Crypto markets have a number of US financial indicators to observe this week that would affect their portfolios.

This comes amid the rising affect of US financial information on Bitcoin (BTC), making it very important that merchants and buyers brace for affect.

US Financial Knowledge to Watch

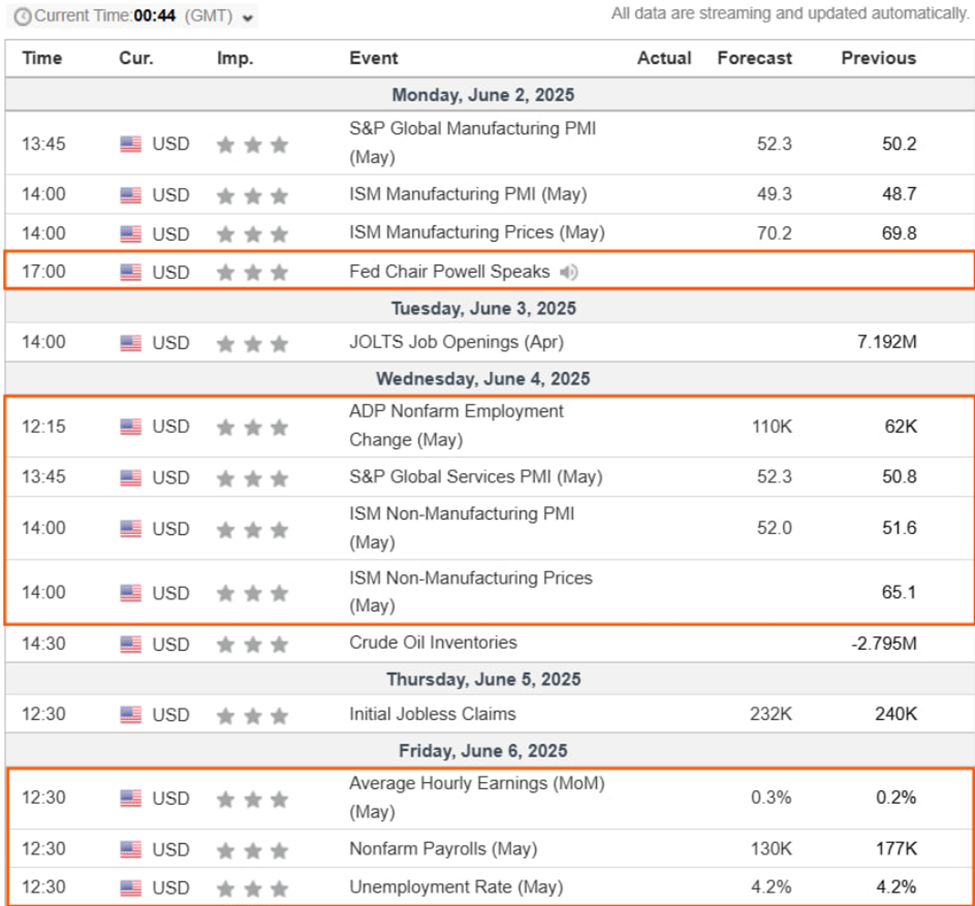

Buyers trying to capitalize on the potential volatility can commerce across the following US financial information factors this week.

US Job Openings (JOLTS)

The Job Openings and Labor Turnover Survey (JOLTS) for April 2025 is ready to be launched on June 3. In March, job openings fell to 7.192 million, marking the bottom stage since September 2024 and falling beneath market expectations of seven.48 million.

This decline occurred earlier than the total affect of the Trump administration’s new tariffs. In line with Bloomberg analysts, the financial insurance policies have depressed hiring.

“…employers specializing in containing prices as households change into a bit extra guarded and companies reconsidered funding plans towards a backdrop of shifting commerce coverage,” Bloomberg acknowledged.

As this US financial indicator approaches, Bitcoin merchants ought to brace for affect. A continued lower in job openings could sign a cooling labor market, probably prompting the Federal Reserve (Fed) to think about easing financial coverage.

Such a shift may weaken the US greenback, making Bitcoin extra enticing as a substitute asset. Conversely, if job openings stabilize or enhance, it might reinforce expectations of continued financial tightening, probably dampening Bitcoin’s attraction.

ADP Employment

One other US financial indicator to look at this week is the ADP Employment report for Could 2025, due on Wednesday, June 4. In April, private-sector employment elevated by 62,000 jobs, a major slowdown from March’s revised acquire of 147,000.

For now, nevertheless, economists see a median forecast of 112,000. A lower-than-expected job progress determine may sign financial cooling, probably prompting the Fed to think about easing financial coverage.

Such a shift may weaken the US greenback, making Bitcoin extra enticing as a hedge towards foreign money depreciation.

Conversely, a stronger-than-expected report may reinforce expectations of continued financial tightening, probably dampening Bitcoin’s attraction.

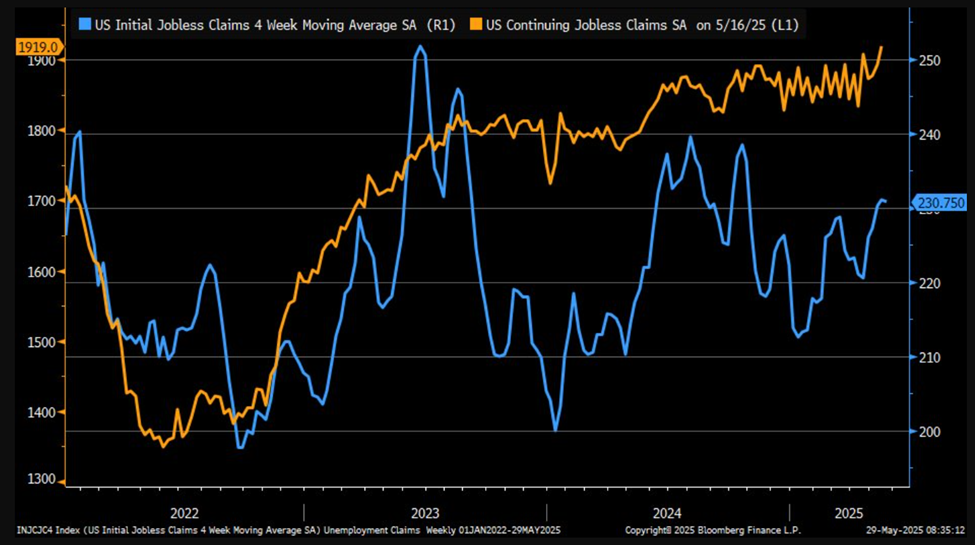

Preliminary Jobless Claims

Preliminary jobless claims for the week ending Could 24 rose to 240,000, up from 226,000 the earlier week and exceeding the forecast of 229,000. This marked the best stage since November 2021, indicating potential softening within the labor market.

As a part of the US financial indicators to look at this week, markets will see how many individuals filed for unemployment insurance coverage for the week ending Could 31.

With a median forecast of 232,000, an uptick in jobless claims could sign financial weak spot. This might enhance the chance of the Fed adopting a extra accommodative financial stance.

Such a shift may result in a weaker greenback, enhancing Bitcoin’s attractiveness as a substitute asset. Nevertheless, if the rise in claims is seen as a short lived fluctuation, the affect on Bitcoin could also be restricted.

“Preliminary jobless claims proceed to steadily, however slowly, enhance,” noticed Eric Basmajian, a enterprise cycle analyst.

Non-Farm Payrolls

The US Employment report, or Non-Farm Payrolls (NFP) for Could 2025, is scheduled for launch on June 6. In April, the financial system added 177,000 jobs, surpassing expectations, whereas the unemployment charge remained regular at 4.2%.

“Economists see payrolls rising by 125,000 after job progress in March and April exceeded projections, primarily based on the median of a Bloomberg survey. That would go away the typical over the previous three months monitoring a still-solid 162,000. The unemployment charge is seen holding at 4.2%,” Bloomberg analysts famous.

Economists anticipate a slowdown in job progress to 130,000 in Could, reflecting potential financial impacts from President Trump’s tariffs.

Robust job progress could lead the Fed to take care of its present financial coverage stance and even contemplate tightening, which may strengthen the US greenback and probably suppress Bitcoin costs.

Nevertheless, if underlying financial issues immediate the Fed to undertake a extra dovish method, Bitcoin may benefit as buyers search various shops of worth.

Analysts say powerful employment situations within the US come as employers looking for readability across the White Home’s commerce coverage progressively need to take care of frequent changes to timelines and schedules.

“Elevated volatility is anticipated—put together your danger administration and look ahead to confirmations earlier than coming into trades,” MrD Indicators cautioned.

As of this writing, Bitcoin traded for $104,858, after rising 0.17% within the final 24 hours.

The put up 4 US Financial Indicators With Crypto Implications This Week appeared first on BeInCrypto.