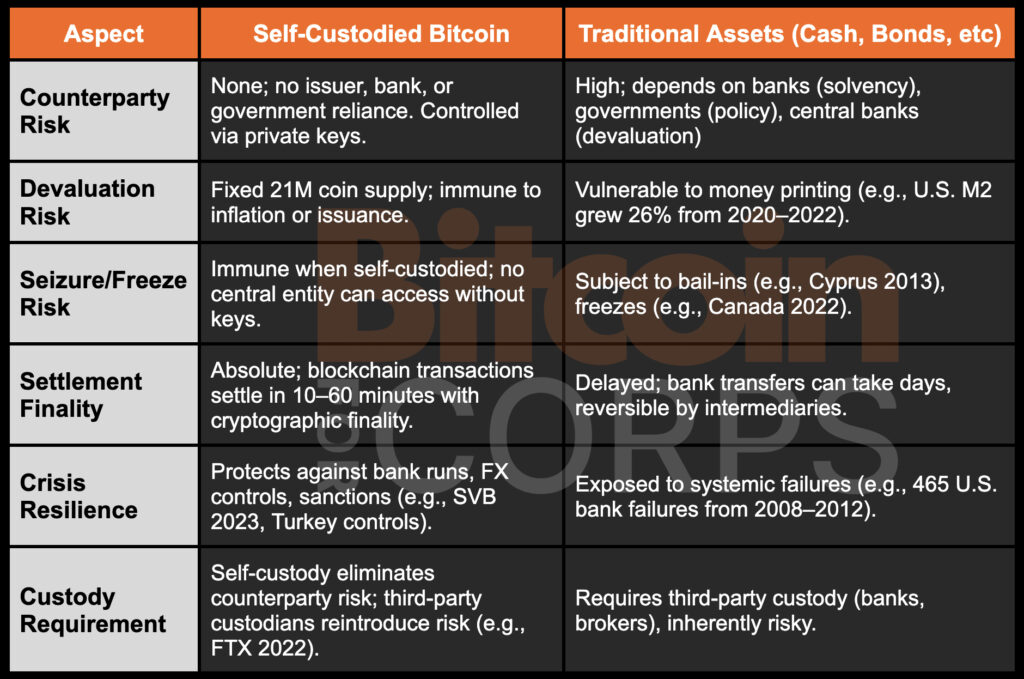

Bitcoin presents firms the uncommon potential to carry pure capital—an asset with no issuer, no counterparty, and no reliance on monetary intermediaries. Nonetheless, these advantages are absolutely realized solely via self-custody, as third-party custodians reintroduce counterparty danger. In an period of rising systemic danger, self-custodied Bitcoin is a strategic asset for de-risking the company treasury stack.

Unseen Counterparty Danger in Treasury Reserves

Company treasury reserves are designed to make sure liquidity and stability, but they’re quietly weak to systemic dangers embedded in conventional monetary techniques. Most reserve belongings—money, authorities bonds, business paper, or cash market funds—are inherently depending on exterior entities:

- Banks: Company money held in banks is uncovered to custodial dangers, together with financial institution insolvency or operational failures. The 2008 monetary disaster revealed how even “too huge to fail” establishments can falter, with 465 U.S. financial institution failures between 2008 and 2012 alone.

- Governments: Financial coverage shifts, akin to quantitative easing or rate of interest hikes, can erode the actual worth of fiat-based reserves. International change controls, like these imposed in Greece in 2015, can limit entry to funds.

- Central Banks: Forex devaluation via unchecked cash provide development—such because the U.S. M2 cash provide rising by 26% from 2020 to 2022—straight undermines the buying energy of money reserves.

These dependencies create a fragile basis for company treasuries, the place dangers are sometimes obscured till a disaster strikes. Bitcoin presents a structurally distinctive different: a non-custodial, non-sovereign, and non-defaultable asset that operates outdoors the standard monetary system. Critically, Bitcoin’s counterparty-free nature is contingent on self-custody—holding non-public keys straight moderately than entrusting funds to third-party custodians, which reintroduce the very dangers Bitcoin avoids. By adopting self-custodied Bitcoin, firms can insulate their reserves from the failures of banks, governments, or different intermediaries, positioning it as a cornerstone for de-risking in an period of rising systemic uncertainty.

Bitcoin as Sovereign Company Capital

Bitcoin’s design eliminates counterparty danger at its core, however solely when firms maintain their very own non-public keys. Self-custodied Bitcoin presents unparalleled monetary sovereignty, making it a transformative asset for company treasuries:

- No Credit score Publicity: Not like bonds or financial institution deposits, Bitcoin has no issuer or debtor whose default might impair its worth. It exists as a decentralized protocol, secured by a worldwide community of miners and nodes, with no single level of failure.

- No Devaluation through Issuance: Bitcoin’s provide is capped at 21 million cash, with issuance ruled by a predictable, unchangeable algorithm. This contrasts with fiat currencies, the place central banks can print cash at will—e.g., the U.S. Federal Reserve expanded its stability sheet from $4.2 trillion in 2019 to $8.9 trillion by 2022, diluting dollar-based belongings.

- No Compelled Bail-Ins, Freezes, or Capital Controls: Self-custodied Bitcoin can’t be seized, frozen, or restricted by centralized authorities with out entry to personal keys. This ensures firms retain absolute management over their capital, even throughout authorities overreach or monetary lockdowns.

- Bearer Asset with Absolute Finality: Bitcoin transactions choose a permissionless, world blockchain with cryptographic finality, usually inside 10–60 minutes. As a bearer asset, self-custodied Bitcoin grants firms direct possession, free from intermediaries like banks or clearinghouses.

The Self-Custody Crucial: These benefits vanish if Bitcoin is held by a third-party custodian, akin to an change or institutional supplier. Custodians reintroduce counterparty danger—e.g., the collapse of FTX in 2022 left billions in shopper belongings inaccessible. Solely self-custody, the place firms management their non-public keys, ensures Bitcoin’s counterparty-free standing. By securing their very own Bitcoin, corporations can maintain capital that’s really unbiased, resistant to the failures or interventions of exterior entities.

Stress Check Environments That Show the Want

Latest crises illustrate the vulnerabilities of conventional treasury belongings and underscore the necessity for a counterparty-free different like self-custodied Bitcoin:

- Cyprus Bail-In (2013): To stabilize failing banks, Cyprus imposed losses on depositors, with accounts over €100,000 dealing with haircuts of as much as 60%. Companies holding money in Cypriot banks had been straight uncovered, highlighting the dangers of custodial dependence. Self-custodied Bitcoin would have been resistant to such bail-ins, as no third occasion might entry or confiscate the funds.

- Canada Trucker Protests (2022): The Canadian authorities froze financial institution accounts of people and companies linked to the protests, demonstrating how rapidly political actions can limit entry to funds. Companies counting on banks confronted quick liquidity dangers, whereas self-custodied Bitcoin would have remained accessible, transferable throughout borders with out permission.

- SVB and Credit score Suisse Collapses (2023): Silicon Valley Financial institution and Credit score Suisse, each thought of “systemically necessary,” confronted liquidity crises that disrupted company depositors. SVB’s failure left 1000’s of companies scrambling for entry to funds, with some dealing with delays of weeks. Self-custodied Bitcoin, saved offline or in safe wallets, would have supplied uninterrupted entry to capital.

- Rising Markets: International locations like Argentina and Turkey have imposed capital controls and FX interventions to stem forex devaluation—Argentina’s peso misplaced 50% of its worth in opposition to the USD in 2023 alone. Companies holding native belongings confronted restrictions on capital outflows, whereas self-custodied Bitcoin might have been moved globally in minutes, bypassing bureaucratic bottlenecks.

These occasions reveal a standard thread: conventional reserves are solely as safe because the establishments and insurance policies behind them. Self-custodied Bitcoin, against this, presents a hedge in opposition to such disruptions, making certain firms can preserve management over their capital in even probably the most excessive eventualities.

Bitcoin as a Danger Mitigation Layer

Self-custodied Bitcoin serves as each a long-term retailer of worth and a catastrophe hedge, providing firms a strong device for danger mitigation:

- Twin-Goal Asset: Bitcoin’s historic value appreciation—averaging 100% annualized returns from 2013 to 2023—makes it a compelling retailer of worth, whereas its decentralized nature protects in opposition to systemic failures. This twin function permits treasuries to protect buying energy whereas hedging in opposition to crises.

- Extremely Transportable Capital: Bitcoin will be transferred globally with minimal charges and no reliance on banks or cost processors. For instance, a company might transfer $10 million in Bitcoin throughout borders in below an hour, in comparison with days or even weeks for conventional wire transfers, that are topic to SWIFT delays or sanctions.

- Black Swan Safety: Bitcoin insulates treasuries from financial institution runs, forex devaluations, sanctions, or capital controls. Throughout Venezuela’s hyperinflation (peaking at 1.7 million% in 2018), Bitcoin grew to become a lifeline for companies to protect worth and transact internationally. Self-custody ensures these protections will not be compromised by third-party failures.

- Resilient Progress: By allocating a portion of reserves to Bitcoin, firms can stability resilience with development. Not like gold, which presents stability however restricted liquidity, Bitcoin combines hedge-like properties with the flexibility to deploy capital dynamically throughout crises.

Self-Custody because the Basis: These advantages depend upon self-custody. Third-party custodians, akin to exchanges or crypto platforms, expose Bitcoin to the identical dangers as conventional banks—e.g., Mt. Gox’s 2014 collapse misplaced 850,000 BTC for shoppers. Through the use of {hardware} wallets or multi-signature setups, firms can guarantee their Bitcoin stays counterparty-free, maximizing its risk-mitigation potential.

Operational Integration

Integrating self-custodied Bitcoin into a company treasury requires cautious planning however is more and more possible as infrastructure matures:

- Custody Methods: Self-custody is non-negotiable for eliminating counterparty danger. Companies can use {hardware} wallets (e.g., Ledger or Trezor) or multi-signature setups requiring a number of non-public keys to authorize transactions, enhancing safety. For bigger companies, enterprise-grade self-custody options, like these supplied by Casa or Unchained Capital, present sturdy key administration with out third-party dependence. Institutional custodians, whereas handy, reintroduce counterparty danger and must be prevented for optimum resilience.

- Evolving Requirements: The ecosystem for company Bitcoin adoption is maturing. Audit companies like Deloitte and PwC now supply crypto-specific reporting frameworks, whereas insurance coverage merchandise for self-custodied Bitcoin (e.g., Coincover’s theft safety) are rising. These instruments assist firms meet regulatory and compliance necessities whereas sustaining sovereignty over their belongings.

- Strategic Deployment: Bitcoin will be held passively as a reserve asset, appreciating over time, however activated throughout crises—e.g., to settle worldwide funds when banks are frozen or to hedge in opposition to forex devaluation. For instance, throughout Turkey’s 2022 lira disaster, companies utilizing Bitcoin preserved worth whereas fiat-based opponents confronted losses.

- Board Governance: Companies ought to set up clear insurance policies for Bitcoin’s function within the treasury. This contains board-approved thresholds for allocation (e.g., 5–10% of reserves), triggers for deployment (e.g., banking crises or FX restrictions), and protocols for safe key administration. Common stress-testing of custody processes ensures preparedness.

By prioritizing self-custody, firms can combine Bitcoin as a strategic asset whereas preserving its counterparty-free benefits, balancing innovation with operational self-discipline.

Conclusion

Company treasuries are educated to diversify throughout asset lessons, however few scrutinize the counterparty dangers embedded in each conventional reserve. Money is dependent upon banks, bonds on issuers, and currencies on central banks—all of which might fail or intervene in ways in which erode worth or entry. Bitcoin, when self-custodied, stands alone as an asset that requires no belief in intermediaries, solely in cryptographic math.

Self-custodied Bitcoin shouldn’t be a substitute for money or bonds however a parallel asset that de-risks the capital stack. It presents firms a hedge in opposition to systemic failures, from financial institution runs to capital controls, whereas preserving long-term development potential. As systemic dangers develop—evidenced by banking crises, geopolitical freezes, and forex devaluations—Bitcoin’s function as a treasury asset turns into simple. For corporations searching for to future-proof their stability sheets, self-custodied Bitcoin is not only a device—it’s a paradigm shift towards true monetary sovereignty.

Disclaimer: This content material was written on behalf of Bitcoin For Companies. This text is meant solely for informational functions and shouldn’t be interpreted as an invite or solicitation to accumulate, buy, or subscribe for securities.