Child boomers are the fastest-growing demographic in crypto, with their numbers doubling within the house of a yr, in response to a survey by Australian change CoinSpot.

The entire proportion of crypto buyers over 60 stays comparatively low — round 4.4% — however with their massive retirement nest eggs and a lifetime’s price of financial savings, boomers have an outsized affect on markets.

Former ANZ banker and funds guide Rod Tasker, himself a child boomer, says lively crypto buyers in his age bracket are usually extremely financially literate.

“Even when the quantity is pretty low, the sum of money invested is kind of prone to be larger than different demographics,” he explains.

“A variety of them are fairly refined, they’ve already obtained their funding portfolios. They could have the funding property, the share portfolio, relying on danger urge for food they may have gotten into choices,” he says.

However on the different finish of the dimensions, he says that child boomers who grew up in a extra trusting and fewer linked world usually find yourself as targets of crypto scammers for his or her wealth.

“The infant boomer demographic does have people who find themselves very susceptible to that scamming for all types of causes, starting from dementia via to being introduced up in a extra sheltered world.”

In accordance with the Pew Analysis Centre, child boomers had been born between 1946 and 1964. Although just about anybody over 50 in crypto stands probability of being labelled a boomer. Within the US, boomers maintain round $79 trillion in belongings, in response to the Federal Reserve.

Boomer will get scammed by Australian ‘prime minister’

Mike is an 80-year previous former mortgage dealer who turned taken with a crypto funding alternative after watching Australian Prime Minister Anthony Albanese interviewed in regards to the scheme on present affairs panel present The Mission.

“He had this Bitcoin funding program, which was positively secure, and it was improbable,” says Mike. “They had been doing a purchase low and promote excessive usually and had this little algorithm that made it work.”

Sadly, the footage was a deepfake cooked up by AI that linked Mike to a crypto rip-off web site, the place a stunning chap from customer support inspired him to ship via a small preliminary funding of some hundred euros.

When the positioning shortly started pestering him to ship 10,000 euros, he began to appreciate one thing fishy was occurring.

“It simply appeared so real,” he says. “It appeared like he was speaking.”

The expertise made Mike extraordinarily skeptical of Bitcoin. His unease solely elevated after a good friend who’d purchased 4 Bitcoin for just a few hundred {dollars} virtually a decade in the past tried to money them in on-line and was fleeced out of $400,000.

“She found that the cryptocurrency had been cashed, however the cash was cashed for another person,” he says. “She was very upset.”

Boomers are warming as much as Bitcoin… slowly

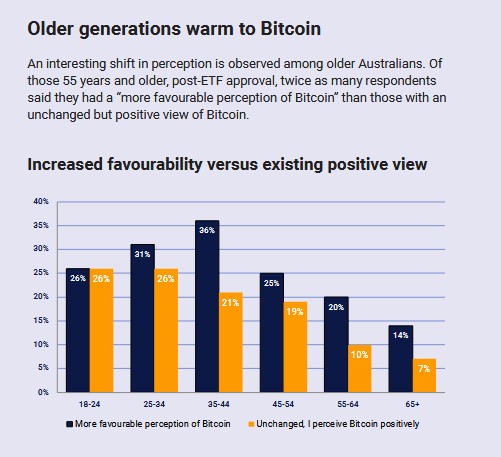

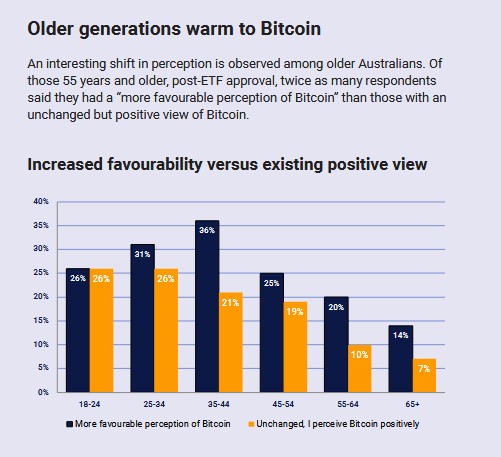

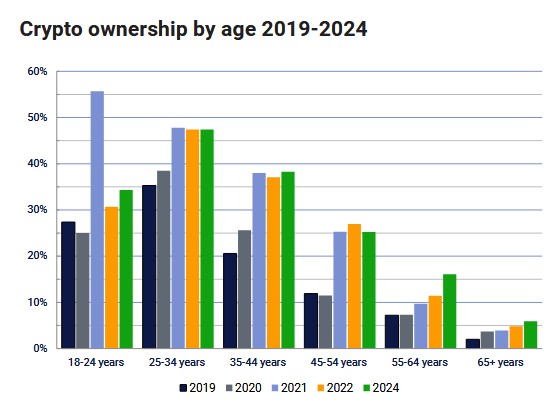

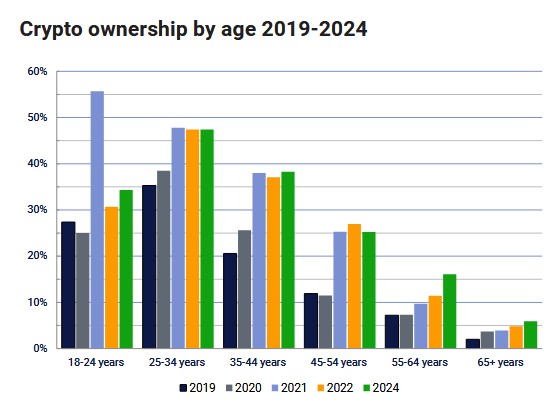

All too frequent tales like this have given crypto a foul status amongst child boomers. Crypto adoption amongst boomers is way decrease than amongst 50- to 59-year-olds (12.2% of whom are buyers) and the 20.7% adoption fee of the final inhabitants, in response to CoinSpot’s April survey.

However Tim Wilks, chief enterprise improvement officer for CoinSpot, says there are indicators boomers are warming as much as crypto. The survey discovered 38.5% of Australians aged 60+ reported being open to investing in crypto sooner or later and don’t reject it outright, which is just about equivalent to the nationwide common (37.8%).

“Whereas the adoption curve for older Australians stays steeper than for youthful cohorts, curiosity and adoption are each nonetheless rising,” he says. “The boomer technology is not dismissing crypto out of hand, and lots of are asking severe questions and weighing it as a part of their retirement technique.”

Traders over 60 who handle their very own retirement funds are twice as prone to maintain crypto (6.2%) than those that don’t (3.2%).

One other Australian change, Impartial Reserve, discovered larger charges of crypto possession amongst boomers than CoinSpot, with possession among the many 65+ age group tripling to six% between 2019 and 2024. Amongst buyers aged 55-64, possession doubled to 16%.

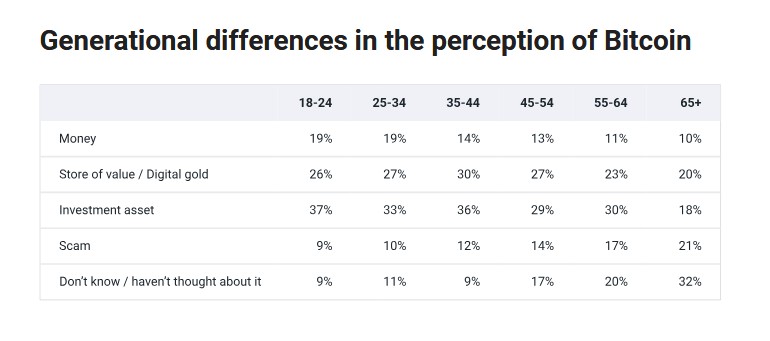

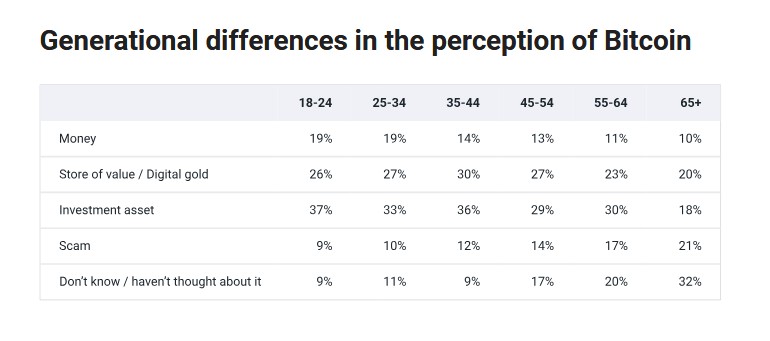

Nevertheless, IR additionally discovered {that a} majority of these over 65 (52.4%) both don’t have any opinion (31.8%) or take into account crypto to be a rip-off (20.6%).

Within the US, knowledge from Blockchain Statistics and Demandsage counsel that child boomers make up 10% of crypto house owners. Within the UK, EY’s Wealth Report discovered that round 15% of boomers need to diversify their portfolios into different belongings like Bitcoin.

Simon’s retirement plan is 100% crypto and Bitcoin

Crypto dealer Simon B. from the Sunshine Coast is a part of the excessive internet price Platinum group for crypto schooling and advisory service Collective Shift. He has all of his retirement funds in crypto and most of his different wealth, too.

The 57-year-old former IT skilled was an lively dealer, however after dropping 1 BTC in a day, he switched to longer-term investing. He says members of the Platinum group are usually older and wealthier and have a special method to investing than Collective Shift’s retail service.

“They’re a bit extra mature than the youthful of us in a lot of alternative ways, not simply of their investing crypto model — a number of them have made cash on the planet in enterprise and different issues and look at it pretty otherwise,” he says.

“There’s even a man that joined the opposite day who’s 78.”

Learn additionally

Options

How the crypto workforce modified within the pandemic

Options

How Silk Street Made Your Mailman a Supplier

[Simon and other interviewees wanted to keep their last names private as they are worried about security threats from being publicly identified as wealthy crypto investors. Mike didn’t want it known publicly that he’d fallen for a scam.]

Simon explains that older buyers are inclined to favor longer-term allocations to large-cap tasks like Bitcoin, Ethereum, Solana, “perhaps Sui,” and have little curiosity in memecoins.

One other member of the group, 52-year-old Alex P from Sydney, tells Journal that the ETFs and the pro-crypto stance of the US authorities have helped legitimise crypto for older buyers.

“It’s extra legit than it was since you’ve now obtained the BlackRocks, you’ve obtained the US authorities, you’ve obtained the crypto czar there. I feel as soon as an asset will get to be a trillion {dollars}, then it must be taken severely by funding funds.”

Simon agrees that child boomers are warming up, however provides that it’s a really gradual course of.

“I positively suppose it’s altering pretty quickly. However I feel that that snowball remains to be pretty small,” he says.

“I nonetheless suppose we’re within the very early adoption stage. And I feel that there may now be, say, 3% to five% of folks that suppose it’s one thing respectable in that age group.”

Bitcoin skeptical boomers need to put money into “one thing actual”

One massive psychological block holding boomers again from investing in digital belongings is conceptual. They will perceive proudly owning one thing in the true world, however discover the concept of digital possession tougher.

“I feel folks my age and our background, and what we’ve accomplished over our lifetime, counsel that we like one thing that’s actual,” explains Mike.

“If I purchase a share in an organization, I’ve obtained the share certificates. So I do know I’ve obtained one thing actual.”

In an opinion piece for The Impartial, Bitcoin skeptic James Moore noticed there was “a generational change in pondering” on this subject.

“Bitcoin’s decentralized retailer of worth is actually backed by an thought, or a perception,” he wrote, including that concepts are extra highly effective within the “digital world inhabited by millennials and the even-more-plugged-in Era Z.”

Learn additionally

Options

Assault of the zkEVMs! Crypto’s 10x second

Options

Fan tokens: Day buying and selling your favourite sports activities crew

“It’s fascinating to notice that what could seem intangible to Gen X dad and mom and boomer grandparents is as actual to their kids as any bodily product.”

One other situation for older folks like Mike is that they’ve discovered the arduous method that something that appears too good to be true, in all probability is.

He explains that tales of individuals getting wealthy in a single day rings alarm bells.

“A thought in our youthful days: if one thing sounds so completely improbable, it in all probability isn’t,” he says.

Wealthy boomers love Bitcoin

A survey of 700 child boomer shoppers worldwide by deVere Group in September reinforces the concept that it’s probably the most financially literate boomers who’re taken with Bitcoin. The ballot discovered that 45% of that subgroup of boomers now favor holding Bitcoin over secure haven belongings like gold.

CEO Nigel Inexperienced described the discovering as “a seismic shift within the funding world” pushed by “the rising participation of main institutional buyers, the introduction of regulated monetary merchandise like Bitcoin ETFs, and a extra outlined regulatory framework in key markets.”

Former Nationwide Australia Financial institution and Westpac banker Ken Standfield, 60, determined to start out his crypto schooling YouTube channel and web site, CryptoTradingKS, in 2021 after a brush with demise resulting from a mind tumor.

The neighborhood is now about 16,000 robust, largely older, high-net-worth professionals with some approaching, or already in, retirement. The oldest member is 89.

“I’ve obtained folks with extremely massive portfolios,” he says. “They’re actually very skilled, they’ve obtained a number of savvy, they’re very good.”

In contrast to Collective Shift’s Platinum group, members of Standfield’s neighborhood are extra usually lively merchants who purchase and promote primarily based on technical evaluation, alerts like volatility indicators and torrents of information.

“These aged buyers, the extra mature inside our neighborhood, they nonetheless commerce,” he says. “They will commerce $10,000, $50,000, $100,000.”

However Standfield says child boomers have a a lot larger deal with defending what they’ve, moderately than risking every part.

“I classify myself as an older dealer as a result of I can’t lose my capital,” he says. “Having labored all my life to get the place I’m, if I screw it up, it’s gone and what am I going to do? That’s arduous to make again.”

However whereas older buyers usually deal with minimizing danger and preserving their nest eggs, one thing that’s usually ignored is that enjoying crypto markets will be a number of enjoyable. It offers retired folks with loads of time on their fingers an enchanting interest.

“I’m by no means, ever going to retire. It doesn’t matter how previous I’m. I could possibly be 99. I’ll nonetheless be doing one thing. And I feel for older buyers: Don’t retire!” declares Standfield.

“And when what you’re doing it could make you some huge cash as properly and that’s actually, actually necessary.”

Subscribe

Probably the most participating reads in blockchain. Delivered as soon as a

week.

Andrew Fenton

Primarily based in Melbourne, Andrew Fenton is a journalist and editor masking cryptocurrency and blockchain. He has labored as a nationwide leisure author for Information Corp Australia, on SA Weekend as a movie journalist, and at The Melbourne Weekly.