Tether CEO Paolo Ardoino has dismissed talks in regards to the stablecoin issuer going public. His stance comes regardless of the corporate’s valuation.

These discussions come after Circle, Tether’s market peer and rival, launched its IPO (Preliminary Public Providing) and went stay on the NYSE.

Paolo Ardoino Quashes IPO Talks

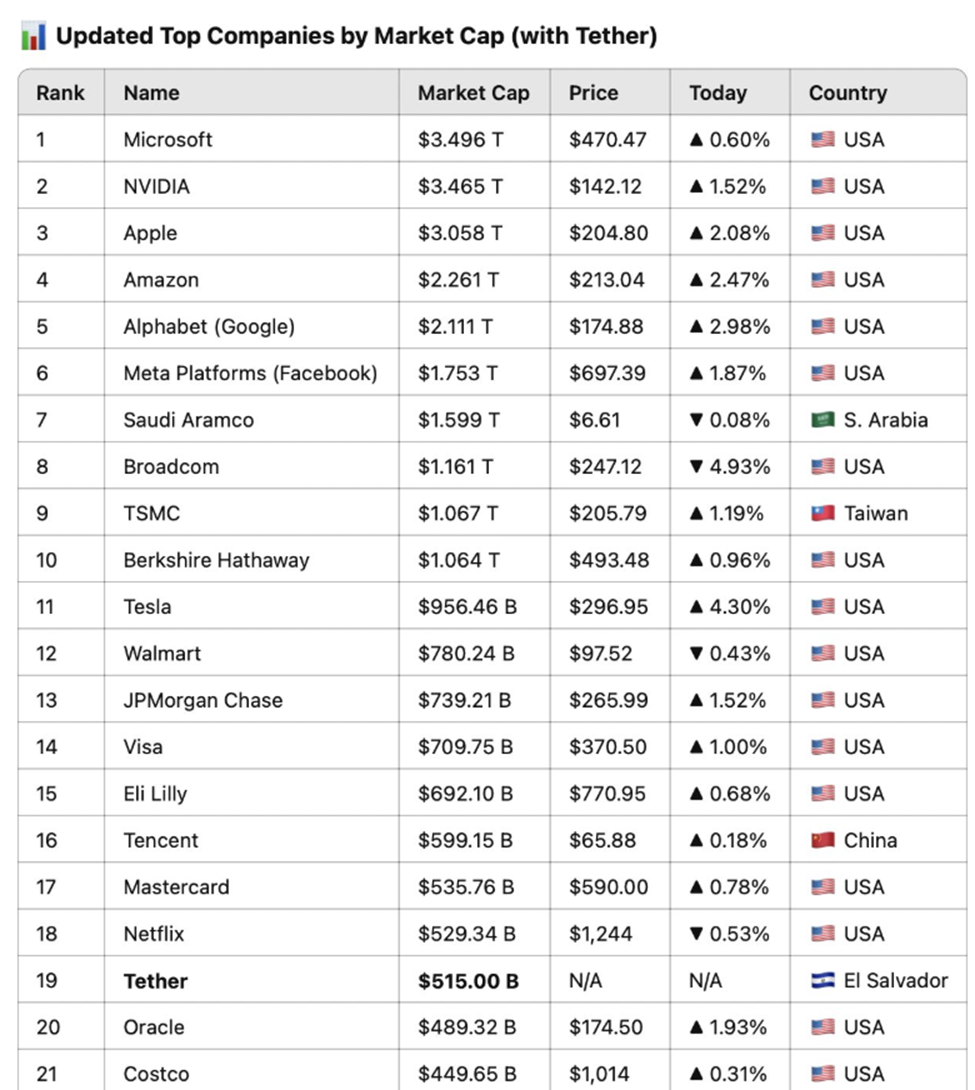

Market evaluation values the stablecoin big at $515 billion. In response to Jon Ma, a builder on Artemis, this is sufficient to make Tether the nineteenth most dear firm globally. Particularly, it might place Tether forward of heavyweights like Costco and Coca-Cola.

“If Tether went public TODAY, Tether can be the nineteenth largest firm on the earth at $515 billion. That’s forward of Costco and Coca Cola,” wrote Ma.

Jon Ma extrapolated that based mostly on Tether’s $13 billion in 2024 web income and projected EBITDA of $7.4 billion for 2025, the agency might command a $515 billion valuation if public.

“Tether valuation at $515 billion is an exquisite quantity. Perhaps a bit bearish contemplating our present (and rising) Bitcoin + Gold treasury, but I’m very humbled. Additionally actually excited for the subsequent part of development of our firm,” Ardoino wrote.

Regardless of the bullish projection, Ardoino clarified that Tether has no intention of going public. In a follow-up submit, he succinctly acknowledged, “No must go public.” This alerts confidence within the firm’s present personal construction and trajectory.

Circle’s Wall Road Debut Places Highlight on Stablecoin Valuations

The dialog gained traction after Circle, Tether’s closest rival within the stablecoin sector, formally went public in a landmark IPO.

Buying and selling underneath the ticker $CRCL, Circle’s providing of 34 million shares at $31 every targets a $8.1 billion valuation. This marks the primary time a stablecoin issuer has listed on the NYSE (New York Inventory Trade).

Ma’s mannequin utilized Circle’s lofty 69.3x EBITDA a number of to Tether’s projected 2025 earnings, which assumes a continued improve in USDT provide and a secure Fed Funds Price round 4.2%.

His submit clarified that the mannequin excluded unrealized positive factors from Bitcoin and gold, which account for roughly $5 billion of Tether’s 2024 income.

Some commentators, like Anthony Pompliano, pushed the valuation envelope even additional. “$1 trillion finally,” he predicted. Jack Mallers of Twenty One Capital echoed the sentiment with an much more optimistic “over $1 trillion” estimate.

Nonetheless, alongside the hype, skepticism loomed. One consumer identified that going public would open Tether to extra scrutiny and audits.

In opposition to this backdrop, customers stay skeptical that Tether might go public, referencing ongoing transparency issues which have dogged Tether for years.

Ardoino’s stance reinforces this view. Regardless of doubtlessly being price greater than many S&P 500 giants, Tether appears content material to maintain scaling privately with out the added regulatory glare of Wall Road.

Tether’s core product, the USDT stablecoin, stays essentially the most traded crypto asset by quantity. However, the corporate has additionally considerably diversified its stability sheet.

Latest attestation stories present that Tether holds billions in US treasuries, gold, and Bitcoin, property that more and more underpin its monetary power and credibility.

Because the stablecoin house enters a brand new part of institutional scrutiny and public-market publicity, Tether seems dedicated to rising on its phrases.

Will that technique preserve it forward of public rivals like Circle? Ardoino is betting that staying personal is a power, not a setback.

Disclaimer

In adherence to the Belief Mission tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. Nonetheless, readers are suggested to confirm details independently and seek the advice of with an expert earlier than making any choices based mostly on this content material. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.