- BNB is caught in a decent vary between $645–$650, displaying indicators of a doable breakout if it will possibly push previous the cussed $670 resistance degree.

- Momentum indicators like MACD and RSI are turning bullish, however low quantity and cautious dealer sentiment are retaining issues in limbo for now.

- If BNB clears $670 with sturdy quantity, it may rally towards $700+, however a drop under $625 may drag it again right into a deeper consolidation.

Binance Coin (BNB) has been kinda caught these days. It’s bouncing inside a decent vary, and whereas there’s no massive transfer but, the charts are beginning to flash some fascinating alerts. After that tough correction earlier in June, the token’s been stabilizing—however don’t let the calm idiot you, one thing is perhaps brewing.

Regardless of the buying and selling quantity being a bit meh, BNB looks like it’s gearing up for an even bigger transfer. That $670 resistance zone is vital. If bulls handle to shove previous it, we may see some good upside. But when not? Properly, again to sideways we go.

After the Drop, a Breather

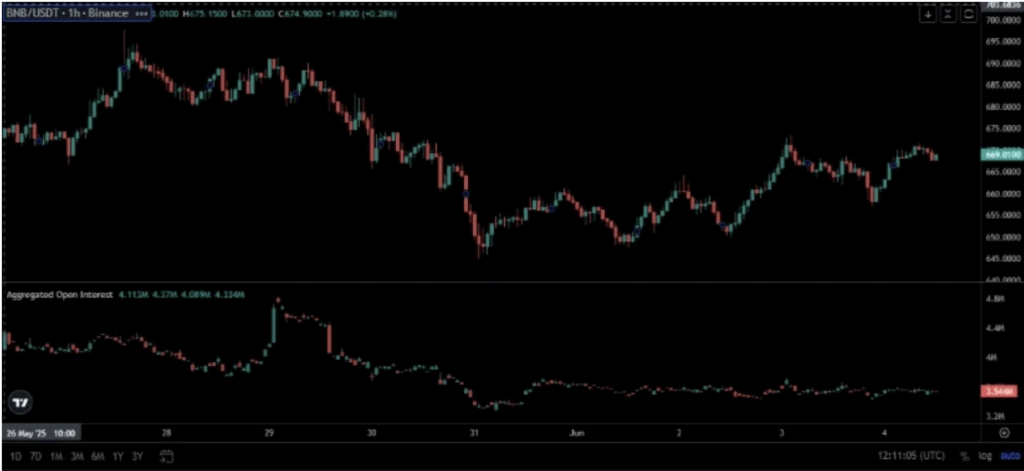

Wanting on the 1-hour chart, there was a fairly aggressive drop on June 5—from round $660 right down to $625 very quickly. That transfer additionally worn out some leveraged merchants primarily based on the open curiosity dipping arduous. Most likely some liquidations there. However apparently, BNB bounced again quick, reclaiming the $650 zone. That restoration didn’t include a leap in open curiosity although, which suggests spot patrons seemingly stepped in, not the apes on leverage.

Now, as of June 7, BNB is simply chilling between $645 and $650. Not a lot motion, no clear pattern, and merchants appear to be ready on some type of catalyst to stir issues up.

Quantity Slumps as Merchants Wait and Watch

During the last day, BNB’s solely nudged up by like 0.22%—it’s now round $650. Value spiked a bit to $653 however couldn’t maintain. Typical indecisive stuff. Quantity’s additionally manner down, sitting at about $875 million, which is properly under its regular $1.5–$2 billion vary. Translation? Persons are hesitant. Possibly they’re ready on information or simply taking a breather.

That being mentioned, BNB nonetheless holds its heavyweight standing, rating fifth in market cap, with over $94.8 billion backing it. And don’t overlook its tokenomics—these quarterly burns and Binance utility nonetheless give it some sturdy long-term fundamentals.

Weekly Chart Hints at a Doable Comeback

Zooming out to the weekly chart, issues begin to look a little bit higher. Value is hovering round $650, down about 1.6% for the week. Nonetheless, the $670–$680 vary has been a brick wall for bulls, whereas $625 looks like stable help.

Candles have been kinda boring these days—quick wicks, blended colours, traditional sideways chop. However that might imply we’re in a base-building section. The MACD is flashing a little bit of hope, with a recent bullish crossover and histogram transferring into constructive territory. It’s early, but it surely’s one thing.

RSI’s at 53.75—not thrilling, however not dangerous both. It’s above 50, and climbing, which hints that patrons are slowly regaining energy. If it pushes previous 60 with a pop in quantity, that might be the inexperienced mild for an even bigger breakout.

Outlook: Eyes on the $670 Line

Backside line—BNB is caught, however not useless. The momentum indicators are whispering bullish issues, however till value breaks above $670 with sturdy quantity and rising open curiosity, it’s simply noise. If it occurs, $700 and even $740 might be in sight. But when it drops under $625, count on extra chop or a deeper pullback.

For now, everybody’s watching and ready. Let’s see who blinks first—bulls or bears.