A recent wave of layoffs is sweeping throughout industries in 2025, signaling that the labor market could enter its most turbulent section for the reason that pandemic-era downturn. This provides to the record of US macroeconomic indicators with crypto implications.

Job cuts are not remoted to tech giants or authorities companies, and the true economic system is flashing pink. Fairness markets are additionally treading water, and crypto buyers are clinging to fee minimize hopes.

Crypto Eyes Labor Market as Layoffs Spike 80% in 2025—Is Inflation No Longer the Important Risk?

Employment and jobs knowledge are progressively gaining affect as one of many US financial indicators with crypto implications.

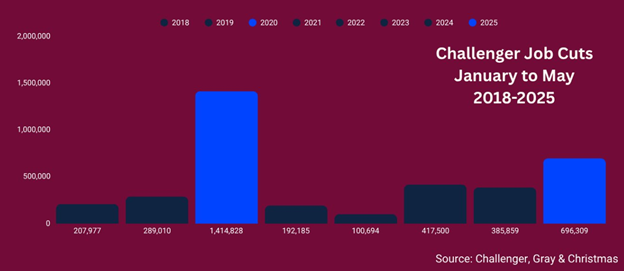

The layoff wave that rattled markets in 2022–2023 is making a pointy return in 2025. Reportedly, US-based corporations introduced extra job cuts within the first 5 months of 2025 than in any equal interval over the previous 4 years.

“Tariffs, funding cuts, client spending, and general financial pessimism are placing intense stress on corporations’ workforces. Firms are spending much less, slowing hiring, and sending layoff notices,” wrote Foreign exchange Analytix, citing Andrew Challenger, Senior Vice President of Challenger, Grey & Christmas.

Knowledge additionally exhibits deterioration within the US labor market. In keeping with Challenger, Grey & Christmas, Might 2025 job cuts are up 47% over the identical month final 12 months. 12 months-to-date (YTD) cuts are additionally up 80% over 2024.

“Cuts are spreading to different sectors than Authorities, for different causes than funds cuts and Dogecoin crashes,” the outplacement agency famous.

Andrew Challenger, Senior Vice President on the agency, supplied a blunt evaluation. He famous that Trump’s tariffs, funding cuts, client spending, and general financial pessimism put intense stress on corporations’ workforces.

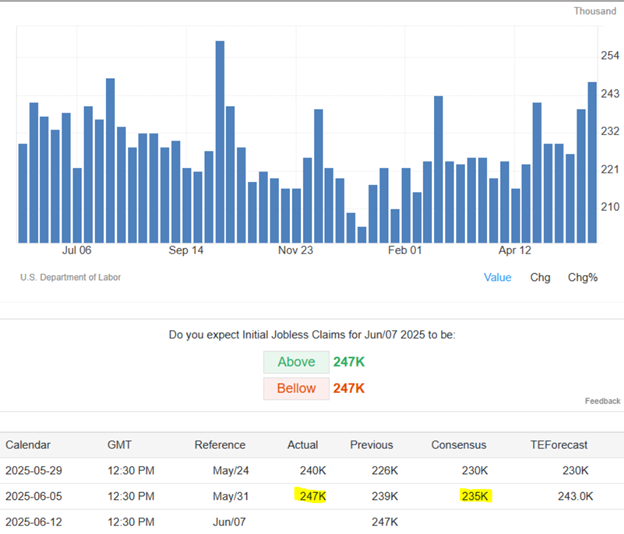

Thursday’s knowledge reinforces the pattern, with US preliminary jobless claims rising by 8,000 to 247,000 for the week ending Might 31.

This implies functions for US unemployment advantages unexpectedly elevated final week. In the meantime, Bloomberg famous that the US commerce deficit narrowed in April by essentially the most on file, on the largest-ever plunge in imports.

That is the very best degree since early October 2024 and considerably above market expectations of 236,000. This means a softening labor market, with indicators of weakening or slowing down, typically indicating lowered financial exercise or confidence.

On the identical time, the Kobeissi Letter flagged a deeper undercurrent, noting that the 3-month transferring common of job openings fell to 7.36 million in April, the bottom since 2021.

That is additionally under the pre-pandemic peak in This autumn 2018, with the ratio of job openings to unemployed staff hitting 1.03, the second-lowest since April 2021.

“US job openings proceed to pattern decrease…The job market is clearly weakening,” wrote The Kobeissi Letter.

Nonetheless, the Might jobs report confirmed that the US economic system added 139,000 nonfarm payrolls in Might, greater than the 126,000 that had been anticipated.

“The US Labour market has shrugged off the tariff uncertainty that rocked international inventory and bond markets in April and Might.

Whereas the Federal authorities has continued to shed a small variety of jobs, the broader economic system has greater than made up the distinction, with the US including barely extra jobs than anticipated in Might. Wage progress additionally got here in larger than anticipated – suggesting the economic system is in impolite well being,” Nicholas Hyett, Funding Supervisor at Wealth Membership advised BeInCrypto.

AI Disruption, Shrinking Demand, and VC Retreat Amplify Labor Market Stress

The causes behind this layoff wave are extra structural than cyclical. In keeping with macro commentator Zachary T. Bravo, the job loss could also be AI-driven.

“We’re within the early innings now; corporations aren’t calling it AI-related (that’s politically unacceptable); the purpose is, corporations are down-sizing and a few roles are actually absolutely out of date,” Bravo said.

He outlined 4 waves of job loss: tech and authorities layoffs, AI-driven job loss, corporations reacting to the lowered top-line crunch with additional layoffs as consumption ticks down, and robot-related job loss.

Primarily based on this, the commentator foresees the federal government printing cash to cushion the financial influence.

“Prediction: the federal government will print cash to tug us out. Anticipate public works tasks, elevated debt to fund them (weak greenback, costly credit score), and (silver lining) some higher infrastructure,” Bravo added.

Crypto-native corporations are feeling the pinch too. BeInCrypto reported the Ethereum Basis shedding employees as a part of a core workforce overhaul. This may increasingly indicate inner value restructuring even in mission-critical blockchain establishments.

In the meantime, the enterprise capitalist (VC) enviornment is present process a shift, with portfolio supervisor Greg Isenberg highlighting the broader penalties.

“Layoffs are available waves, not . First spherical in Q2 (10-15%), then once more in This autumn (15-25%) as corporations notice the primary minimize wasn’t deep sufficient…VCs get quieter. LPs pull again commitments when markets drop, slowing capital calls… Company spending will get chilly/freezes,” he warned.

Isenberg pointed to “a double whammy” for client startups: recession-wary prospects spend much less, and tariffs improve the price of items bought. Direct-to-consumer (DTC) or e-commerce corporations with skinny margins are hit hardest.

“The losers… high-burn DTC manufacturers… late-stage startups that prioritized progress over unit economics… The winners… worthwhile corporations, solo founders with low burn, startups with pricing energy, and AI corporations fixing real enterprise issues,” Isenberg defined.

With layoffs rising, job openings shrinking, and investor threat urge for food waning, the second half of 2025 could hinge on employment past inflation and rates of interest. This narrative shift has deep implications for crypto, capital, and client demand.

Bitcoin was buying and selling for $103,720 as of this writing, down by almost 1% within the final 24 hours.

The publish Might Labor Market Shock Overtake Inflation as Bitcoin’s Subsequent Macro? appeared first on BeInCrypto.