- TRON’s community utilization is up and whales are accumulating, hinting at bullish potential beneath the floor.

- Lending TVL’s sharp $2B drop and dominant sell-side taker quantity increase short-term warning flags.

- TRX should flip $0.29 into strong assist with robust shopping for quantity to interrupt free from its consolidation zone.

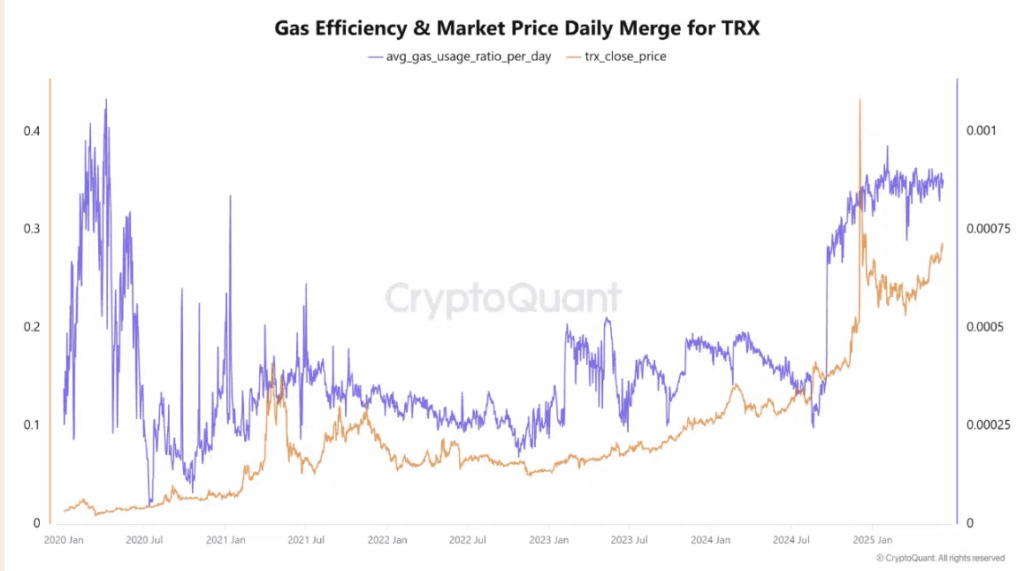

TRON’s been quietly heating up since late 2024, with fuel utilization on the community climbing steadily. That form of exercise often means persons are truly utilizing the chain—and when that occurs, value tends to observe. TRX has in truth bounced again alongside this uptick, which appears to recommend a fairly tight hyperlink between community utilization and investor optimism. That mentioned, it’s not all the time a lock. Typically the 2 transfer collectively… different occasions they fully ignore one another.

Proper now, the info nonetheless leans bullish, however let’s not get too cozy simply but. The trick is to look at if this good little dance between value and utilization stays in sync—or if one begins ghosting the opposite once more. That’s often when the surprises hit.

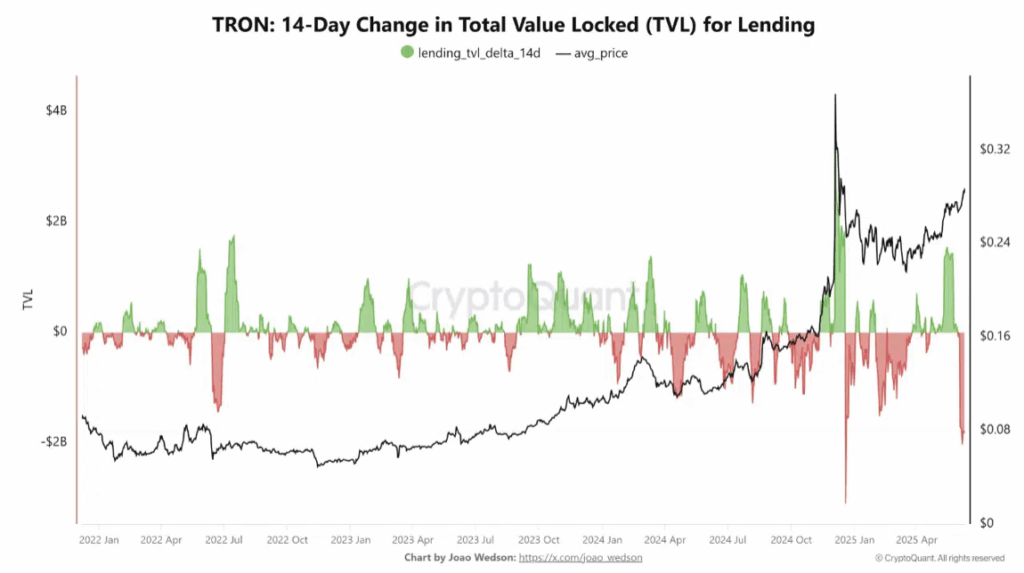

Cracks within the Basis? TVL in Lending Simply Tanked

Right here’s the half that’s bought a couple of eyebrows raised—TRON’s lending scene simply misplaced $2 billion in whole worth locked (TVL). That’s not a small dip, it’s a nosedive. What makes it much more puzzling is that this crash got here whereas TRX’s value was truly climbing. Normally, when folks begin pulling capital out of lending, it means one thing’s off—perhaps much less demand for borrowing, perhaps folks simply enjoying it secure.

Both manner, it doesn’t paint an image of full-on confidence. And if these outflows sustain, the worry is they may begin to drag value sentiment down with them.

Taker Quantity Isn’t Shopping for the Hype (Actually)

One other flag price noting: promote orders are kinda dominating. In response to the 90-day cumulative taker quantity delta, promote stress is outweighing buys. That tells us market individuals are offloading greater than they’re snatching up. Not ultimate while you’re attempting to interrupt out of a multi-month value rut.

TRX is likely to be inching towards a breakout, however with out patrons stepping in aggressively? The momentum may fizzle out earlier than something significant occurs.

Whales Are Stocking Up—However Retail? Meh.

Curiously, whereas short-term information feels a bit shaky, the long-term whales are stacking TRX prefer it’s on clearance. Wallets holding large baggage bumped their positions by 10%+, and mid-size buyers added much more—over 41%. Retail merchants? Not likely displaying up, which could truly be a very good factor. Fewer retail fingers often means much less panic-selling if issues flip uneven.

When the large wallets transfer quietly like this, they’re usually prepping for one thing greater. Could possibly be a run-up. Could possibly be one other fakeout. However once they accumulate like this, it’s price paying consideration.

So… Is TRX Gonna Break Free?

TRX has been locked between $0.25 and $0.29 for what appears like without end. Proper now, it’s kissing the higher finish of that vary, hovering round $0.288. If it lastly manages to interrupt and shut above $0.29, particularly with quantity backing it up, issues might get actual fascinating—probably a transfer towards its earlier highs.

But when the breakout fizzles just like the others, it might be again to range-bound limbo. All in all, TRON’s bought the substances for a strong run, however it wants that closing spark to get cooking.