Bitcoin’s worth slipped to $101,579 right this moment, down 3.5% in 24 hours and 4.5% over the previous week, as almost $1 billion in leveraged crypto positions have been liquidated throughout main exchanges.

The decline coincides with an intensifying political feud between Elon Musk and US President Donald Trump—an uncommon however materials issue spooking markets and triggering investor exits.

Almost $1 Billion Liquidated as Market Reacts to Political Volatility

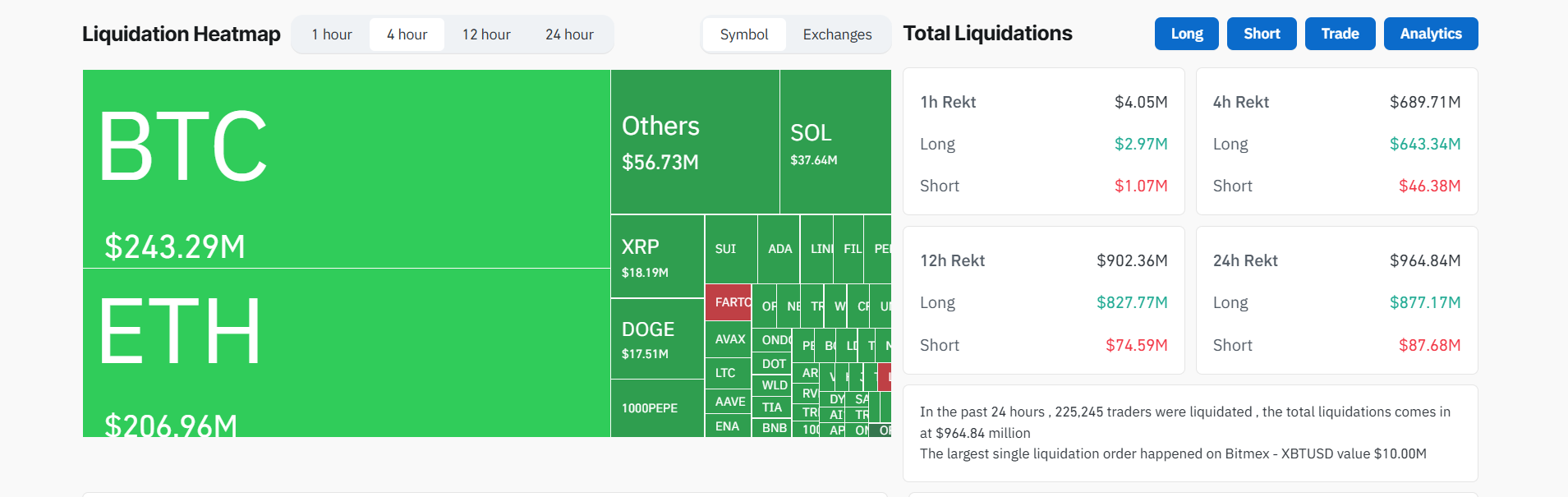

In line with liquidation information, a complete of $964.84 million in positions have been liquidated over the previous 24 hours, with $877.17 million of these being lengthy positions.

Bitcoin accounted for $243.29 million of the entire, adopted carefully by Ethereum at $206.96 million. Over 225,000 merchants have been liquidated throughout the identical interval.

The abrupt unwinding of leverage highlights rising unease amongst market individuals—lots of whom are reacting to broader macro dangers and the surprising ripple results of home US politics on digital asset markets.

Trump-Musk Feud Sparks Volatility

The drop in Bitcoin’s worth aligns with the general public fallout between Elon Musk and President Trump, which escalated this week after Musk publicly criticized Trump’s $1.6 trillion “One Large Stunning Invoice Act.”

Additionally, Musk accused the invoice of ballooning the nationwide deficit and chopping crucial electrical car subsidies that instantly have an effect on Tesla.

In response, Trump threatened to chop off all federal contracts with Musk’s firms—together with Tesla, SpaceX, and Starlink—triggering a 15% drop in Tesla’s inventory worth.

Musk then retaliated with requires Trump’s impeachment. He additionally alluded to Trump’s alleged ties to unreleased Epstein recordsdata.

In the meantime, a number of sources have confirmed that prime White Home aides held emergency conferences right this moment to evaluate the potential financial fallout.

The high-profile battle is now seen as a possible destabilizer for tech equities and digital property alike. Crypto merchants are apparently dashing to cut back publicity.

General, regardless of a broader risk-on setting pushed by the anticipation of price cuts later in 2025 and rising institutional participation in crypto, this political drama is clouding sentiment.

Will Bitcoin Maintain the $100,000 Line?

Technically, Bitcoin now sits simply above a key psychological help stage at $100,000.

A decisive breakdown beneath this stage might set off a contemporary spherical of algorithmic promoting and liquidation occasions. Particularly with lengthy overleveraged positions dominating the books.

If lengthy liquidations proceed at this tempo, Bitcoin might take a look at the $95,000–$98,000 vary earlier than discovering significant help.

The Musk-Trump fallout displays the rising entanglement of crypto markets with world politics and legacy finance.

Merchants are actually studying that Bitcoin’s volatility isn’t only a perform of on-chain metrics or macroeconomic indicators. Billionaire feuds and legislative threats may also set off volatility.

Till tensions ease or markets discover a new catalyst, Bitcoin’s short-term outlook stays fragile.

Disclaimer

In adherence to the Belief Venture pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nevertheless, readers are suggested to confirm details independently and seek the advice of with an expert earlier than making any selections based mostly on this content material. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.