Hyperliquid (HYPE) exhibits early indicators of a development reversal after a pointy 12.63% drop in simply two days, regardless of just lately setting new all-time highs. Key indicators such because the DMI and RSI level to weakening momentum and rising bearish strain.

The ADX is rising whereas -DI overtakes +DI, and RSI has slipped under 40—each suggesting sellers are gaining management. Whereas the EMA construction stays technically bullish, a looming dying cross may begin a deeper correction if assist ranges fail to carry.

Hyperliquid Bears Acquire Floor as DMI Shifts Bearish

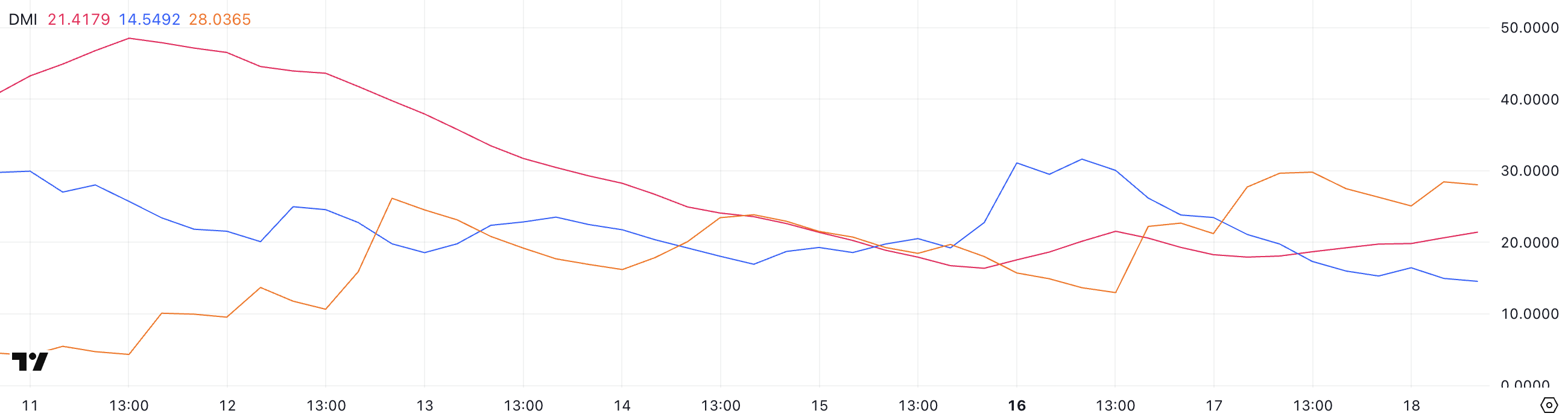

Hyperliquid’s Directional Motion Index (DMI) exhibits that its Common Directional Index (ADX) has risen to 21.41, up from 17.93 only a day earlier.

This improve suggests {that a} development is beginning to strengthen, though the present worth nonetheless displays a comparatively weak development total.

The ADX measures the power—however not the path—of a development, with values above 25 sometimes signaling sturdy developments and values under 20 indicating low momentum or consolidation.

The supporting directional indicators, nonetheless, paint a bearish image for HYPE. The +DI has fallen sharply to 14.54 from 31.61 simply two days in the past, whereas the -DI has climbed to twenty-eight from 12.97 in the identical interval.

This crossover and widening hole point out that promoting strain is rising whereas shopping for momentum is fading.

If this setup continues, it may level to a creating downtrend for HYPE, with sellers more and more accountable for value motion.

Hyperliquid RSI Drops Beneath 40 as Momentum Weakens

Hyperliquid’s Relative Power Index (RSI) has dropped to 39.52, down considerably from 56.26 two days in the past.

This decline displays a shift in momentum, with latest promoting strain overtaking shopping for curiosity.

Because the RSI strikes nearer to the oversold threshold, it suggests weakening bullish sentiment and a possible transition into bearish territory.

The RSI is a momentum indicator that measures the velocity and magnitude of latest value modifications. It ranges from 0 to 100.

Readings above 70 sometimes sign overbought situations—typically adopted by value corrections—whereas readings under 30 recommend oversold situations and potential for a rebound.

An RSI of 39.52 locations Hyperliquid in a neutral-to-weak zone, indicating declining momentum however not but reaching ranges that sometimes immediate a reversal. If RSI continues to fall, it may level to additional draw back danger except momentum shifts happen.

HYPE Pulls Again After ATH as Key Assist Ranges Come Into View

Hyperliquid just lately reached new all-time highs however has since pulled again sharply, falling 12.63% during the last two days. This decline comes regardless of its EMA traces nonetheless holding a bullish construction.

Nonetheless, a possible dying cross could possibly be forming the place short-term EMAs cross under long-term ones.

If this bearish crossover confirms, HYPE could take a look at the important thing assist at $37.32, and a break under that degree may expose it to additional draw back towards $32.62.

Conversely, if momentum shifts and the bullish construction holds, Hyperliquid may get well and retest the resistance zones at $43.98 and $45.77.

A powerful transfer above these ranges would probably sign a renewed uptrend and open the trail for a push towards $50, setting new all-time highs as soon as once more.

Disclaimer

Consistent with the Belief Venture pointers, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. All the time conduct your individual analysis and seek the advice of with an expert earlier than making any monetary choices. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.