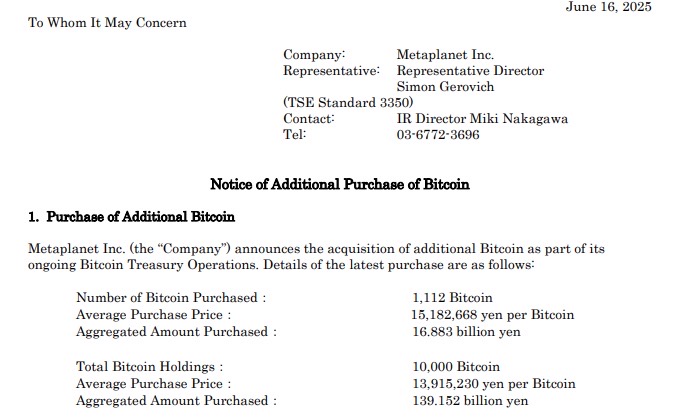

Tokyo-based funding agency Metaplanet made headlines on June 16, 2025, by buying 1,112 BTC for round $117.2 million. This transfer pushed its treasury previous the ten,000-coin milestone and positioned it forward of Coinbase on the checklist of public holders.

The acquisition highlights the growing confidence establishments have in Bitcoin as a strategic reserve asset. As extra corporations improve their crypto investments, buyers are rethinking the position of digital gold of their portfolios and asking: what’s the finest crypto to purchase now?

This publication is sponsored. CryptoDnes doesn’t endorse and isn’t answerable for the content material, accuracy, high quality, promoting, merchandise or different supplies on this web page.

Metaplanet Hits 10k Bitcoin Milestone, Units Sights on 210k BTC

Japanese funding agency Metaplanet has greater than doubled its holdings in Bitcoin, shopping for one other 1,112 BTCs. The $117.2 million buy, reported on Monday, brings their general holdings to a neat 10,000 BTC. This milestone is a major one, reaching the agency’s first goal for 2025 because it began constructing its Bitcoin reserves in April.

Metaplanet’s forceful acquisition technique has now positioned it as one of many world’s largest public BTC holders. Its 10,000 BTC is greater than the quantity held by crypto trade Coinbase, which Bitbo reveals to be holding 9,267 BTC. Traders welcomed the information, pushing the inventory worth of Metaplanet greater than 17% increased to 1,769 yen in Tokyo buying and selling.

Wanting ahead, Metaplanet has dramatically raised its ambitions. Whereas initially concentrating on 21,000 BTC by 2026 beneath its “21 Million Plan,” the corporate revised its objectives this June. It now goals to carry 100,000 BTC by the tip of 2026 and a considerable 210,000 BTC by 2027. Reaching this ultimate goal would imply controlling roughly 1% of all Bitcoin.

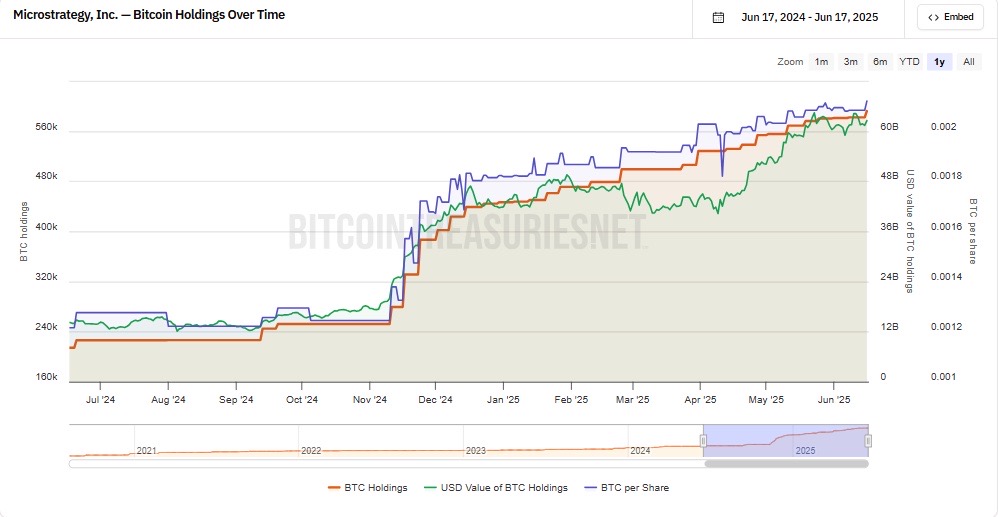

Metaplanet’s transfer displays a wider pattern of corporations holding Bitcoin. Information from BitcoinTreasuries.NET reveals 116 public corporations now maintain Bitcoin, together with latest additions GameStop and Sweden’s H100.

Giants like Tesla and Marathon Digital nonetheless lead with over $1 billion every. Institutional curiosity stays sturdy even after Bitcoin’s dip from $110,000 to $103,000 final week, with US spot bitcoin ETFs seeing 5 consecutive days of inflows totaling over $1.3 billion.

This company adoption continues to spark debates. Bitwise CEO Hunter Horsley suggests Bitcoin may finally rival the large $30 trillion US Treasuries market. In the meantime, MicroStrategy’s Michael Saylor reaffirmed his firm’s dedication to purchasing BTC, highlighting how the “Bitcoin customary” idea nonetheless influences company treasury methods globally.

Bitcoin Value Evaluation

Bitcoin’s worth is hovering round $106K, with a market capitalization of roughly $2 trillion. Wanting on the technical evaluation of Bitcoin’s one-day chart, we are able to see that the resistance stage is round $108K to $109K, whereas the assist stage is round $104.5K.

If Bitcoin fails to reclaim $108K, there’s an opportunity it may drop beneath $104.5K, signaling a deeper pullback. Nonetheless, a bullish set off would happen if Bitcoin breaks above the orange resistance line. A decisive shut above $108.5K to $109K on sturdy quantity would shift momentum again to the bulls.

In accordance with well-known X-based crypto analyst HeLIN, a clear break above $112K may rapidly propel the value towards $130K or increased. Till that occurs, the technique is to bid on each dip close to $104K, whereas maintaining a tally of broader macro developments.

BITCOIN

IT IS POST-ATH COMPRESSION

– 50-day MA crossing above 200-day MA

– RSI staying within the impartial to bullish zone

– MACD sign line affirmation holding

A clear break above $112k, and I’m taking a look at $130k+ quick

Till then, I’m bidding each dip close to $104k with… pic.twitter.com/bcJ3wt3uqB

— HELiN (@turkish_babby) June 15, 2025

Greatest Crypto to Purchase Now

Metaplanet’s record-breaking build-up highlights the extent to which growing institutional participation can have ripple results all through {the marketplace}. This will make markets extra liquid, give buyers better confidence, and stimulate competitors between altcoins and tokens.

For buyers intent on capitalizing on future waves of progress, deciding on the fitting timing and tokens has by no means been extra essential. The query stays: what’s the finest cryptocurrency to purchase now?

BTC Bull

With staking rewards that comply with Bitcoin’s rising market developments, BTC Bull turns optimism into earnings. It’s an excellent selection for these seeking to capitalize on Metaplanet’s document buy as confidence in crypto continues to develop.

BTC Bull Token ($BTCBULL), a brand new Bitcoin-themed meme coin, is gaining consideration as a result of its distinctive strategy to rewarding holders. The mission is at present in its presale part and has already raised $7.1 million.

In distinction to different meme cash, which normally undergo from volatility and short-term trendiness, $BTCBULL has quantified its worth by way of Bitcoin worth motion and supplied a extra steady, long-term returns system for holders.

The token will dispense precise Bitcoin to its holders when Bitcoin hits important worth thresholds: $150,000, $200,000, and $250,000. However there’s a catch: solely the members within the presale will grow to be eligible for these rewards.

Traders who promote their tokens will lose entry to future Bitcoin airdrops. This setup encourages holders to maintain their $BTCBULL tokens, doubtlessly boosting demand when the token lists on exchanges.

One other key function of the mission is a burning mechanism. As Bitcoin reaches sure worth ranges, a portion of the $BTCBULL provide shall be destroyed, decreasing the full variety of tokens and growing shortage. The primary burn will happen when Bitcoin hits $125,000, with extra scheduled at $175,000 and $225,000.

With its rising neighborhood, low entry worth, and Bitcoin-based rewards system, $BTCBULL affords a contemporary alternative for buyers. If the mission continues to achieve momentum, it may present a singular probability to revenue from each the meme coin craze and the long-term progress of Bitcoin.

Bitcoin Hyper

Bitcoin Hyper is a quick Layer-2 protocol designed to hurry up Bitcoin transactions. It takes benefit of rising institutional curiosity to unravel Bitcoin’s scaling points, combining environment friendly on-chain efficiency with sturdy market assist.

Bitcoin was by no means constructed to assist refined purposes or sensible contracts. Its deliberately restricted scripting language can constrain what builders can create on the community within the first place.

Bitcoin Hyper goals to bridge these gaps and retain Bitcoin’s elementary strengths. Now in presale, the mission is gaining traction for having the ability to present faster transactions, lowered charges, and assist for sensible contracts all atop Bitcoin’s safe basis layer. This mix is designed to sort out Bitcoin’s sore spots with out diluting its core tenets.

One of the vital notable facets of Bitcoin Hyper is its compatibility with the Solana Digital Machine (SVM), enabling builders to execute refined sensible contracts at excessive speeds. This facilitates an atmosphere for software improvement that may be unthinkable to implement immediately on Bitcoin. Doing so extends Bitcoin’s capabilities with out compromising its stability.

Within the view of widespread crypto YouTuber 99Bitcoins, Bitcoin Hyper has the potential to generate returns of 10x to 100x.

For long-term buyers, Bitcoin Hyper affords a promising alternative. Staking $HYPER tokens permits holders to earn rewards primarily based on community exercise, whereas token-gated entry provides unique entry to imminent DeFi protocols, premium instruments, and high-yield merchandise.

Builders additionally stand to learn. Those that use $HYPER of their deployed contracts can qualify for grants, ecosystem incentives, and charge rebates, fostering natural progress and innovation from the outset.

Greatest Pockets Token

Greatest Pockets Token affords easy cross-chain integrations and powerful safety, making it a dependable selection as company investments in crypto rise. It gives customers with a quick and safe solution to handle digital property when timing issues most.

Greatest Pockets is a decentralized, non-custodial crypto pockets that provides customers full management over their digital property, making it a powerful different to centralized techniques just like the upcoming digital euro.

What units Greatest Pockets aside are its superior options that transcend conventional pockets capabilities. Customers can entry derivatives buying and selling, a staking aggregator, cross-chain swaps, MEV safety, and gas-free transactions, options which can be not often out there in different crypto wallets.

The app will quickly add assist for greater than 1,000 cryptocurrencies and 60 blockchain networks, permitting customers to deal with, buy, and trade an enormous array of digital property in a safe, one-stop store.

Greatest Pockets additionally contains a native token, $BEST, which comes with numerous in-app rewards. $BEST reduces the charges for transactions and confers governance rights to the consumer over the ecosystem.

This allows token holders to vote on important selections, like which blockchains or cryptocurrencies to incorporate, thus guaranteeing the platform is community-appropriate by way of privateness, buying and selling choices, and accessibility.

Conclusion

Metaplanet’s transition to 10,000 BTC is not only a front-page headline; it represents a warning sign of the market’s shift in direction of company treasuries controlling the availability and demand of Bitcoin. The transition represents a broader sample during which corporations are actually critically occupied with proudly owning Bitcoin as a high asset to behave as collateral, relatively than simply as a hedge.

For buyers, it means aligning their technique with a even handed mixture of property, mixing tried-and-true blue-chip cryptocurrencies with high-yielding layer-2 options and tokenized utility performs. With a market that has institutional shopping for to go together with retail demand, figuring out one of the best crypto to purchase now could be a distinction maker.

This publication is sponsored. CryptoDnes doesn’t endorse and isn’t answerable for the content material, accuracy, high quality, promoting, merchandise or different supplies on this web page. Readers ought to do their very own analysis earlier than taking any motion associated to cryptocurrencies. CryptoDnes shall not be liable, immediately or not directly, for any harm or loss induced or alleged to be brought on by or in reference to use of or reliance on any content material, items or providers talked about.