Russian authorities plan to ban crypto mining in occupied Ukrainian territories, marking a brand new regulatory step because the battle surpasses 1,000 days.

Russian’s Deputy Prime Minister Alexander Novak convened a gathering with senior officers to handle the nation’s strained electrical energy provide throughout the peak autumn and winter seasons. The main focus included the vitality challenges pushed by crypto mining, significantly in areas with restricted energy capability.

Russia’s Crypto Mining Restrictions Can Final Until 2031

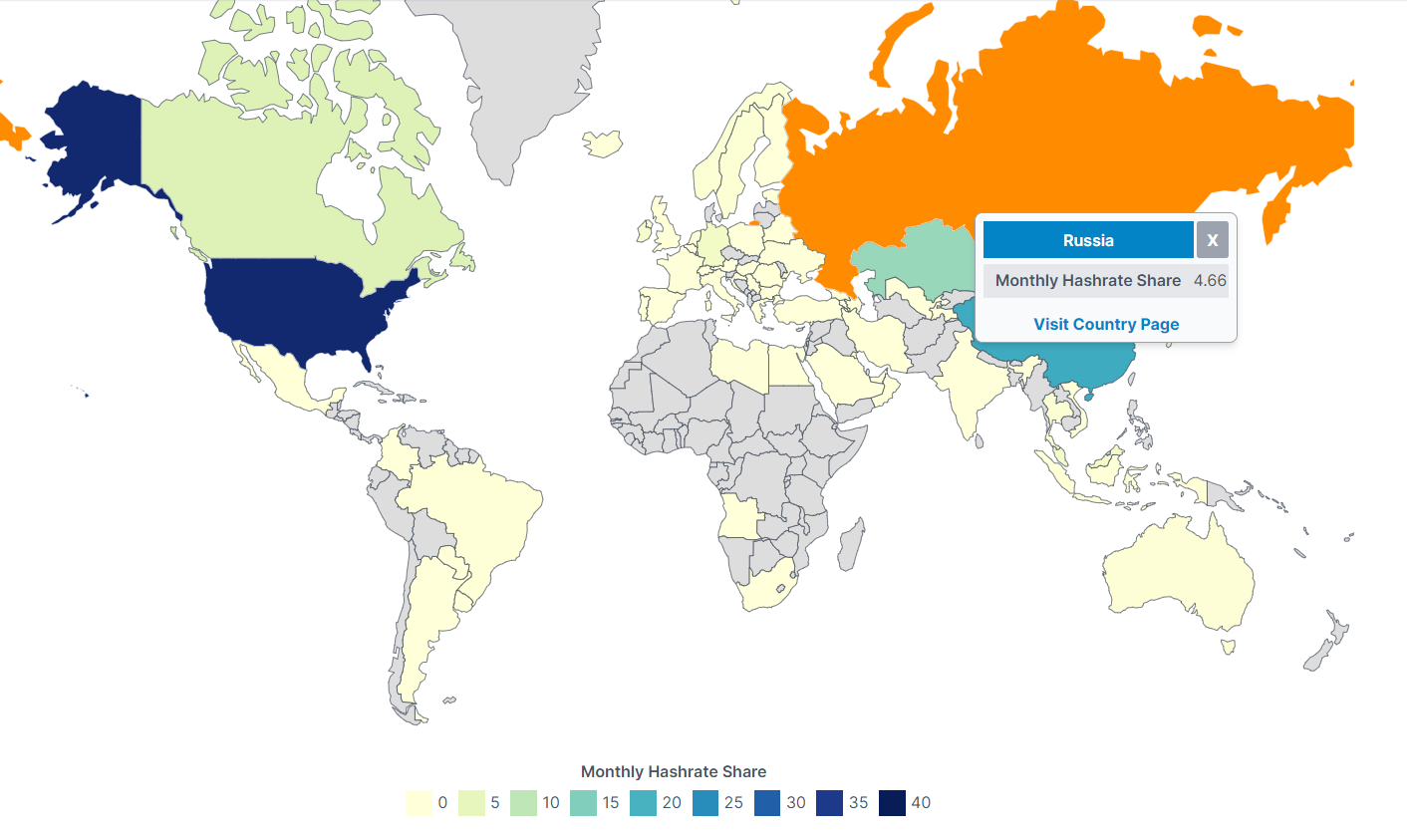

In accordance with studies from the Moscow Occasions, the proposed ban will cowl territories below Russian management, together with Donetsk, Lugansk, Zaporizhia, and Kherson. The federal government goals to curb mining actions in these areas, citing the influence on native electrical energy grids.

Within the North Caucasus and occupied areas of Ukraine, a full ban on mining will take impact beginning December 2024.

Additionally, crypto mining in Siberia will likely be suspended from December 1 to March 15, 2025. Comparable restrictions will apply yearly from November 15 to March 15 till 2031.

“Beginning Dec 2024, Russia’s Vitality Ministry is clamping down on mining rigs in energy-stressed zones like Irkutsk, Chechnya, and DPR. The takeaway’s clear: vitality ≠ infinite, and miners may have to get stealthy or pivot,” Maria Nawfal wrote on X (previously Twitter).

Putin’s authorities has been contemplating a number of adjustments to Russia’s crypto laws previously few months. The brand new legislation permits direct regulation of mining swimming pools, whereas assist for utilizing crypto as a fee technique stays robust.

Final week, the federal government revised its crypto taxation coverage. Beneath the brand new guidelines, cryptocurrency is assessed as property for tax functions. Revenue from mining will likely be taxed primarily based on its market worth on the time of receipt.

Nevertheless, miners can even deduct bills incurred throughout operations, easing some monetary strain on the trade. Cryptocurrency transactions will likely be exempt from value-added tax (VAT).

As a substitute, earnings will likely be taxed below the identical framework as securities. This may cap the private revenue tax on crypto-related revenue at 15%.

Moreover, studies point out that Russia is shifting ahead with plans to ascertain nationwide cryptocurrency exchanges. These exchanges are prone to be primarily based out of St Petersburg and Moscow.

Disclaimer

In adherence to the Belief Challenge tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nevertheless, readers are suggested to confirm details independently and seek the advice of with an expert earlier than making any choices primarily based on this content material. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.