Common dealer James Wynn, broadly often known as the Hyperliquid Whale, now has simply $23 in his buying and selling account. As one viral joke on X put it — Wynn can now not afford a Large Mac Meal and a Subway sandwich in the identical sitting.

Hyperdash knowledge reveals that his account’s all-time P&L is now $17.5 million within the crimson, down from $82.5 million within the inexperienced on Could twenty third.

Probably the most profitable merchants simply misplaced $100 million in per week — a blow-up that will go down as one of many largest cautionary tales towards emotional, high-leverage buying and selling.

Nonetheless, may a brand new Telegram-native crypto buying and selling bot save merchants like Wynn sooner or later?

The Snorter Bot, a full-stack Telegram buying and selling suite, is laced with sub-second execution, real-time market insights, and scheduled stop-loss and restrict orders. It’s purpose-built to provide customers a aggressive edge in crypto buying and selling, along with early meme coin snipes and cutting-edge safety towards scams.

How Did James Wynn Lose $100M In A Week?

James Wynn’s portfolio had a $100 million P&L on Could twenty third, a results of a number of sensible trades in addition to the latest bull market.

Nonetheless, he quickly engaged in emotion-based buying and selling with excessive leverage — the right powder keg for an enormous liquidation.

First got here greed — Wynn began opening trades with billion-dollar leveraged positions in Bitcoin and Pepe. Unsurprisingly, the market makers turned towards him and began to maneuver asset costs to liquidate his positions.

Wynn suffered huge losses from his peak, however remained in important revenue general — some extent the place most seasoned merchants would safe good points, step again, and reassess their technique with a transparent head.

Wynn even posted on X that he would do the identical, revealing that he has determined to “go away the on line casino” with $25 million in earnings.

https://twitter.com/JamesWynnReal/standing/1926813864940765599

Nonetheless, he quickly doubled down. Even after his general P&L went deep crimson, Wynn stored opening high-leveraged trades in Bitcoin and Pepe.

Based on Arkham Intelligence, Wynn opened a $50 million lengthy on BTC on Could thirtieth. Unsurprisingly, the place was liquidated — alongside together with his high-exposure commerce on Pepe.

https://twitter.com/arkham/standing/1928457983639396586

The result’s that Wynn now has a cumulative P&L of minus $17.5 million, down $100 million from its peak. In the meantime, his latest X posts recommend that he’ll possible proceed with the degeneracy, promising to show his losses right into a $1 billion revenue.

What may probably go fallacious?

Might The Snorter Bot Have Prevented Wynn’s $100M Liquidation?

Snorter Bot is a Telegram-native crypto buying and selling assistant that lets customers snipe, commerce, and handle their portfolio with the identical velocity, automation, and safety that have a tendency to provide whales a aggressive edge out there.

Contemplating that the venture remains to be in growth, it wouldn’t have helped Wynn.

Nonetheless, for merchants making the identical errors Wynn did, Snorter may’ve been a game-changer — providing smarter entries, higher danger management, and fewer emotion-driven choices.

Take Wynn’s entries, for instance. Analyst Taqwa Ayub identified that the whale repeatedly opened lengthy positions within the $108K–$109K vary — proper within the thick of uneven worth motion, reasonably than ready for a transparent assist stage.

https://twitter.com/taqwaayub/standing/1927963659130532184

Many merchants make the identical mistake. With Snorter, they’ll profit from cutting-edge market knowledge evaluation and real-time insights.

Furthermore, the bot lets customers auto-copy the strikes of prime merchants, making it straightforward to comply with confirmed, worthwhile methods.

Snorter additionally helps merchants determine the place to position stop-losses and restrict orders, then schedules them to execute mechanically — eradicating emotion and ego from the method.

Furthermore, the Snorter Bot is a high-speed meme coin sniper — constructed to catch early entries the second liquidity hits. Nonetheless, early entries don’t imply no due diligence.

Snorter routes trades by means of MEV-resistant relayers to forestall sandwich assaults and front-running. Its on-chain scanner blocks tokens with blacklist capabilities, hidden mints, stealth taxes, and different widespread rug-pull mechanics earlier than any commerce is executed.

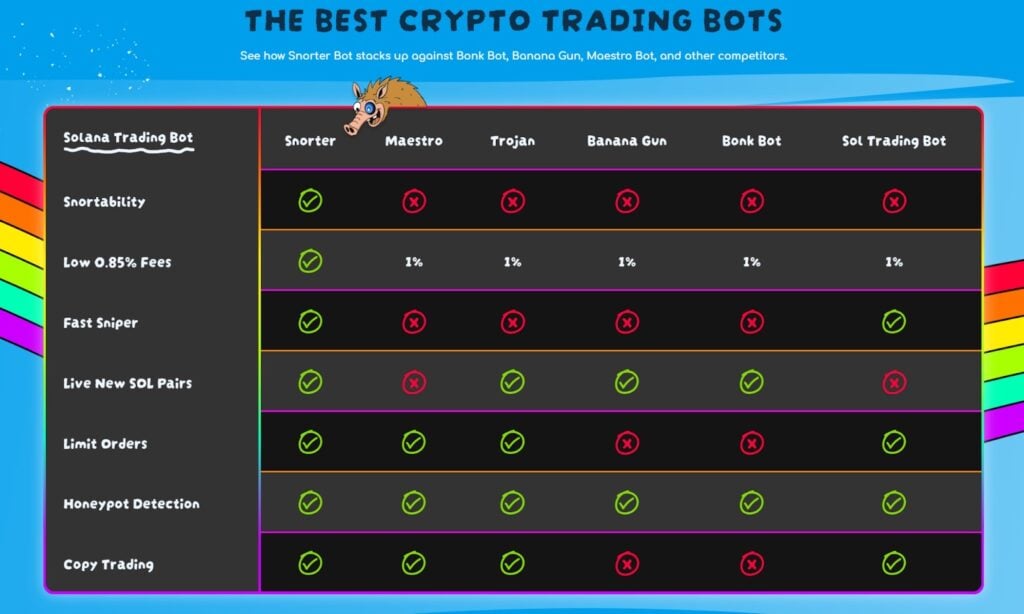

As well as, it’s the most cost-effective Telegram-native crypto buying and selling bot. Whereas the buying and selling payment is already low at 1.5% typically, it drops to 0.85% for SNORT holders, which is the venture’s native cryptocurrency.

It’s, due to this fact, no shock that SNORT has already raised $300k in its ongoing presale in simply two days.

Owing to its distinctive worth proposition and the sturdy demand for the Snorter Bot, distinguished analysts consider that SNORT may very well be the following 100x crypto. As well as, early presale patrons can stake their holdings and earn engaging passive revenue.

Go to Snorter Token Presale

This text has been offered by one in every of our industrial companions and doesn’t mirror Cryptonomist’s opinion. Please bear in mind our industrial companions might use affiliate packages to generate revenues by means of the hyperlinks on this text.