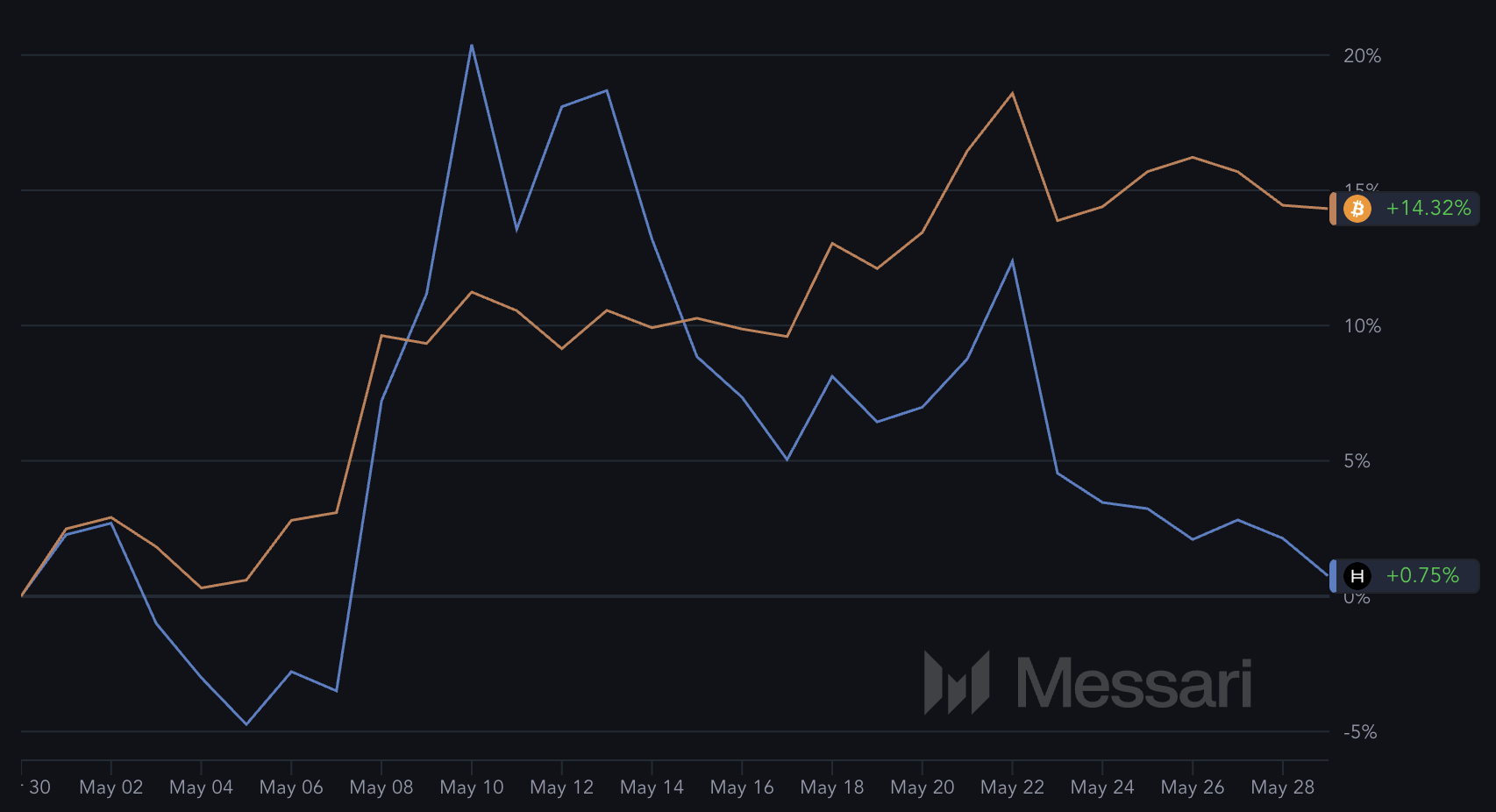

Nevertheless, over the previous 30 days, that relationship seems to have weakened—BTC is up 14.3%, whereas HBAR has gained simply 0.75% over the identical interval.

This divergence means that HBAR has not but responded to the latest bullish momentum within the crypto market, regardless of usually being a higher-beta asset.

In earlier cycles, HBAR has usually outperformed BTC throughout rallies but additionally confronted steeper declines throughout broader market corrections, reflecting its sensitivity to shifts in sentiment.

If Bitcoin reaches new highs in June, HBAR may very well be well-positioned for a sharper transfer upward, because it did throughout previous surges.

HBAR Approaches $0.18 Assist as Bearish EMA Setup Persists

HBAR’s EMA construction stays bearish, with short-term exponential shifting averages nonetheless positioned beneath long-term ones—a basic signal of ongoing downward momentum.

The token has been buying and selling beneath the $0.20 mark for the previous six days, reflecting sustained strain and a scarcity of bullish follow-through.

This setup reinforces the cautious sentiment surrounding HBAR because it hovers close to key technical ranges.

At present, HBAR is approaching the vital help at $0.18, and dropping this degree would mark its first break beneath that threshold since Might 8.

Nevertheless, if the market turns and momentum improves in June, HBAR might break again above $0.20, with room to rally towards $0.25—an space it hasn’t touched since early March.

Disclaimer

According to the Belief Venture pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. All the time conduct your personal analysis and seek the advice of with an expert earlier than making any monetary selections. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.