- Ethereum noticed $1.4B in stablecoin inflows and a $2.88B TVL enhance—indicators of rising community demand.

- Spot merchants are nonetheless dumping ETH ($61M offered not too long ago), making use of short-term strain on value.

- ETH is caught in a consolidation section; breakout or breakdown relies on incoming market momentum.

Ethereum’s had a tough stretch recently. Regardless of strong long-term vibes, the worth took one other hit—dropping about 1.75%—extending its purple streak from the previous week. It’s not a significant crash, but it surely’s received individuals questioning if ETH can shake off this strain quickly.

Now, the larger image nonetheless leans bullish. However ETH appears to be getting dragged down by some short-term promoting strain, particularly from spot merchants who aren’t fairly aligned with the optimistic outlook. So… what’s actually occurring beneath the hood?

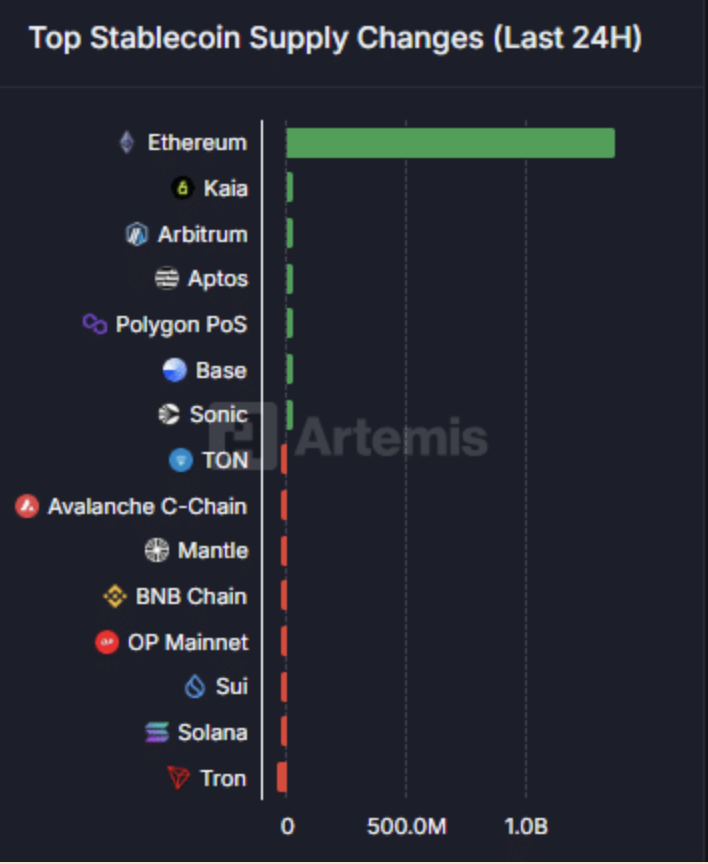

Stablecoins Are Flowing In – That’s a Large Deal

Within the final 24 hours alone, Ethereum noticed one among its greatest stablecoin inflows—roughly $1.4 billion value. That’s not nothing. When that a lot USDT or USDC strikes in, it often means of us are gearing up for one thing. May very well be shopping for, may very well be new protocol exercise, however both manner—it alerts motion.

The stablecoin provide flooding into Ethereum reveals that persons are stacking dry powder, possibly ready to deploy it. Artemis information additionally identified a pleasant spike in Bridged Netflow—$114K or so got here into ETH, a lot of it leaving Solana. That’s not simply random exercise. It suggests larger gamers are tilting towards ETH as a substitute of SOL proper now.

If that influx pattern sticks, we may see ETH get a carry quickly. These types of strikes are inclined to precede value rallies—particularly when capital’s shifting from different Layer 1s into Ethereum.

TVL Pops as Buyers Lock In Liquidity

Right here’s one other one for the bulls: Complete Worth Locked (TVL) on Ethereum shot up by 3.46% in a day, climbing from $83.6B to only over $86.5B. That’s practically $3B value of capital flowing into protocols constructed on ETH.

That sort of spike doesn’t occur out of nowhere. It reveals buyers are prepared to commit belongings—staking, farming, lending, no matter—moderately than sitting on the sidelines. When individuals begin locking up ETH, circulating provide drops, which regularly creates upward value strain. It’s not rocket science.

Nonetheless, it’s not all roses. Some spot merchants aren’t satisfied. They’ve been offloading ETH—$61 million of it, to be actual. That’s seemingly of us enjoying protection, hedging in case the worth dips additional. But when the promoting slows and demand retains constructing? May very well be explosive.

So… The place’s the Chart Pointing?

Since mid-Might, ETH’s simply been bouncing round. Sideways grind. However that sort of conduct usually reveals quiet accumulation. It’s like a strain cooker—it’s calm till it’s not.

From right here, ETH may do one among two issues: punch by the highest of this consolidation vary and push towards resistance… or lose its footing and slide to one among two decrease help ranges (there’s a dashed line hanging out down there, after which the bottom of the channel).

Which manner it breaks? Actually, it’ll most likely come all the way down to momentum. If sufficient consumers step in with confidence, this factor may pop. If not, it’d dip first earlier than any actual rally begins.