Bitcoin’s worth has surged over the previous couple of days, reigniting hopes of reaching a brand new all-time excessive (ATH). As of the newest worth motion, BTC is simply inches away from breaching the $110,000 resistance.

Regardless of the sturdy momentum, Bitcoin could wrestle to type a brand new ATH if exterior elements such because the upcoming CPI report is weighed in.

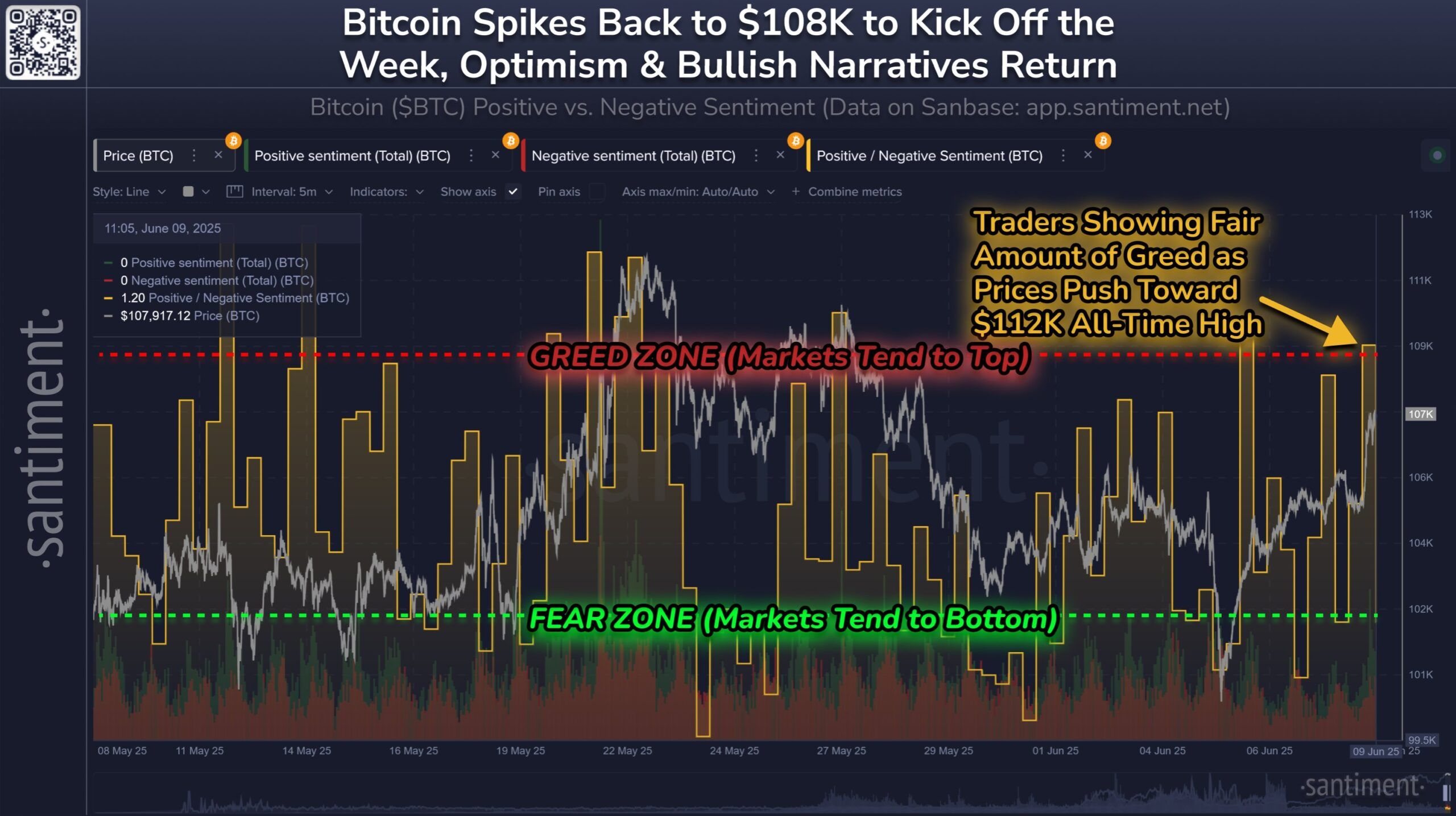

Bitcoin Traders’ Greed Rises

Dealer sentiment has been on the rise not too long ago, signaling a rise in optimism. Nonetheless, this shift towards bullishness could possibly be a warning signal of an impending market high. As Bitcoin enters the Greed zone, it raises considerations that the asset could possibly be overbought. Traditionally, this has been a sign that Bitcoin’s worth is reaching its peak, and a reversal might comply with quickly after.

Whereas the market sentiment could recommend a continuation of the bull run, Bitcoin has usually prolonged its rise even whereas within the Greed zone. This combined sign has left buyers unsure, as the standard sample of a market high could not all the time apply. As Bitcoin inches nearer to its $110,000 resistance, the heightened optimism might additionally set the stage for a worth correction.

Bitcoin’s macro momentum is closely influenced by the upcoming Shopper Value Index (CPI) report, scheduled for launch on June 11. The CPI for Might is forecasted to rise by 0.2%, which might improve the year-over-year (YoY) inflation charge from 2.3% in April to 2.5%. This improve might contribute to market uncertainty, particularly if inflation stays increased than anticipated.

Moreover, latest promoting conduct available in the market has contributed to a extra cautious investor outlook. The rising pink bars on the chart point out rising Bitcoin gross sales by buyers.

This, mixed with the CPI knowledge, might result in bearish sentiment, prompting a decline in Bitcoin’s worth. Traders could regulate their positions, anticipating that the rising inflation might negatively impression Bitcoin’s progress, particularly if market expectations are usually not met.

BTC Value Is Shut To A New Excessive

Bitcoin’s worth is at the moment at $109,480, just under the important $110,000 resistance. Though BTC briefly crossed this resistance previously 24 hours, the broader market alerts recommend a possible worth drop. With rising dealer sentiment and the looming CPI report, Bitcoin might wrestle to take care of its present stage.

If the CPI report fails to fulfill investor expectations, Bitcoin might drop to its subsequent assist stage of $108,000. This decline could be in response to the bearish sentiment surrounding the potential inflation rise. A failure to interrupt above the $110,000 resistance might sign a extra extended downturn for Bitcoin’s worth, sending it to $108,000 or $106,265, wiping a piece of the latest features.

Alternatively, if the CPI report is available in beneath expectations, displaying a YoY inflation charge of two.1% as a substitute of two.3%, Bitcoin might expertise a bounce again. On this case, securing $110,000 as assist may lead Bitcoin towards its ATH of $111,980 and past. A constructive CPI report would seemingly renew investor confidence, pushing Bitcoin to new highs and invalidating the bearish outlook.

Disclaimer

According to the Belief Challenge tips, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. All the time conduct your personal analysis and seek the advice of with an expert earlier than making any monetary choices. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.