Whereas Bitcoin (BTC) continues to commerce close to its all-time highs (ATHs), buying and selling quantity on main exchanges has sharply declined in current months. This downturn has raised issues in regards to the sustainability of the present rally.

Bitcoin Buying and selling Quantity On Exchanges Slumps

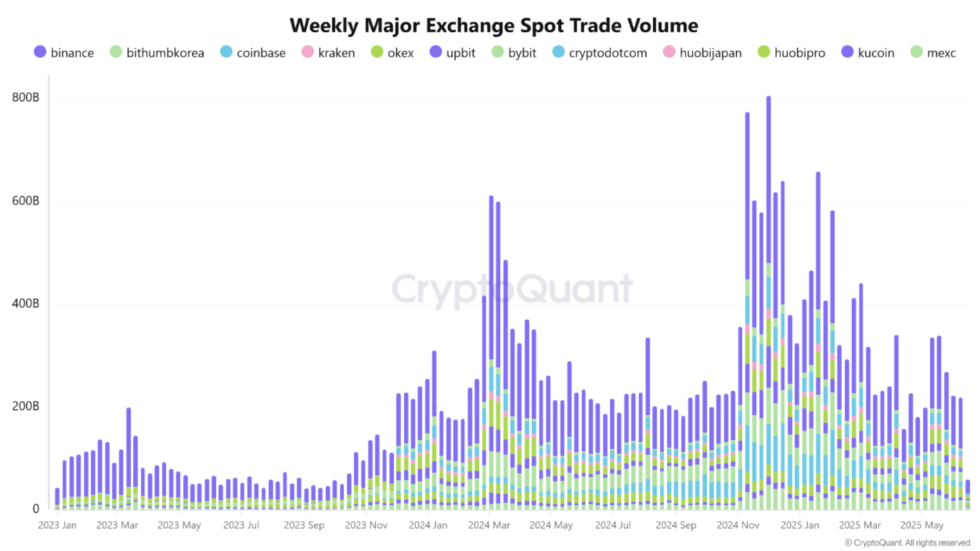

In a current CryptoQuant Quicktake publish, contributor caueconomy highlighted the numerous drop in BTC buying and selling quantity throughout prime cryptocurrency exchanges. Notably, buying and selling volumes have reached multi-year lows, reflecting a diminished urge for food for buying and selling – significantly amongst retail buyers.

The analyst partly attributed the decline in buying and selling quantity to the rising share of spot Bitcoin exchange-traded funds (ETFs) in total BTC buying and selling exercise. In line with knowledge from SoSoValue, roughly $132.5 billion value of BTC is now held by US spot ETFs.

Moreover, caueconomy pointed to waning curiosity in altcoins as one other contributing issue. This pattern is clear within the declining Ethereum (ETH)/BTC ratio and the next rise in BTC dominance.

On a extra constructive word, the continuing decline in BTC buying and selling quantity doesn’t seem to coincide with a interval of market euphoria. This implies that the present momentum is basically being pushed by strategic capital allocators relatively than inexperienced speculators.

The analyst concluded that monitoring any spikes in buying and selling quantity can be important, as renewed demand usually alerts the strategy of an area market prime. At current, BTC is buying and selling roughly 6.4% under its all-time excessive.

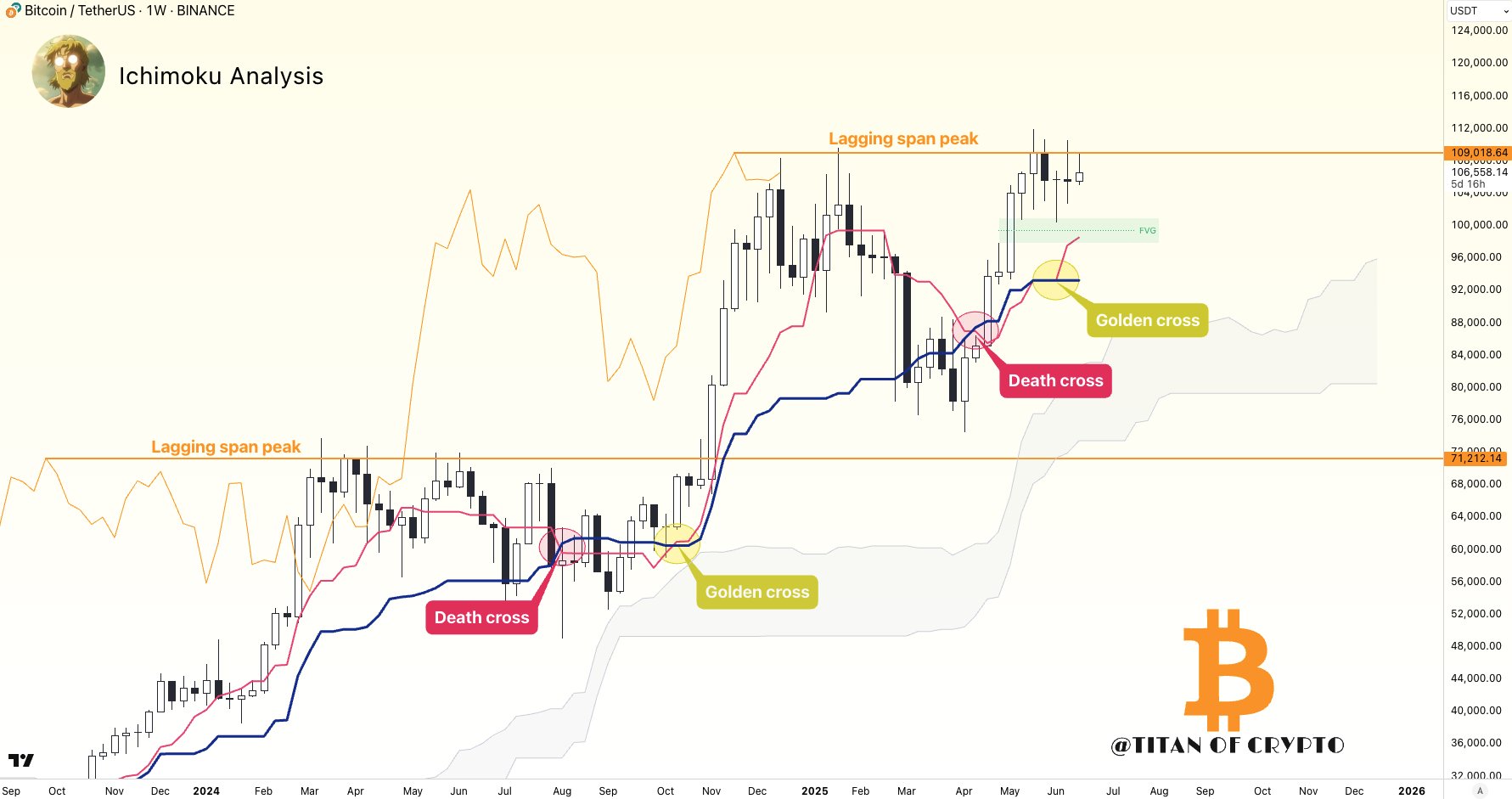

Amid the present sideways worth motion, some analysts are nonetheless ready for a definitive directional breakout. For instance, famend analyst Titan of Crypto recognized $109,000 as a vital resistance degree. They said:

BTC wants to interrupt above the final Lagging Span peak to unlock additional upside. A rejection wouldn’t invalidate the pattern as sturdy confluence help stays round $100,000. We’re not there but.

Equally, crypto analyst Merlijn The Dealer famous that BTC is forming a bullish inverted head-and-shoulders sample on the 3-day chart, with a neckline round $113,000. A breakout above this degree may pave the best way for a brand new ATH close to $140,000.

Some Warning Indicators For BTC

Whereas many specialists predict BTC to learn from rising world liquidity – particularly the improve in world M2 cash provide – others usually are not as optimistic. Seasoned crypto analyst Ali Martinez not too long ago warned that Tom Demark’s (TD) sequential indicator has flashed a promote sign on the hourly BTC chart.

Additional, Binance open curiosity not too long ago recorded a divergence from BTC worth, signalling warning. The Bitcoin RCV indicator has additionally moved out of the “purchase” zone, elevating fears of a worth pullback. At press time, BTC trades at $104,292, down 3% up to now 24 hours.

Featured Picture from Unsplash.com, charts from CryptoQuant, X, and TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our crew of prime know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.