Bitcoin (BTC) is down 6% over the previous eight days after reaching new all-time highs, and up to date technical indicators recommend rising uncertainty out there. Whale exercise, which briefly declined, has began to get well, hinting that some massive holders could also be returning to accumulation.

Nevertheless, bearish indicators are mounting, with the Ichimoku Cloud exhibiting weak spot and BTC buying and selling beneath key assist ranges. As value hovers simply above $104,584, the specter of one other loss of life cross and deeper draw back stays until bulls can reclaim momentum above resistance.

Bitcoin Whale Rely Rebounds After Robust Decline

The variety of Bitcoin whales—addresses holding between 1,000 and 10,000 BTC—has rebounded barely to 2,006 after falling to 2,002 earlier this week.

This temporary dip adopted a sharper decline from 2,021 on Might 25, marking a notable short-term discount in massive holders. Nevertheless, the restoration means that some whales could also be returning to accumulation.

Whereas the fluctuation was small, such modifications are intently monitored, as they usually precede shifts in market sentiment or value motion.

Monitoring whale conduct is crucial as a result of their outsized affect on Bitcoin’s liquidity and volatility. A decline in whale rely can point out profit-taking or distribution, usually signaling warning or a possible market cooldown.

Conversely, a stabilization or rise—just like the one noticed now—can ease investor considerations and assist value resilience at elevated ranges.

The variety of massive holders recovering after a pointy drop might sign renewed confidence amongst key gamers, decreasing the instant threat of heavy promoting strain and serving to Bitcoin preserve its present vary.

Technical Indicators Flip Bearish as BTC Struggles Under Key Ranges

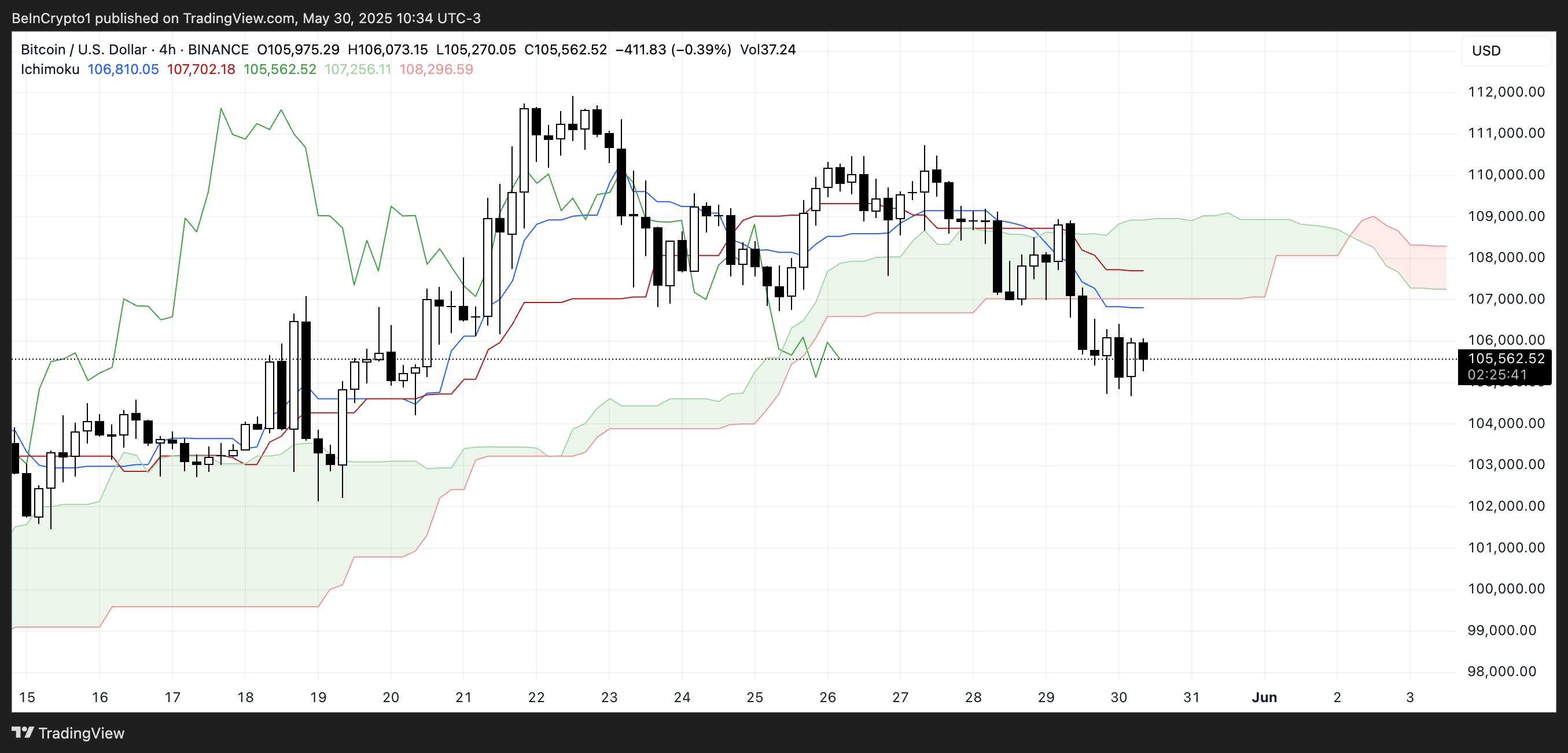

The Ichimoku Cloud chart for Bitcoin exhibits a short-term bearish construction.

Worth motion is at present positioned beneath the Kumo (cloud), which is shaded in inexperienced and crimson—indicating that Bitcoin is buying and selling in a zone of weak spot relative to historic and projected momentum.

The cloud forward is crimson, suggesting that the development bias for the close to future stays bearish until a reversal breaks by way of the higher boundary.

The Tenkan-sen (blue line) is beneath the Kijun-sen (crimson line), confirming short-term downward momentum. Each strains are angled downward, one other bearish sign.

The Chikou Span (inexperienced lagging line) is beneath each value and the cloud, reinforcing that present momentum lacks bullish affirmation.

The longer term cloud additionally narrows, which can trace at a possible equilibrium or a consolidation zone forward. For now, the Ichimoku parts align with a bearish outlook. A bullish shift would require the value to interrupt above the cloud and flip the longer term Kumo from crimson to inexperienced.

Bitcoin Faces Potential Demise Cross

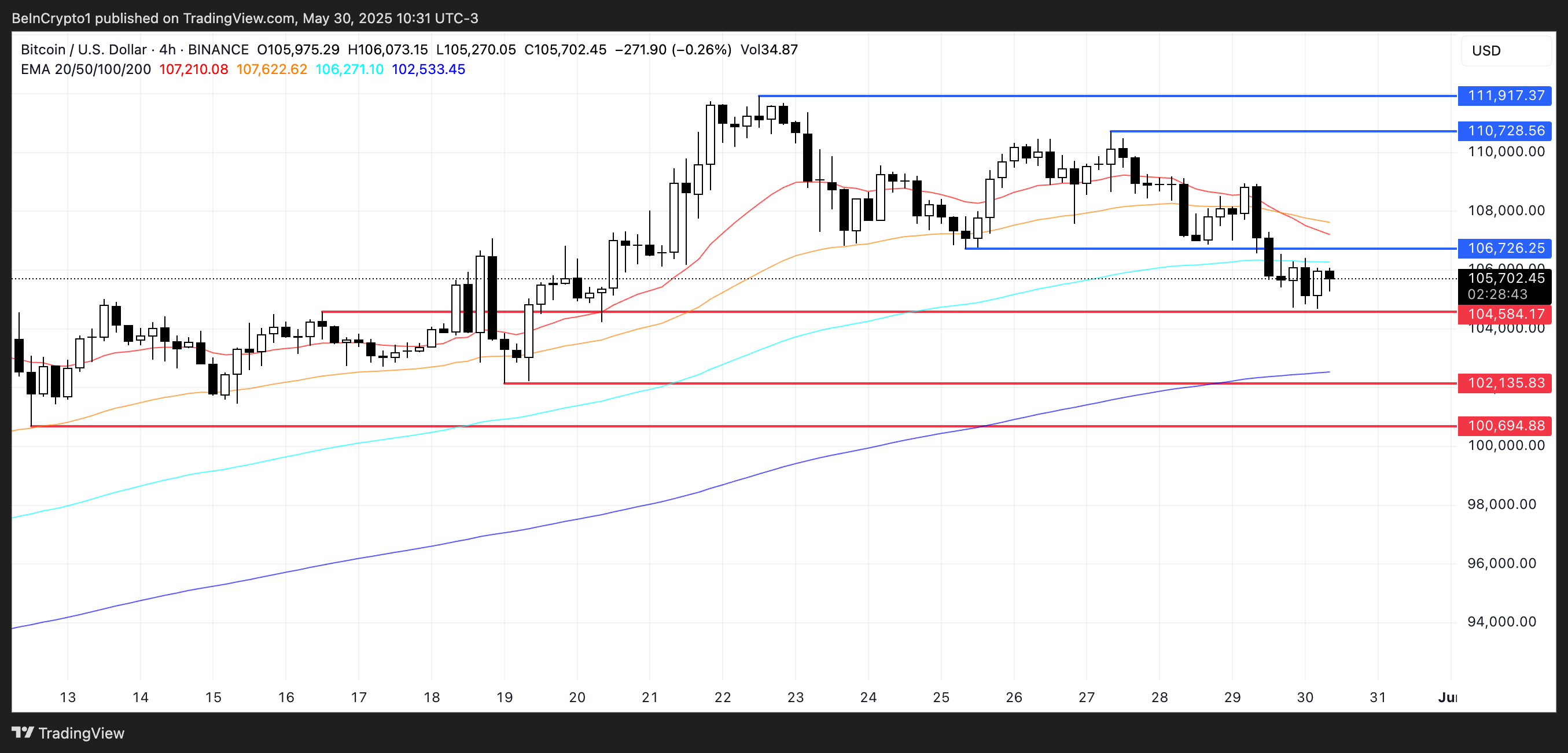

Bitcoin value just lately fashioned a loss of life cross, and technical indicators recommend one other one could possibly be on the horizon. Worth is at present buying and selling simply above crucial assist at $104,584, which has acted as a short-term ground.

If this assist fails, the subsequent draw back targets sit at $102,135 and doubtlessly as little as $100,694 if the promoting strain intensifies.

The presence of back-to-back loss of life crosses, mixed with weakening value motion close to these ranges, raises the likelihood of a deeper correction within the brief time period.

On the bullish aspect, if Bitcoin can mount a restoration and set up robust momentum, it could retest resistance at $106,726.

A break above this stage may set off a sharper transfer towards $110,728, with an additional upside chance of reaching $112,000 if the rally accelerates.

Disclaimer

According to the Belief Mission tips, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. At all times conduct your personal analysis and seek the advice of with an expert earlier than making any monetary choices. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.