- Worth Drop With a Twist: Fartcoin fell 13% in 24 hours, almost erasing its month-to-month positive factors. Nevertheless, knowledge exhibits important accumulation throughout this dip, suggesting some merchants see it as a shopping for alternative.

- Help Zone Holds Promise: The value has returned to a beforehand energetic accumulation zone between $1.01 and $1.20, which might act as a springboard for a future rally—if consumers maintain sturdy.

- Combined Market Sentiment: Whereas the derivatives market nonetheless exhibits some bullish bias with a optimistic funding price, the spot market sentiment is shaky, with extra merchants leaning quick and traders rising cautious.

Properly, Fartcoin isn’t having the perfect week—dropping a steep 13% within the final 24 hours, wiping out almost each little bit of acquire it had made this month. Now, it’s wobbling round with a -0.75% drawdown on the month-to-month chart. Fairly tough. However oddly sufficient, there may nonetheless be one thing brewing beneath the floor.

Liquidity Flooding In… Even Whereas Worth Slips

Regardless of the dip, some of us on the market are clearly shopping for the blood. A brand new Nansen report confirmed that Fartcoin really had the very best optimistic netflow throughout all tracked tokens throughout the identical 24-hour window. Yep, about $178K price of FARTCOIN moved into exchanges. So, both somebody’s making a giant guess—or the group’s quietly constructing baggage at low cost costs. Generally when these quiet buys stack up, they result in a pointy reversal. Not at all times… nevertheless it’s occurred earlier than.

Again to the Outdated Accumulation Zone

In case you try the charts, the coin has principally slid proper again into a well-known pocket—someplace between $1.01 and $1.20. That vary final noticed motion between late April and early Might, proper earlier than the final rally. Now that it’s parked there once more, some consumers may get , perhaps even begin scooping extra up. Factor is, costs might hand around in this field for some time earlier than deciding on a route. Doesn’t imply a pump is coming—simply that the bottom could be forming once more.

Bulls Nonetheless Hopeful, However Bears Aren’t Gone But

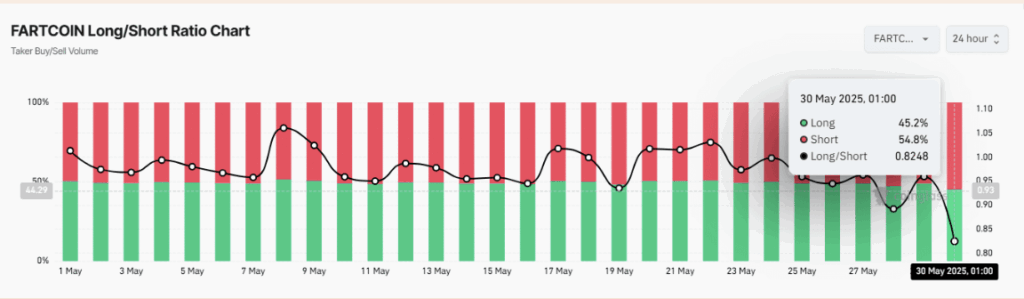

Zooming out to the derivatives aspect, issues get a bit messy. The Lengthy/Brief ratio as of Might 30 exhibits 54.8% of quantity is from sellers, which tells you—short-term, individuals are nonetheless betting towards it. However curiously, the funding price is holding up in optimistic territory and slowly climbing. That usually means bullish contracts are main, even when there’s strain from the opposite aspect.

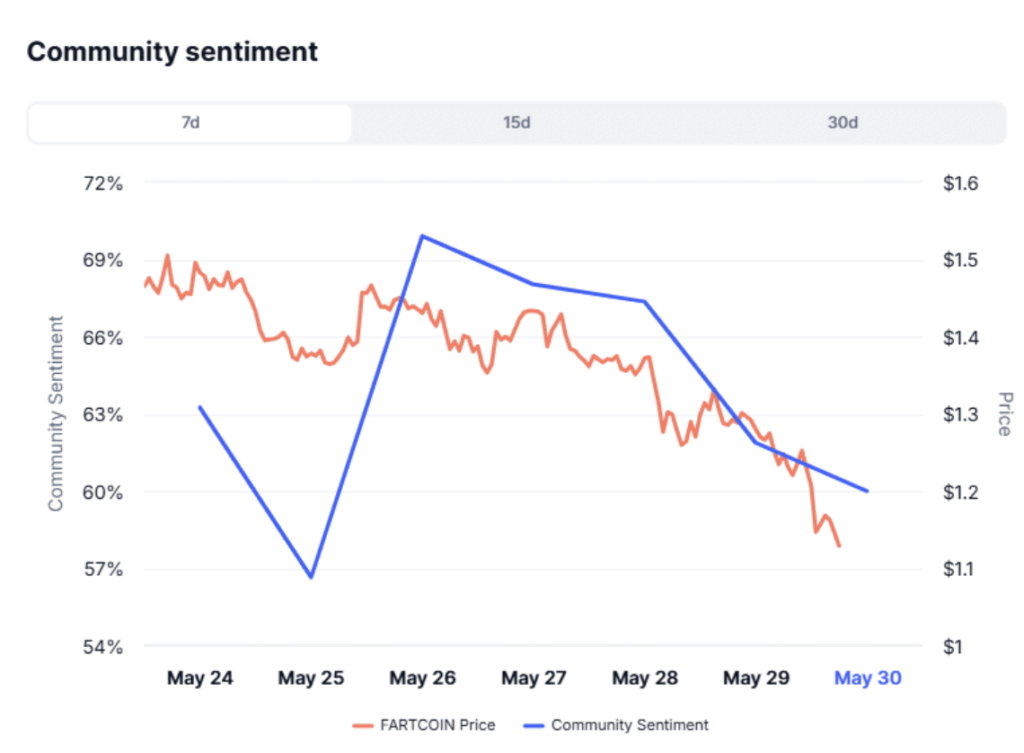

One factor to keep watch over, although, is how the spot market is feeling. And proper now, it’s… nicely, kinda grim. Sentiment’s taken a nosedive. If issues drop any decrease, we would see much more holders surrender and hit the exit. So yeah, momentum’s constructing—however the crowd nonetheless appears nervous.