Regardless of main bullish headlines, XRP is going through intense draw back stress, with the token down practically 5% within the final 24 hours and eight.5% over the previous week. A number of EMA loss of life crosses have additionally shaped in current days, reflecting the sustained weak spot.

Even with bulletins like a $300 million funding from a Chinese language AI agency and a $121 million treasury increase led by Saudi-linked VivoPower, the technicals counsel sellers stay firmly in management for now.

XRP Enters Oversold Territory

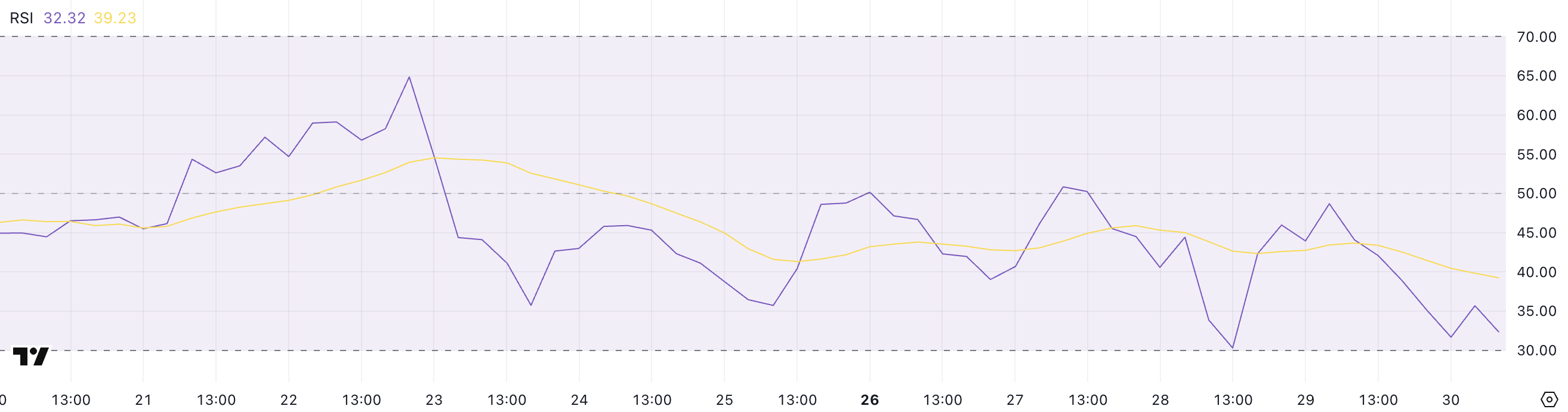

XRP’s Relative Power Index (RSI) has dropped considerably to 32.32, down from 48.68 simply in the future earlier—marking a pointy deterioration in short-term momentum.

This steep decline displays intensified promoting stress, pushing XRP near the oversold threshold with out absolutely breaching it.

Apparently, XRP’s RSI has not fallen beneath 30 since April 7, suggesting that whereas current corrections have been sharp, they haven’t but triggered the deeply oversold situations seen throughout extra extreme market pullbacks.

The present studying close to 30 signifies that XRP is nearing a possible exhaustion level within the downtrend. If patrons step in, the value might stabilize or try a rebound.

That dangerous momentum comes even after a Chinese language AI Firm introduced it plans to take a position as much as $300 million in XRP, and after VivoPower raised $121 million for XRP Treasury backed by a Saudi Royal.

The RSI is a extensively used momentum indicator starting from 0 to 100, designed to measure the pace and magnitude of value actions. Readings above 70 sometimes point out overbought situations and potential for a value pullback, whereas readings beneath 30 sign oversold situations and potential value restoration.

With XRP hovering simply above that oversold threshold, the market is at a crossroads: additional draw back might push RSI beneath 30, attracting consideration from technical merchants anticipating a bounce.

On the similar time, stabilization at present ranges might stop deeper losses.

Provided that XRP hasn’t damaged beneath 30 in practically two months, a dip beneath that stage now might set off renewed volatility—both drawing in cut price hunters or accelerating bearish momentum if assist ranges fail to carry.

XRP DMI Alerts Sturdy Bearish Pattern as ADX Surges Above 34

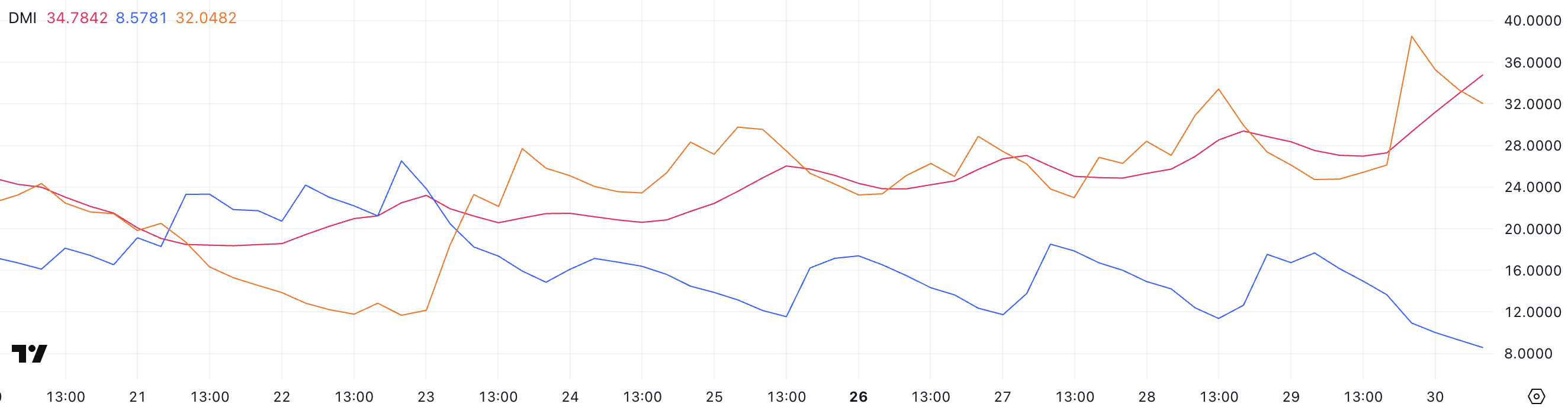

XRP’s Directional Motion Index (DMI) reveals a big shift in development energy and momentum, with the ADX rising to 34.78, up from 27 only a day earlier.

The ADX, or Common Directional Index, measures the energy of a development with out indicating its route—readings above 25 sometimes counsel a powerful development, and people above 30 point out a really robust one.

The sharp improve in ADX confirms that the present development is intensifying. Nevertheless, the route of that development is made clear by the motion of the directional indicators: +DI has plunged to eight.57, whereas -DI has surged to 32.

This widening hole between the directional indicators highlights a powerful bearish development in play. The falling +DI implies that bullish momentum is weakening quickly, whereas the rising -DI reveals that promoting stress is accelerating.

With -DI now considerably larger than +DI and the ADX confirming the energy of this transfer, XRP seems to be firmly in a downtrend.

Except there’s a sudden reversal in shopping for curiosity, the present setup factors to continued draw back stress within the close to time period, reinforcing what different indicators just like the RSI have already signaled.

XRP Dangers Dropping Beneath $2 as Bearish Momentum Builds

XRP’s exponential shifting averages (EMAs) have flashed a number of loss of life crosses in current days, reflecting sustained downward stress because the token struggles to regain traction beneath the $2.50 mark.

These bearish crossovers—the place short-term EMAs fall beneath long-term EMAs—point out a weakening development and align with XRP’s current lack of ability to interrupt again into bullish territory.

If the correction deepens, XRP might retest assist at $2.07, and a failure to carry that stage would open the door for a drop beneath $2, a value not seen since April 8. This could possible affirm a broader shift in market sentiment and probably speed up bearish momentum.

Nonetheless, the outlook might shift if patrons regain management and XRP manages to reverse the development. In that case, $2.26 stands out as a key resistance stage; a profitable breakout there might sign renewed energy and produce the following upside targets at $2.36, $2.47, and even $2.65 into focus.

These resistance ranges would should be cleared with convincing quantity to invalidate the present bearish EMA construction.

Till then, the a number of loss of life crosses function a warning that downward stress stays dominant until bulls stage a powerful restoration.

Disclaimer

According to the Belief Venture tips, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. At all times conduct your individual analysis and seek the advice of with an expert earlier than making any monetary choices. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.