US Spot Ethereum ETFs have logged 15 consecutive buying and selling days of web inflows, amassing $837.5 million since Might 16.

The influx streak began per week after Ethereum’s Pectra Improve, which elevated EIP-7702 transactions to almost 1,000 every day and enhanced pockets options with out handle adjustments.

Ethereum ETFs Hit $837.5 Million Influx Streak

These inflows represent round 25% of all web inflows for the reason that funds launched in Might 2024. The streak marks Ether ETFs’ longest uninterrupted influx interval since late 2024.

In line with knowledge from SoSoValue, it positions spot Ethereum ETFs at their highest cumulative influx worth to this point, now totaling $3.33 billion.

BlackRock’s ETHA fund leads the Ethereum ETF market in particular person inflows, contributing practically $600 million throughout this surge. Whereas ETHA boasts the very best inflows, Grayscale’s twin choices, ETHE and ETH, maintain a bigger asset base, with $4.09 billion in AUM in comparison with ETHA’s complete.

In the meantime, Constancy’s providing trails with $1.09 billion, whereas different funds stay under the $250 million mark. Notably, the surge coincides with a 38% rally within the value of Ether over the previous 30 days.

Key drivers embody renewed institutional curiosity, optimism round Ethereum’s long-term fundamentals, and the community’s latest Pectra improve. Towards these backdrops, analysts are optimistic concerning the Ethereum value outlook.

Regardless of this, analysts at JPMorgan famous that whereas institutional allocations are rising, person exercise on the Ethereum community has but to speed up post-upgrade meaningfully.

“Neither the variety of every day transactions nor the variety of lively addresses noticed a cloth improve put up latest upgrades,” JPMorgan analysts led by Nikolaos Panigirtzoglou wrote within the latest report.

If the present tempo continues, the streak may cross the $1 billion mark by subsequent week. Such an final result would additional underline a pointy pivot in sentiment after a comparatively muted begin for Ether ETFs.

Bitcoin ETFs Retreat After Report Highs

Whereas Ethereum ETFs proceed to collect momentum, the identical can’t be mentioned for his or her Bitcoin counterparts. Spot Bitcoin ETFs noticed their most up-to-date influx streak break on Might 29, when $346.8 million exited the market in a single day.

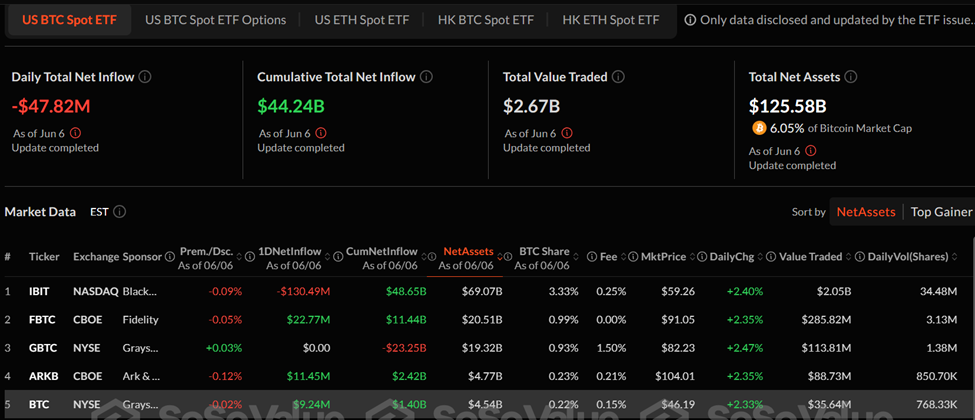

Since then, Bitcoin ETF flows have turned risky, and cumulative inflows have fallen by greater than $1 billion. That is from $45.34 billion on Might 28 to $44.24 billion as of Friday’s buying and selling session.

BlackRock’s IBIT stays the class chief by a large margin, managing $69 billion in property. Constancy’s FBTC and Grayscale’s GBTC observe with $20.51 billion and $19.32 billion in AUM, respectively.

The market additionally skilled transient turbulence after a heated on-line trade between President Donald Trump and Elon Musk triggered a broader sell-off in crypto markets and equities.

Highlight on Staking and ETF Innovation

As investor curiosity in Ether ETFs accelerates, some analysts argue that future inflows will rely upon whether or not staking performance is launched. James Seyffart, ETF analyst at Bloomberg, not too long ago highlighted regulatory workarounds being employed to launch staking-enabled ETFs.

ETF supplier REX Shares has already filed for Ethereum and Solana staking ETFs, and the primary such merchandise might arrive within the US inside weeks.

Rising demand can also be mirrored in broader Ethereum adoption metrics. In line with Santiment, Ethereum holders have now surpassed 148 million.

This alerts long-term conviction within the asset. Comparatively, Bitcoin has 55.39 million holders, whereas different in style property like Dogecoin, XRP, and Cardano report between 4 and eight million holders.

With Ether ETFs now delivering their strongest efficiency to this point, the highlight is firmly on whether or not this momentum can persist.

Maybe, staking-enabled choices would possibly drive the following wave of institutional adoption.

Disclaimer

In adherence to the Belief Mission tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nevertheless, readers are suggested to confirm details independently and seek the advice of with an expert earlier than making any choices primarily based on this content material. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.