Bitcoin (BTC) not too long ago ended a two-week downtrend, which noticed its worth fall to $100,200 earlier than bouncing again. Regardless of the restoration, Bitcoin nonetheless faces promoting strain from long-term holders (LTHs), which might make it susceptible to a possible worth correction.

The crypto market stays unstable, and Bitcoin’s subsequent worth motion will rely upon these elements.

Bitcoin Promoting Brings Concern

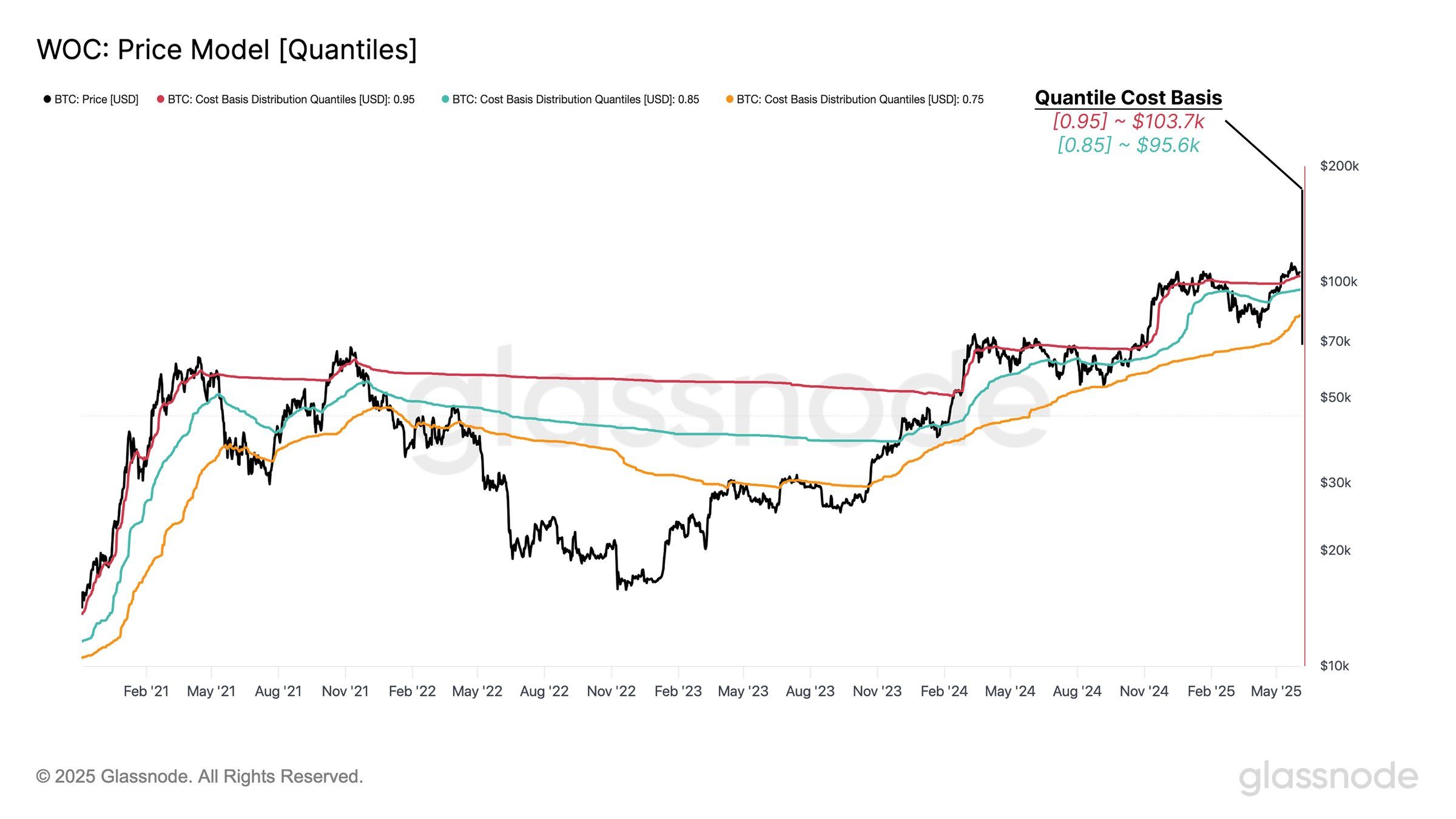

Bitcoin’s price foundation quantiles spotlight key assist ranges that might be essential within the close to time period. The 0.95 SSD (Spendable Provide Distribution) signifies that 95% of the circulating Bitcoin provide was purchased beneath $103,700.

This implies that solely 5% of Bitcoin was acquired above this stage, making $103,700 a powerful assist zone.

Moreover, one other vital assist stage sits at $95,600, the place the 0.85 SSD coincides. This stage represents some extent at which 85% of circulating Bitcoin has a decrease acquisition worth, making it one other potential stronghold for Bitcoin’s worth.

If Bitcoin faces extra promoting strain, these ranges might function robust limitations to a deeper drop.

Regardless of the promoting strain from LTHs, Bitcoin’s macro momentum suggests a optimistic outlook in the long run.

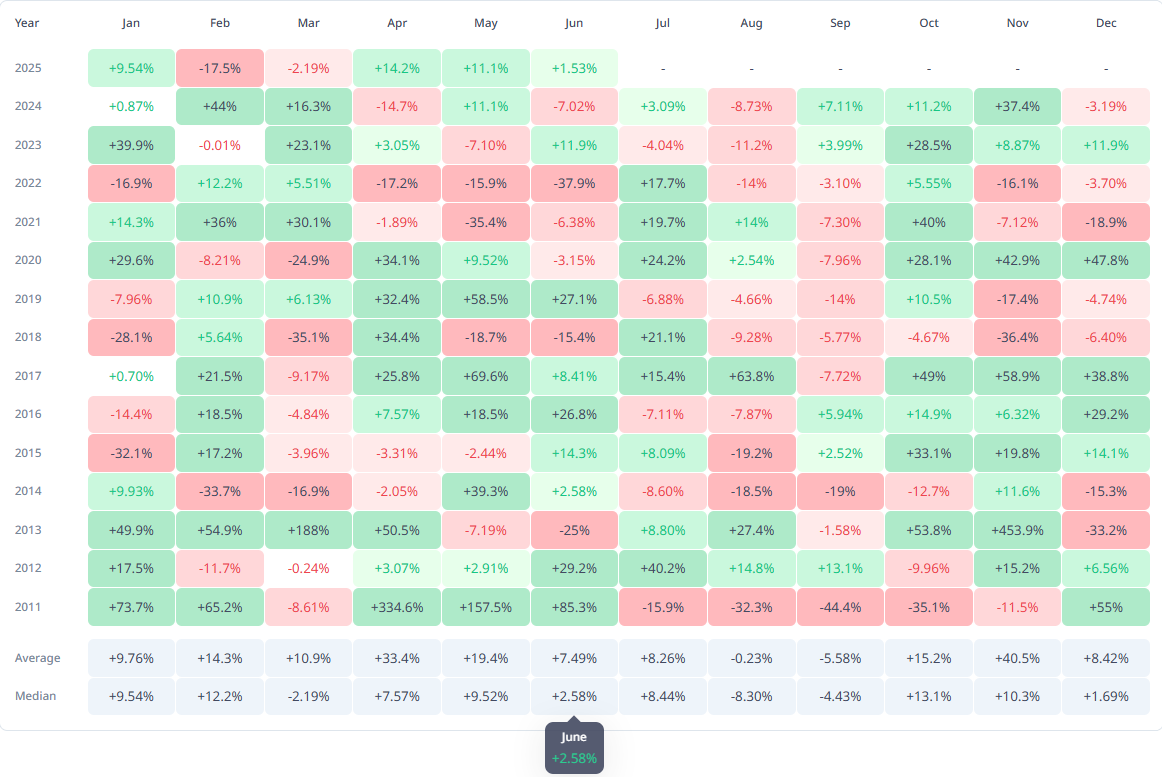

Historic month-to-month return information for Bitcoin exhibits that June has sometimes been a optimistic month for the asset, with a median rise of two.58%. This means that whereas Bitcoin might face short-term corrections resulting from promoting, the broader market development might assist worth restoration.

The historic development means that any correction Bitcoin faces resulting from LTH promoting will possible be non permanent. With Bitcoin’s worth displaying potential for progress in the long run, the market might quickly shift towards bullish sentiment, particularly if broader market situations enhance.

BTC Worth Has Help

Bitcoin’s worth has not too long ago risen 4.7% over the previous three days, buying and selling at $106,263. Nonetheless, the cryptocurrency stays just under the resistance stage of $106,265.

Given the present market sentiment and key assist ranges, the elements at play recommend that Bitcoin would possibly expertise a decline within the quick time period.

If Bitcoin fails to keep up the $106,265 stage and faces additional promoting strain, it might fall by way of the $105,000 assist and transfer towards $103,700.

This stage, as recognized within the quantiles price foundation, might present important assist. In a extra bearish state of affairs, Bitcoin might even slide to the following assist at $102,734.

However, if the broader market turns bullish and counters the impression of LTH promoting, Bitcoin might push previous the $106,265 resistance stage.

A profitable breach of this stage may lead Bitcoin towards $108,000 and even increased, invalidating the present bearish thesis and signaling a possible worth rally.

Disclaimer

In keeping with the Belief Venture tips, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. All the time conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.