- SharpLink simply grabbed $463M value of Ethereum, turning into the biggest publicly traded ETH holder and presumably kicking off a wave of company adoption.

- Institutional and whale curiosity in Ethereum is on the rise, with on-chain knowledge displaying accumulation and surging depositor exercise.

- ETH’s worth stability and robust fundamentals may set the stage for a brand new adoption cycle, mirroring Bitcoin’s institutional breakout.

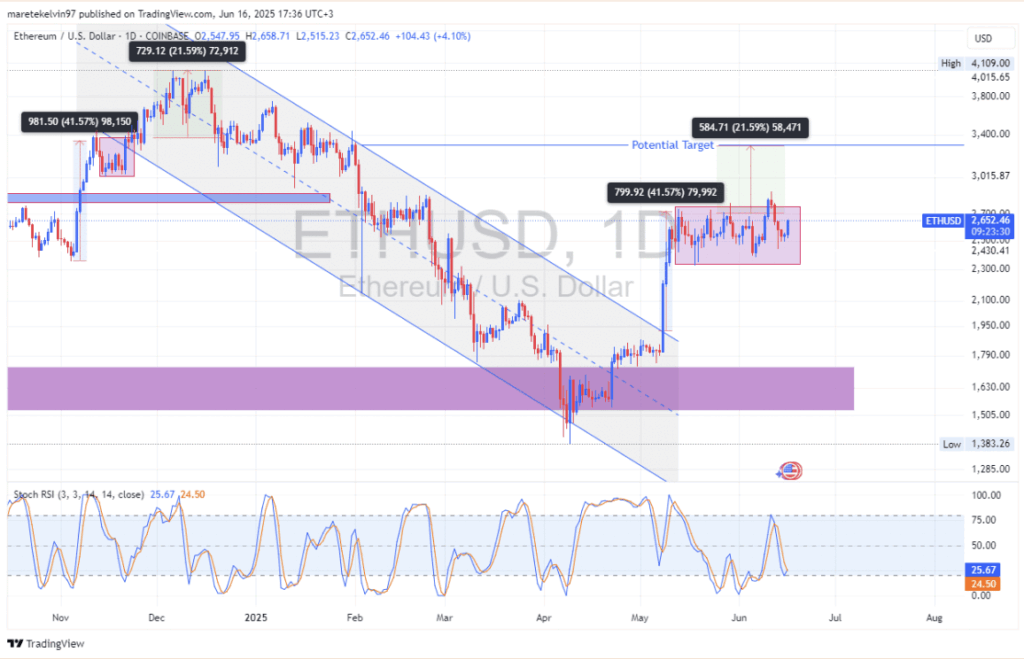

Ethereum’s been holding its floor across the $2,500 mark for weeks now. It hasn’t precisely damaged out, nevertheless it additionally hasn’t crumbled beneath strain—spectacular, given the market’s been all over these days.

This quiet resilience hasn’t gone unnoticed. Whereas some cash have been swinging wildly, ETH has saved calm, slowly gaining the curiosity of retail merchants and, extra importantly, institutional eyes that normally transfer a bit extra cautiously.

SharpLink’s Large ETH Purchase-In Raises Eyebrows

Right here’s the place issues get fascinating: SharpLink, outta nowhere, simply purchased 176,271 ETH. That’s roughly $463 million value—making them the largest publicly traded Ethereum holder. Yeah, critically. It’s like a MicroStrategy-level play, however for ETH.

This transfer isn’t nearly numbers. It’s about setting the tone. SharpLink’s clearly betting that Ethereum goes to play a a lot greater function in world finance, particularly cross-border stuff. Kinda like how MicroStrategy’s early Bitcoin grabs kicked off a wave of company BTC adoption—this might do the identical for ETH.

Establishments Warming As much as Ethereum

SharpLink’s timing won’t be random both. Extra conventional companies are beginning to have a look at Ethereum in another way—not as a dangerous moonshot, however as a severe portfolio piece. With staking rewards, DeFi dominance, and the entire sensible contract ecosystem, ETH’s utility is beginning to communicate for itself.

And now, with regulatory readability slowly enhancing, establishments may really feel safer getting concerned. If that shift retains selecting up steam, Ethereum may change into a core asset in much more long-term methods.

Whale Strikes & Spike in Community Exercise

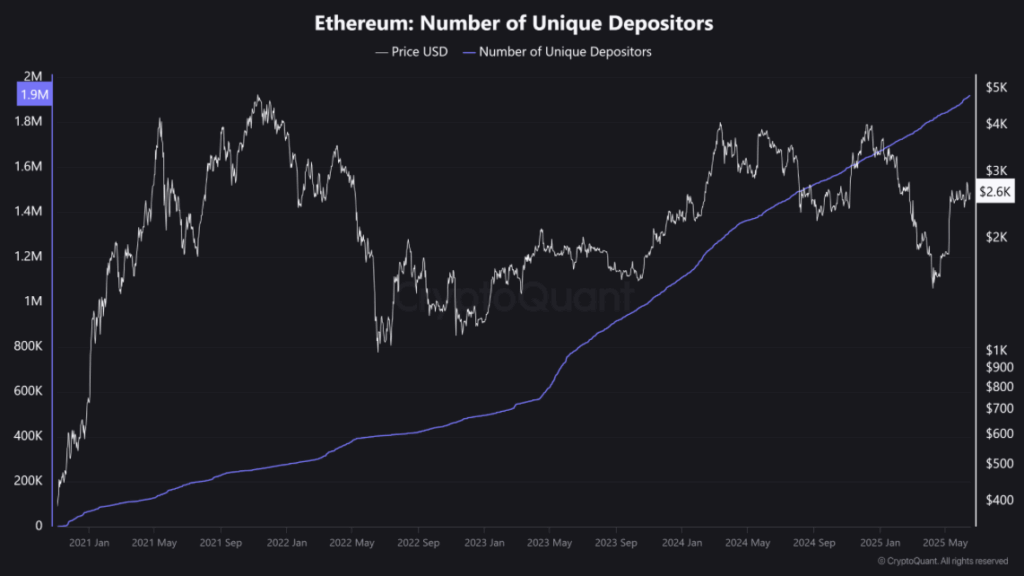

On-chain knowledge provides to the story. Smaller whales (assume wallets holding 1K to 10K ETH) have been quietly scooping up cash. That form of regular accumulation normally means they consider in a strong worth flooring—or perhaps a respectable rally coming quickly.

And it’s not simply whales. The variety of distinctive depositors on the Ethereum community has been climbing quick, hinting at rising retail curiosity and normal confidence in ETH’s future utility. The community’s buzzing, and that tends to be an excellent signal.

So… What’s Subsequent?

With institutional gamers like SharpLink making headlines and on-chain knowledge backing bullish alerts, Ethereum is likely to be gearing up for a brand new chapter. If this echoes Bitcoin’s rise post-MicroStrategy, then SharpLink’s transfer may very well be the spark.

Positive, there’s no assure, and the market’s by no means quick on surprises. However one factor’s clear: ETH’s foundations are getting stronger by the week—and individuals are beginning to concentrate.