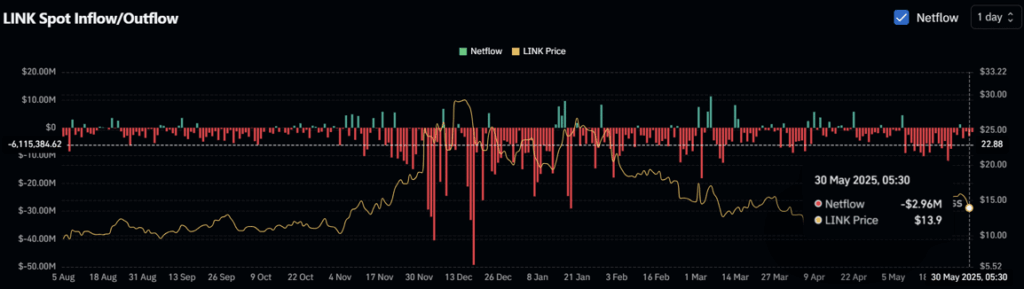

- Main Whale Exercise Detected: Practically 1.8 million LINK tokens (price $25.5M) have been moved from BitGet to a non-public pockets, suggesting accumulation. Moreover, over $4.49M in LINK has flowed out of exchanges previously 48 hours, typically a bullish sign.

- Value Assessments Key Assist Stage: LINK has dropped 6% in 24 hours, touchdown close to $13.71. Regardless of this, buying and selling quantity is up 7%. The $13.40 assist degree is essential—holding it may result in a 15% rebound, whereas dropping it dangers an extra dip to $10.40.

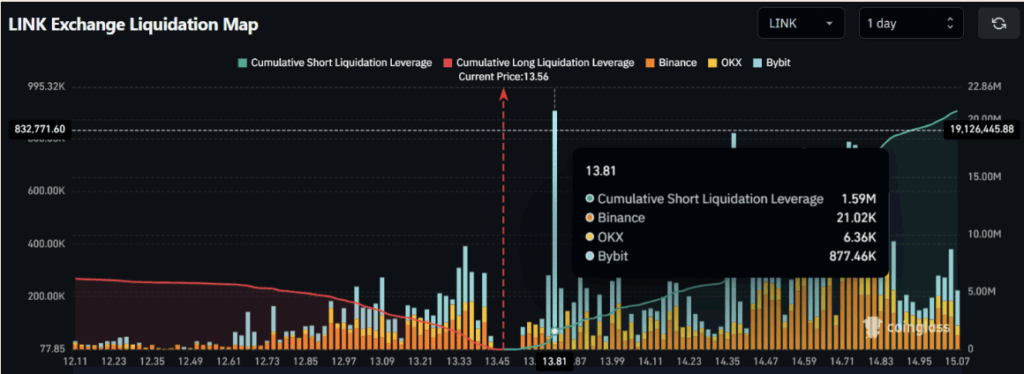

- Merchants Lean Bearish, However Reversal Doable: Liquidation knowledge reveals extra curiosity in brief positions close to $13.81. Nonetheless, if accumulation continues and sentiment shifts, LINK may bounce again strongly within the close to time period.

After taking hits for 4 straight days, Chainlink (LINK) has now stumbled proper right into a essential value zone—one that might both bounce it again up or ship it sliding even decrease. However right here’s the twist: whereas the worth has been sinking, some whales and merchants are quietly loading up, perhaps betting on a comeback.

Practically 1.8 Million LINK Simply Left BitGet

On Might thirty first, Whale Alert posted one thing that undoubtedly bought people speaking. About 1.78 million LINK tokens—roughly $25.5 million price—have been moved from BitGet to an unknown pockets. That form of transfer often screams “whale exercise” and infrequently indicators accumulation, particularly when costs are falling. And it’s not simply that one transaction. In line with CoinGlass, exchanges have been seeing a gradual outflow of LINK, with greater than $4.49 million price taken off platforms previously 48 hours. That’s typically a bullish signal, exhibiting holders could also be planning to maintain their tokens tucked away.

Value Dips, However Quantity Climbs

Proper now, LINK’s hovering round $13.71 after dropping one other 6% in only a day. Kinda tough, yeah—however right here’s the place it will get attention-grabbing. Even with the worth falling, buying and selling quantity has really jumped 7%, which implies extra individuals are leaping in—probably betting on a reversal. LINK’s now parked proper at $13.40, a degree that traditionally triggered a pleasant bounce. If sufficient folks hold accumulating and the promoting chills out, LINK may very nicely flip round and shoot up 15% to hit $15.40. But when this assist breaks? Nicely, issues may get uglier.

Eyes on the Liquidation Map

Now for the liquidation sport—merchants are watching two massive ranges. On the low finish, $13.35 is holding $1.14 million in lengthy positions. On the flip facet, up at $13.81, there’s $1.59 million price of shorts stacked up. That tells us sentiment’s nonetheless kinda bearish for now, with extra bets piling up towards a value rise. If LINK fails to carry the $13 degree and closes a day by day candle beneath it, we is likely to be taking a look at a deeper drop—probably all the way in which to $10.40.

So yeah, LINK’s at a crossroads. If whales and buyers are proper, we may see a rebound quickly. If not? Strap in for extra pink.