Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

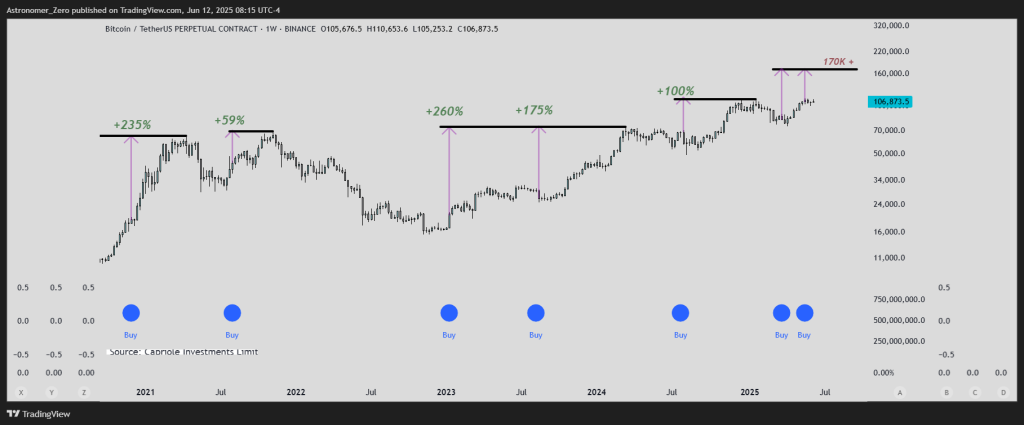

The Hash Ribbon “purchase” set off – a sign embedded in Bitcoin’s community hashrate dynamics – has flashed once more, and technical analyst Astronomer Zero believes it might pave the best way to no less than $170,000 per coin. A chart the analyst posted on X on 12 June overlays each prior weekly‐timeframe Hash Ribbon entry since 2020 on the BTC/USDT perpetual contract at Binance, illustrating why the sign is handled with nearly talismanic respect by some quantitative merchants.

Bitcoin Surge To $170,000 Imminent?

The graphic reveals 5 earlier occurrences of the capitulation-to-recovery crossover embedded within the Hash Ribbon algorithm. Every is marked on the worth pane by a cobalt-blue “Purchase” dot straight beneath the weekly candles and linked to the following rally by a violet measuring arrow.

After the sign in late-2020, Bitcoin accelerated by 235% from the $18,000 consolidation flooring to problem the then-all-time-high zone simply above $60,000 earlier than any main pull-back unfolded. Mid-2021’s ribbon occasion proved extra modest – roughly 59% from a $30,000 base into resistance close to $48,000 – but it nonetheless revered the rule that the market rewards the crossover with vital upside.

Associated Studying

The following two alerts, printed in late-2022 and early-2023, have been far stronger: a 260% surge from the capitulation trough beneath $18,000, adopted by a 175% leg in mid-2023 that carried value cleanly to the long-standing provide shelf within the $60,000 space. In mid-2024, the hash ribbon sign led to a 100% rally above $100,000.

Most not too long ago, the ribbon crossed once more three weeks in the past, with Bitcoin quoted at roughly $105,000 on the weekly shut. The analyst annotates present value at $106,873 and attracts a contemporary horizontal barrier on the $160,000–$165,000 band – the extent that might align with the imply magnitude of earlier post-signal advances. Have been the market merely to match the smallest historic share transfer (≈ 60%) from the current crossover, spot would prolong to the $170,000 area indicated in crimson on the chart.

Associated Studying

Hash Ribbon logic is mechanical. When the 30-day shifting common of community hashrate climbs again above the 60-day common after a interval of miner capitulation, on-chain observers learn it as an all-clear that pressured promoting stress has exhausted. Up to now, that transition has coincided with aggressive spot accumulation seen on-chain and in derivatives positioning.

Sceptics will be aware that correlation just isn’t causation and {that a} six-figure quote for Bitcoin already bakes in ETF inflows, a looming halving provide shock and a worldwide liquidity cycle that might but tighten. Nonetheless, Astronomer Zero’s chart underscores an goal reality: within the final half-decade the Hash Ribbon “purchase” has by no means mis-fired. Whether or not historical past’s rhythm repeats or merely rhymes, merchants are watching the $170,000 stage marked on the chart as the subsequent check of that report.

At press time, BTC was down 3.1% over the previous 24 hours, buying and selling at $104,898.

Featured picture created with DALL.E, chart from TradingView.com