- Apple, Google, Airbnb, and X are quietly exploring stablecoin integration to chop prices on worldwide transactions.

- Elon Musk’s X teamed up with Polymarket and may very well be heading towards tremendous app standing with built-in crypto options.

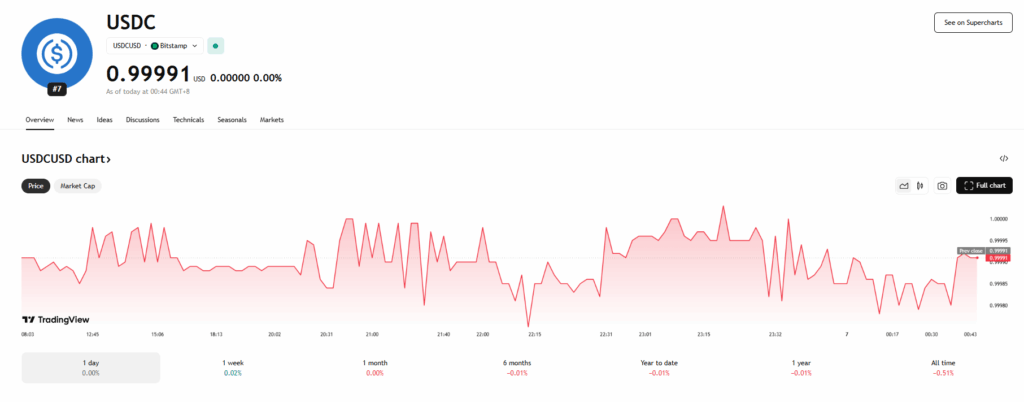

- Circle’s USDC continues dominating stablecoin quantity, as CRCL shares soar 200% following its IPO.

A wave of huge names—Apple, Google, Airbnb, and X (yeah, that’s Twitter 2.0)—have began speaking to crypto corporations about stablecoins, Fortune Crypto reported Thursday. The intention? Trim down transaction charges and make international funds means much less painful. These chats are nonetheless within the early levels, however they echo strikes already being made by Meta and Uber, each eyeing dollar-pegged tokens as the way forward for frictionless funds.

Again in Could, Meta floated the concept stablecoins may assist creators (assume Instagram influencers) dodge these pesky cross-border charges. Uber, not one to be not noted, stated it’s exploring the house too—nonetheless early, however the curiosity’s there. All of this buzz is occurring as regulators begin warming as much as crypto and traders maintain piling into stablecoins like they’ve seen the longer term.

Elon’s Tremendous App Dream and a Shock IPO Surge

Elon Musk’s X has been tiptoeing deeper into the crypto scene for some time. Even earlier than he stepped in, Twitter was dabbling in NFTs and constructing a small crypto squad. Now, below Musk, X is chasing a full-blown WeChat-style “the whole lot” app that might mix funds, messaging, and who-knows-what-else. Oh, and so they simply partnered with Polymarket to supply on-chain prediction markets—an area that noticed over a billion {dollars} in quantity final month.

In the meantime, Circle, the corporate behind USDC, lastly pulled off its IPO after years of almost-but-not-quite. The consequence? A skyrocket. CRCL inventory shot up practically 200% from its $31 launch value to hit $112. That’s critical momentum—and an indication the stablecoin house is heating up quick.

Stablecoins Are Gaining Main Traction

Let’s discuss numbers for a sec. Stablecoins hit a document $250 billion market cap this month. Ethereum-based stablecoins alone moved $1.42 trillion in Could. Circle’s USDC snagged practically 42% of that, logging near $589 billion in quantity. That’s not simply buzz—that’s actual, arduous adoption. And as extra tech giants dip their toes in, stablecoins may lastly be getting their second within the mainstream highlight.