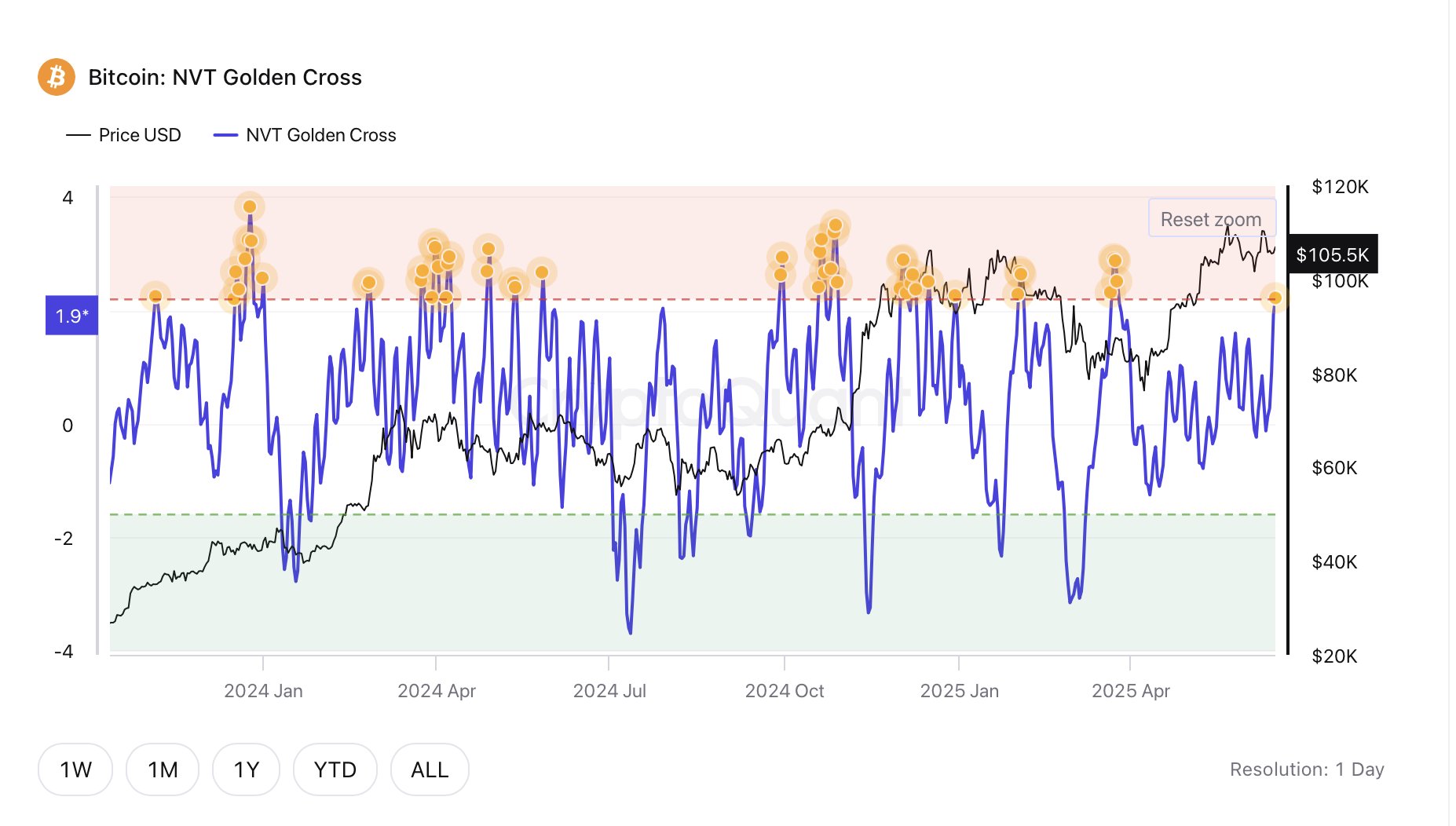

On-chain knowledge exhibits the Bitcoin Community Worth to Transactions (NVT) Golden Cross has surged right into a zone that has traditionally signaled overpriced situations for the asset.

Bitcoin NVT Golden Cross Has Crossed Above 2.2

In a brand new put up on X, CryptoQuant writer Darkfrost has talked concerning the newest development within the NVT Golden Cross of Bitcoin. The NVT Golden Cross is an indicator based mostly on one other metric generally known as the NVT Ratio.

The NVT Ratio retains monitor of the ratio between the BTC market cap and transaction quantity. The concept behind the indicator is that the flexibility to transact cash (as gauged by the transaction quantity) may very well be thought-about as a mirrored image of the asset’s ‘honest worth.’

Thus, by the comparability of the cryptocurrency’s present worth (that’s, the market cap) with this honest worth, the metric can inform us about whether or not the asset is overvalued or undervalued.

When the worth of the metric is excessive, it means the market cap is excessive in comparison with the transaction quantity. Such a development may suggest BTC could also be turning into overheated. Alternatively, the indicator being low may recommend room for the coin to develop relative to its quantity.

Now, the NVT Golden Cross, the precise metric of relevance right here, is a signaling indicator just like the Bollinger bands for the NVT Ratio that goals to find tops and bottoms in its worth. The NVT Golden Cross does so by evaluating the short-term development (represented by the 10-day MA) with the long-term one (30-day MA).

Beneath is the chart shared by the analyst that exhibits the development within the metric during the last couple of years.

As displayed within the above graph, the Bitcoin NVT Golden Cross has lately registered a pointy uptick and entered into the area above the two.2 mark (highlighted in pink).

This zone is the place the cryptocurrency’s market cap has traditionally outpaced the transaction quantity to a level {that a} reversion to the imply has tended to happen. In different phrases, it’s the place value corrections to the draw back have taken place for the asset.

Although, it’s seen from the chart that not each high within the NVT Golden Cross inside this territory coincides with a value high. And in lots of situations that it does, the decline within the asset isn’t to some main diploma.

To date for the reason that sign has appeared, nevertheless, the asset has certainly been taking place, a possible signal that the identical reversion impact could also be in play as soon as extra. It now stays to be seen whether or not draw back might be restricted, or if this might be a type of situations the place the sign was adopted by an prolonged drawdown.

BTC Worth

On the time of writing, Bitcoin is floating round $103,700, down virtually 5% within the final seven days.