- Trump and Musk chaos shake markets: Trump’s assaults on Fed Chair Powell and Musk’s Epstein accusations spark political and monetary turmoil, whereas the Trump Group flip-flops on the $TRUMP memecoin, complicated buyers.

- Crypto regulation and IPO shocks: California passes a invoice permitting seizure of inactive crypto accounts, whereas Circle’s blockbuster IPO alerts Wall Avenue’s rising embrace of stablecoins.

- Ethereum steals the highlight: ETH surges 46% in a month, beating Bitcoin and pulling institutional inflows, with analysts predicting costs may prime $8,500 by 2025.

Trump’s calling out the Fed and hinting at firing Jerome Powell, Elon Musk is dragging Trump into Epstein conspiracies, California simply made a serious transfer on crypto exchanges, and establishments are quietly scooping up Ethereum like loopy. In case you thought issues have been heating up earlier than, nicely, buckle up—as a result of this week, it’s absolute chaos.

Welcome again to JRNY TV, your trusted supply for making sense of the wildest headlines in finance, crypto, and politics. At the moment, we’re overlaying all the huge tales unfolding proper now which you could’t afford to overlook. From Trump’s relentless assaults on rates of interest and Fed Chair Powell, to his group’s surprising 180-degree activate the $TRUMP memecoin, issues are getting significantly unpredictable. And talking of drama, Elon Musk is publicly feuding with Trump once more, linking him to Epstein and calling for impeachment. Yeah—this isn’t your common information cycle.

However that’s not all: California simply handed a groundbreaking legislation that might allow them to seize crypto property straight from exchanges. USDC issuer Circle has formally introduced its IPO, marking one other enormous milestone for crypto legitimacy. Plus, Ethereum is abruptly on fireplace, outperforming Bitcoin by a stable 30% final month as establishments load up—does this imply ETH season is formally right here?

In at present’s video, we’re going deep on each single one in every of these tales. We’ll provide the details, the impacts, and precisely what that you must be careful for subsequent.

So, let’s bounce straight into it—beginning first with Trump’s explosive assaults on the Federal Reserve and Chairman Jerome Powell. Is a shakeup on the Fed imminent? Let’s discover out.

Trump Unleashes on the Fed—Will Powell Get the Axe?

Trump isn’t precisely identified for maintaining his opinions quiet—and proper now, Jerome Powell and the Federal Reserve are firmly in his crosshairs. In a dramatic escalation this week, Trump took to social media, aggressively criticizing Powell for what he calls a cussed refusal to slash rates of interest. He’s demanding instant motion, particularly calling for a large full share level charge reduce, arguing that the U.S. is being left behind economically due to Powell’s cautious method. His actual phrases? “Europe has had 10 charge cuts, we’ve got had none. Regardless of Powell, our nation is doing nice. Go for a full level.” It doesn’t get clearer than that.

This isn’t the primary time Trump’s clashed with the Fed Chair, however issues are clearly hitting a boiling level. He’s gone even additional, publicly labeling Powell a “idiot” and stating that Powell’s termination “can not come quick sufficient.” With these harsh criticisms, buyers and economists are significantly questioning whether or not Trump is setting the stage to exchange Powell completely. The implications may very well be huge—rates of interest straight impression the whole lot from the inventory market to crypto costs and mortgage charges, that means a change in management may shake markets laborious.

If Trump pushes Powell out and installs somebody extra aligned with aggressive charge cuts, markets may see instant volatility. Crypto buyers, particularly, are watching carefully—decrease charges typically imply increased asset costs, probably pushing crypto markets into one other rally. On the flip facet, uncertainty across the Fed may create instability within the quick time period, sending buyers working for safer property till the mud settles.

Backside line? Trump’s newest transfer is making markets nervous, and everybody—from crypto merchants to main institutional buyers—is maintaining their eyes glued to Washington. A significant shakeup on the Federal Reserve isn’t simply political noise; it may redefine the monetary panorama for months, if not years.

Trump Group’s Memecoin Flip-Flop—Stop and Desist, then All-In?

Think about this: someday, the Trump Group is sending authorized threats to a memecoin mission utilizing the Trump identify with out authorization. The subsequent, they’re asserting a big funding in that exact same coin. Appears like a plot twist, proper? Effectively, that’s precisely what’s unfolding on the planet of $TRUMP memecoin.

Initially, the Trump household, via their crypto enterprise World Liberty Monetary (WLF), issued a cease-and-desist letter to Struggle Struggle Struggle LLC and NFT market Magic Eden. These entities had launched a crypto pockets branded because the “official $TRUMP pockets,” claiming affiliation with the Trump household. Donald Trump Jr. and Eric Trump publicly denied any involvement, warning in opposition to unauthorized use of their household’s identify.

However the narrative took a shocking flip. Shortly after the authorized motion, Eric Trump introduced that WLF plans to amass a considerable place within the $TRUMP memecoin for his or her long-term treasury. This transfer signaled a shift from authorized opposition to lively funding, leaving many within the crypto group puzzled.

This flip-flop raises questions concerning the inside dynamics of Trump’s crypto ventures, in addition to pink flags. The preliminary authorized motion advised a want to manage the usage of the Trump model within the crypto house. Nevertheless, the following funding signifies a recognition of the coin’s potential profitability. It’s a traditional case of brand name administration colliding with market alternative.

Pump.enjoyable’s $1B Token Launch—A Recreation-Changer or a Purple Flag?

Think about a platform that lets anybody create a meme coin in seconds, now planning to lift $1 billion via its personal token sale. That’s precisely what’s taking place with Pump.enjoyable, and it’s sending shockwaves via the crypto group.

Pump.enjoyable, the Solana-based memecoin launchpad, is reportedly getting ready a token sale aiming to lift $1 billion at a $4 billion valuation. The sale is anticipated to incorporate each private and non-private buyers, with a possible launch within the subsequent two weeks.

Since its launch in early 2024, Pump.enjoyable has enabled customers to create practically 11 million tokens, producing over $700 million in cumulative income. The platform’s success has been attributed to its user-friendly interface and the viral nature of meme cash.

Nevertheless, the proposed token sale has sparked debate. Critics argue that introducing a local token may result in liquidity points and elevated volatility within the Solana ecosystem. Some concern it could divert consideration and sources from extra sustainable initiatives.

Then again, supporters consider the token may improve Pump.enjoyable’s ecosystem by introducing staking mechanisms, creator rewards, and governance options. This might probably appeal to extra customers and solidify its place available in the market. This has potential to be one of many BIGGEST liquidity occasions of 2025, for higher, or for worst.

Elon vs. Trump—The Feud That Shook the Web

Think about two of probably the most influential figures on the planet, as soon as allies, now locked in a public feud that’s sending shockwaves via politics, enterprise, and social media. That’s precisely what’s taking place between Elon Musk and President Donald Trump.

The fallout started when Musk criticized Trump’s “One Huge Stunning Invoice,” labeling it a “disgusting abomination” resulting from its potential to extend the nationwide debt and reduce electrical car subsidies. In response, Trump dismissed Musk’s considerations, suggesting he was appearing out of non-public curiosity. The scenario escalated when Musk endorsed a social media publish calling for Trump’s impeachment and claimed, with out proof, that Trump was named in sealed Jeffrey Epstein recordsdata.

Trump retaliated by threatening to cancel federal contracts with Musk’s firms, together with SpaceX, which has obtained substantial authorities funding. Musk countered by threatening to decommission SpaceX’s Dragon spacecraft, a crucial element of NASA’s operations.

The feud has had tangible results available on the market. Tesla’s inventory value dropped considerably, and Trump’s media firm additionally noticed a decline. The general public spat has divided their shared political base, with supporters taking sides within the #TeamTrump vs. #TeamMusk debate. There’s a good likelihood this discipline is way from over

California’s Crypto Custody Regulation—What You Have to Know

Think about waking as much as discover that your dormant crypto property held on an alternate have been transferred to state custody. That’s the truth California residents may face underneath a brand new invoice handed by the State Meeting.

Meeting Invoice 1052 (AB 1052) permits the state to take custody of unclaimed cryptocurrency property held on exchanges after three years of inactivity. The invoice, which handed unanimously within the Meeting, now strikes to the Senate for additional consideration.

Beneath AB 1052, if a crypto account reveals no exercise—akin to transactions or logins—for 3 years, the property are thought of unclaimed property. The state would then maintain these property of their unique kind, with out liquidation, permitting house owners to reclaim them later.

Whereas proponents argue that the invoice modernizes unclaimed property legal guidelines to incorporate digital property, critics categorical considerations about privateness and state overreach. The laws primarily targets custodial accounts on exchanges, not self-custodied wallets, highlighting the significance of lively account administration.

Because the invoice progresses via the legislative course of, crypto holders in California ought to keep knowledgeable and take into account reviewing their account exercise to make sure compliance and keep management over their digital property.

Circle’s Blockbuster IPO—A New Period for Stablecoins

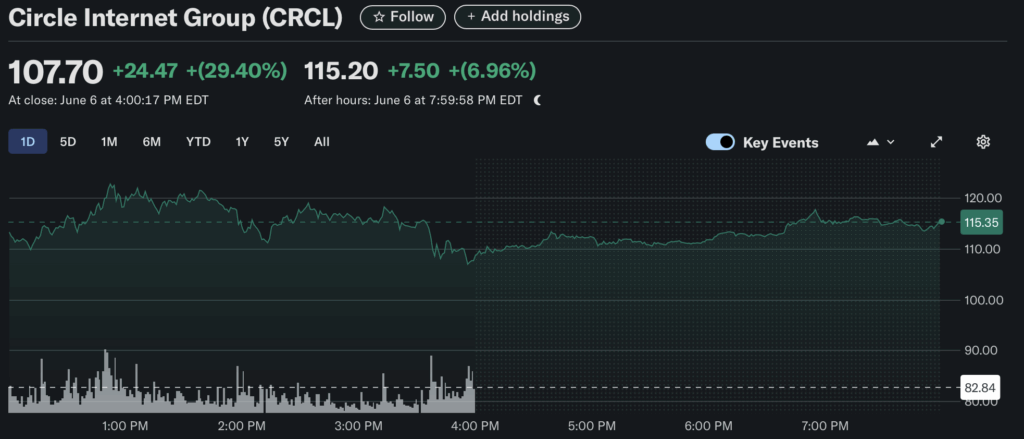

It lastly occurred. After years of hypothesis, delays, and market chaos, Circle—the corporate behind USDC—simply hit the inventory market, and it exploded out of the gate. We’re speaking one of many largest crypto IPOs ever, and yeah, Wall Avenue truly confirmed up for this one.

Circle didn’t simply slide onto the general public markets… it launched like a rattling rocket. The IPO was priced at $31 a share, however by the top of day one, it was buying and selling above $83. That’s a 168% rip, and it put Circle’s valuation above $18 billion virtually immediately. That sort of efficiency sends a really clear message: stablecoins are now not only a crypto area of interest—they’re changing into Wall Avenue darlings.

However maintain up—it’s not all hype and headlines. Circle makes most of its cash off the curiosity from USDC reserves. So if the Fed truly cuts charges like everybody’s anticipating, that might eat into their income quick. Some analysts say each 25 bps reduce may shave off $100 million in earnings. That’s an enormous deal for a enterprise that’s now taking part in within the large leagues.

Nonetheless, this IPO is a game-changer. It reveals conventional finance is prepared—possibly even keen—to wager large on stablecoins. And with Circle main the cost, don’t be shocked if different crypto companies begin submitting their paperwork subsequent.

Ethereum’s Surge—Outperforming Bitcoin and Attracting Institutional Curiosity

Ethereum is making headlines with its current efficiency, outpacing Bitcoin and drawing vital consideration from institutional buyers. Over the previous month, Ether (ETH) has surged by 46%, whereas the ETH/BTC buying and selling pair has elevated by 30%, indicating a robust demand for Ethereum over Bitcoin.

This spectacular rally is attributed to a number of components. Notably, Ethereum has seen twelve consecutive days of internet inflows into spot Ethereum ETFs, reflecting rising institutional confidence. Moreover, the current Pectra improve has enhanced Ethereum’s scalability and effectivity, additional solidifying its place within the crypto market.

Analysts are optimistic about Ethereum’s future. VanEck predicts that Ethereum’s value may surpass $6,000 by the top of 2025, whereas JPMorgan forecasts it reaching $8,500, pushed by elevated institutional adoption and the expansion of decentralized finance (DeFi).

The surge in Ethereum’s efficiency has additionally sparked discussions concerning the potential onset of an “altseason,” the place various cryptocurrencies outperform Bitcoin. Traditionally, such intervals have led to vital features throughout the crypto market.

Keep Forward of the Curve

And there you’ve it—one other wild week in crypto. From Trump drama and token bans to Circle’s IPO and Ethereum flipping the script on Bitcoin, one factor’s clear: this market by no means sleeps.

In case you’re feeling overwhelmed, don’t stress—it simply means you’re paying consideration. The neatest factor you are able to do proper now could be keep knowledgeable, keep strategic, and encompass your self with the proper group. Whether or not it’s meme cash, macro coverage, or altseason alpha… we’ve obtained you lined.

In case you discovered one thing new at present, hit that like button, drop a touch upon what shocked you most, and subscribe to JRNY TV so that you don’t miss what’s coming subsequent. We’re right here that can assist you navigate the noise and make sense of the insanity.

Thanks for watching—Catch you within the subsequent one.