- Ethereum ETFs noticed large inflows this week, with 154,000 ETH added—far outpacing Bitcoin’s 7,800 BTC.

- Establishments appear to favor ETH’s rising utility in DeFi, staking, and Layer 2 tech over Bitcoin’s static store-of-value position.

- This might sign a broader shift in crypto funding methods, with ETH rising as a severe contender for institutional dominance.

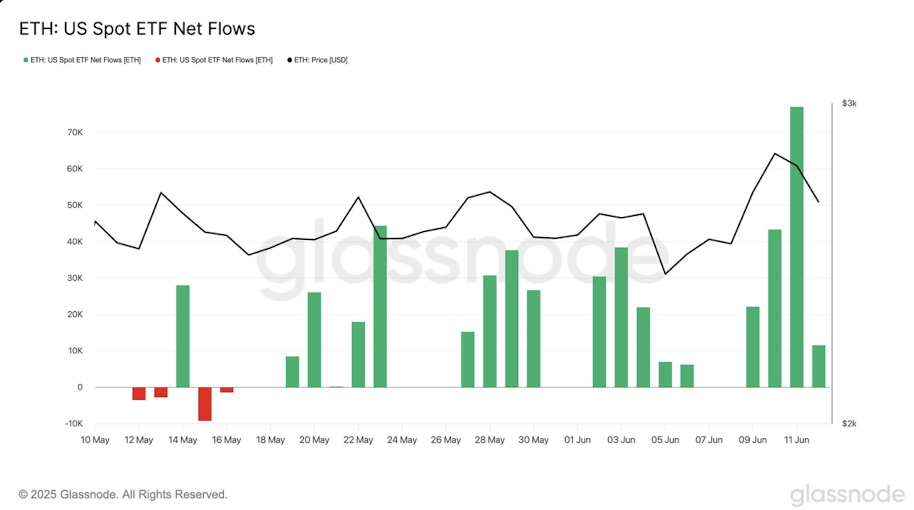

Ethereum’s abruptly stealing the highlight within the ETF world. This previous week, ETH exchange-traded funds racked up round 154,000 in web inflows—yeah, that’s about 5 instances its current common. In accordance with Glassnode, that features a record-setting single-day haul of 77,000 ETH on June 11. It’s a severe shift and has individuals questioning if establishments are lastly treating Ethereum as extra than simply Bitcoin’s understudy.

In the meantime, Bitcoin? Not so scorching. BTC ETFs introduced in solely about 7,800 BTC over the identical week. For comparability, that’s not even near Ethereum’s one-day complete. Some are pointing to Ethereum’s deeper ecosystem—staking, DeFi, dev exercise, all that great things—as the rationale for this momentum. Feels prefer it’s much less about hype now and extra about perform.

BTC ETF Flows Stagnate Whereas ETH Steals the Present

Bitcoin ETFs aren’t lifeless, clearly. They’re nonetheless the go-to for a lot of large gamers. However these days, their numbers have been far and wide—sharp redemptions, slower entries, that sort of factor. That 7,800 BTC influx this week? It’s solely a small bump, particularly in comparison with a single-day 7,900 BTC influx we noticed again on Might 23. It’s like Bitcoin ETFs are hitting pause whereas Ethereum picks up velocity.

The numbers counsel one thing extra than simply short-term noise. There is perhaps a deeper shift taking place—a rotation, perhaps. Establishments are sniffing out broader use circumstances and perhaps even a bit extra upside in ETH, particularly if staking-enabled ETFs go stay. Bitcoin’s store-of-value vibe nonetheless performs, however Ethereum’s flexibility is drawing consideration.

Ethereum’s Use Case May Change the ETF Recreation

Analysts are being attentive to this divergence. It’s not simply worth or hypothesis; it’s use-case pushed. ETH’s versatility—from powering DeFi to NFTs to sensible contracts—is including layers that Bitcoin doesn’t actually provide. That may very well be why institutional traders are slowly reshaping their portfolios to incorporate extra Ethereum publicity. Some even assume this is perhaps the beginning of a much bigger shift.

Ethereum nonetheless has floor to cowl in complete ETF quantity, certain. But when this influx streak retains up? ETH may quickly be extra than simply second place—it would lead the following institutional wave altogether.