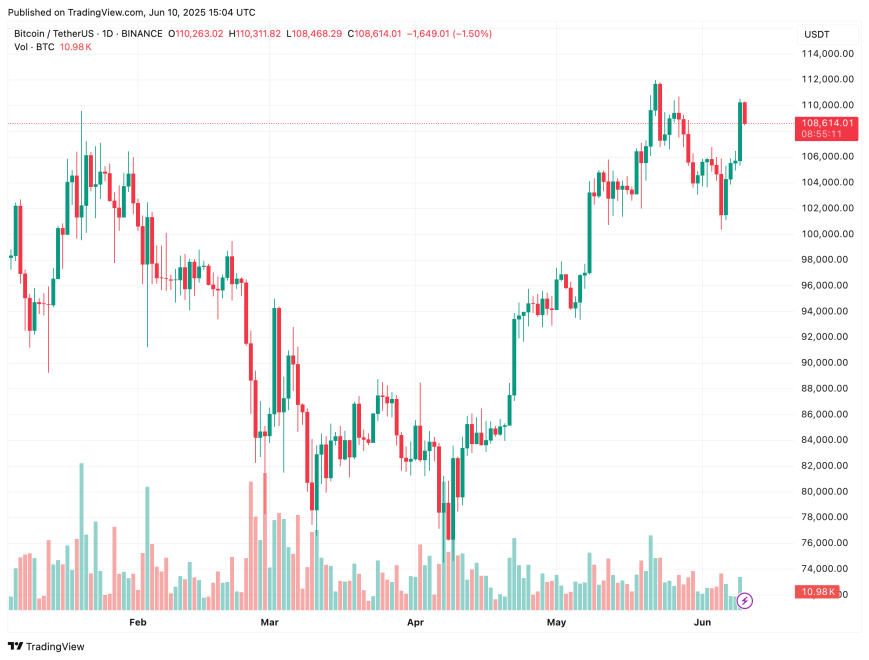

After per week of downward worth motion, Bitcoin (BTC) staged a powerful restoration over the weekend, reclaiming a lot of its current decline. It’s now buying and selling simply shy of its all-time excessive (ATH) of $111,814, recorded in Might 2025.

Bitcoin Might Have Extra Room To Run

In keeping with a current CryptoQuant Quicktake put up by contributor Avocado_onchain, Bitcoin’s present upward momentum – hovering just under its ATH – should have room to run, probably resulting in a brand new document “at any second.”

The analyst famous that the present rally stands other than earlier ones on account of its emergence in a “a lot quieter market setting.” This statement is supported by the continued lack of retail investor participation.

For example, Google Traits knowledge reveals that search curiosity in Bitcoin stays considerably low – round a rating of 21 – in comparison with a peak of 66 in November 2024. For reference, it stood at 100 throughout the bull market of Might 2021.

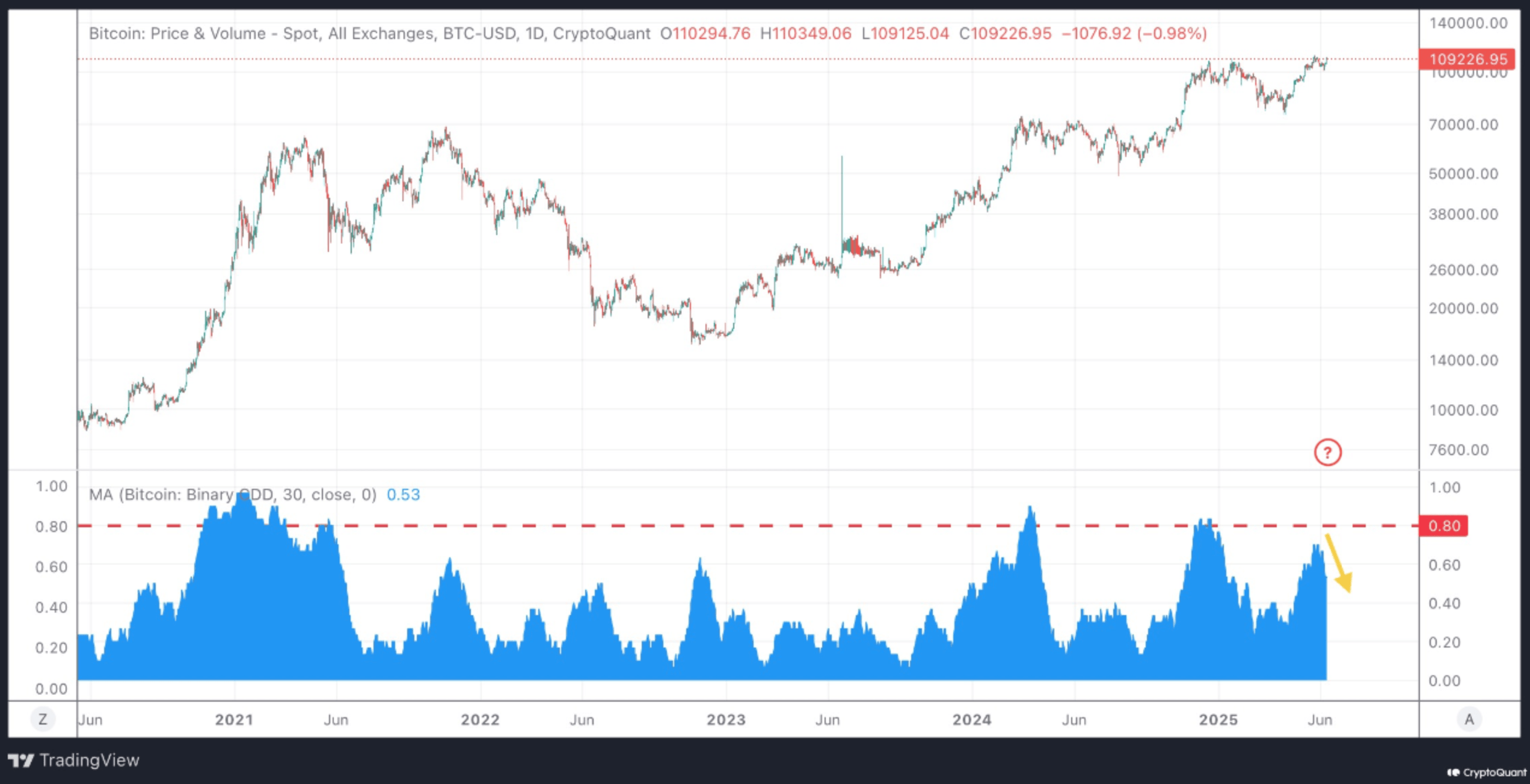

Equally, a key on-chain metric referred to as the 30-day Binary Coin Days Destroyed (CDD) has been declining whilst BTC’s worth rises. This means that long-term holders (LTHs) are selecting to carry their Bitcoin somewhat than promote.

For the uninitiated, Bitcoin Binary CDD measures the sum of coin days – cash held multiplied by days held – spent in a transaction, indicating when LTH transfer their cash. Excessive CDD suggests important exercise from older cash, typically signaling potential market shifts as long-term buyers promote.

Conversely, declining Binary CDD suggests fewer previous cash are being spent, implying diminished promoting strain from LTH. This conduct typically displays rising confidence or accumulation, probably indicating bullish sentiment as circulating provide tightens.

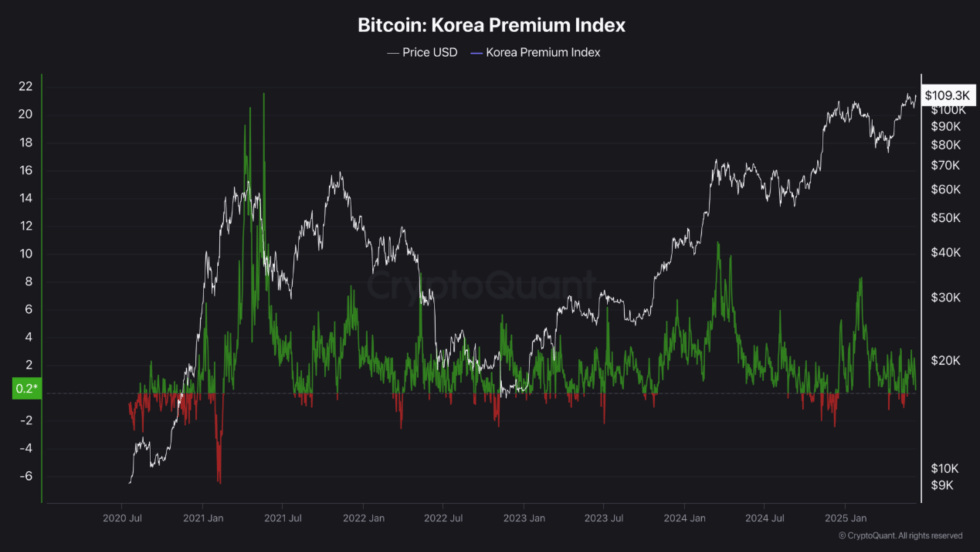

One other metric underscoring the subdued retail presence is the Premium Index throughout exchanges. Whereas the Coinbase Premium is nearing ranges final seen in April 2024, the Korea Premium Index stays comparatively low – pointing to a scarcity of retail-driven enthusiasm within the present rally.

Moreover, the Market Worth to Realized Worth (MVRV) ratio has been progressively growing, however with out the sharp spikes normally seen throughout overheated market circumstances.

BTC Might Face Some Hurdles

Regardless of the absence of market euphoria, some indicators counsel that Bitcoin might encounter headwinds within the weeks forward. For instance, the Bitcoin RCV indicator has just lately exited the “purchase” zone, elevating warning flags.

There are additionally indicators that promoting strain could enhance. Notably, miner-to-exchange transfers have just lately surged to historic highs, indicating that BTC miners could also be opting to liquidate somewhat than maintain their reserves. At press time, BTC trades at $108,614, up 0.9% up to now 24 hours.

Featured Picture from Unsplash.com, charts from CryptoQuant and TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our workforce of high expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.