- Sui’s market cap dropped 40.3% in Q1 2025, nevertheless it nonetheless climbed to thirteenth place total as low charges and sponsored transactions helped keep person exercise.

- Over $549M price of tokens had been unlocked, fueling inflation considerations; actual staking yields slipped to -0.14% regardless of 77.3% of eligible provide remaining staked.

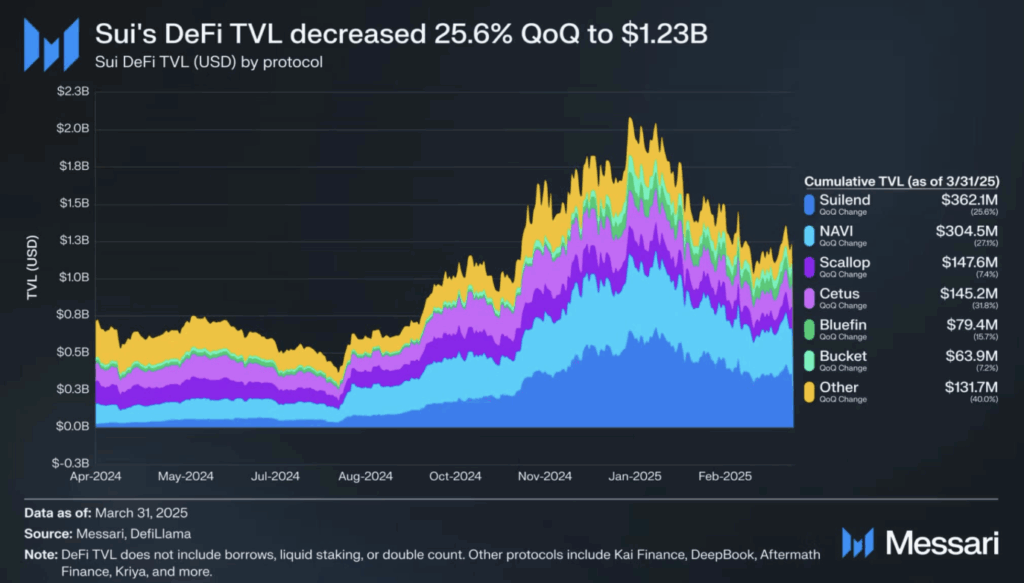

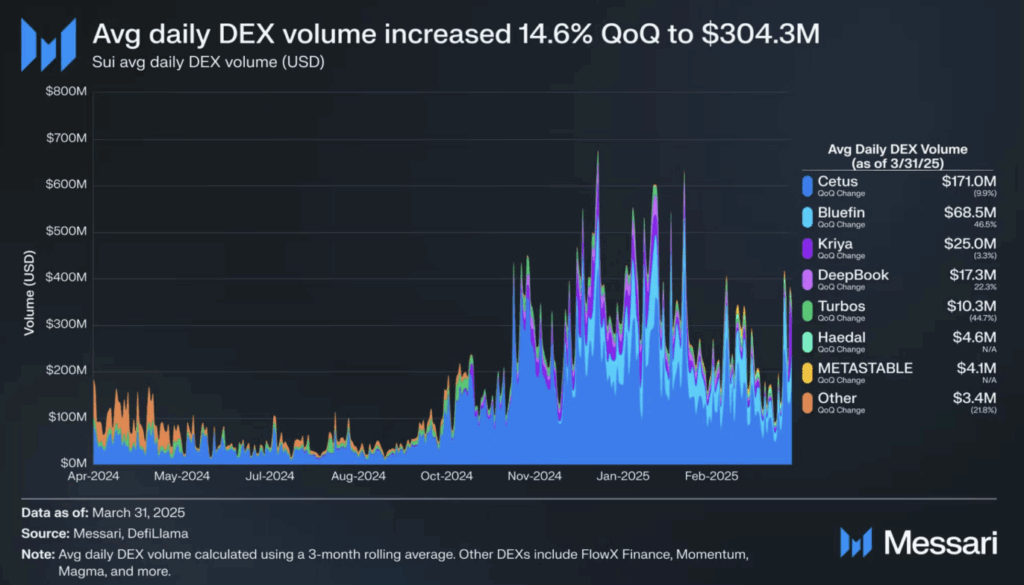

- Sui’s DeFi and DEX ecosystems confirmed resilience, with Suilend, NAVI, and Cetus driving exercise and DEX quantity hitting a report $304.3M every day common.

The primary quarter of 2025 was… not nice for Sui. Its circulating market cap nosedived by 40.3%, touchdown at round $7.2 billion. That’s greater than double the hit the general crypto market took, which dropped about 18.2% throughout the identical stretch, in line with Messari’s newest information. However oddly sufficient, Sui nonetheless managed to maneuver up—two spots, really—now sitting at #13 by market cap. So, not all doom and gloom.

Charges on the community dropped too, consistent with the worth dip. Sui solely pulled in $3.6 million in whole charges for the quarter, a 33.3% slide from the one earlier than. Once you have a look at it in SUI phrases, charges had been down 44.4%. Much less buying and selling, much less person exercise—all of it provides up. Nonetheless, Sui caught to its low-cost transaction mannequin, with charges averaging simply $0.0087 per switch. Additionally, over 23% of transactions had been sponsored, serving to builders hold issues accessible for customers.

Inflation Pressures Creep In Amid Token Unlocks

Now, about inflation—yeah, that was a factor too. In Q1, Sui unlocked about 242.5 million tokens, which had been distributed to early backers, contributors, and reserve swimming pools. Sounds small at 2.42% of whole provide, however the market felt it; that unlock was price almost $550 million. And though 77.3% of the eligible provide stayed staked by the top of March, it wasn’t sufficient to maintain yields engaging. When you think about inflation, actual annual returns dipped barely adverse to -0.14%.

Nonetheless, the community’s staking system, particularly with liquid staking energetic even for locked tokens, helped hold some stability. It wasn’t a collapse—it was extra like a strain check. And Sui didn’t precisely break.

DeFi Protocols Push By means of as Worth Contracts

Sui’s DeFi scene held its floor, even with shrinking numbers. Lending protocol Suilend nonetheless led the pack, closing the quarter at $362.1 million in TVL—that’s a 25.6% drop, nevertheless it managed to hold on to just about 30% market share. In addition they rolled out STEAMM, a “superfluid” AMM that lets LP belongings multitask throughout swaps and lending. Fairly slick.

Proper behind them, NAVI ended the quarter with $304.5 million in TVL and 24.7% market share. NAVI.ag acquired rebranded to Astros, and Mayan Finance acquired looped in to spice up swapping performance. Scallop wasn’t far off both—it reached $147.6 million TVL and racked up over $300 million in swap quantity, including multicurrency assist and scoring trade listings on BTSE and Coinstore for its SCA token.

DEX Quantity Surges Because of Suilend and Cetus

On the buying and selling aspect, Sui’s decentralized exchanges had a second. Each day common quantity throughout DEXs hit $304.3 million—up 14.6% from final quarter. Cetus led the cost with $171 million every day, whereas Bluefin wasn’t too far behind at $68.5 million. Others like Kriya, DeepBook, and Turbos additionally saved busy, displaying off Sui’s throughput muscle and rising infrastructure.

So yeah—Q1 was tough. However even with headwinds, Sui’s ecosystem saved transferring. And which may rely for greater than a inexperienced candle in the long term.