Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Dogecoin’s six-month consolidation is a coil, not a coffin, in accordance with the pseudonymous technician Cantonese Cat, whose 19 June video marshals a number of timeframe proof to argue that the meme-coin’s subsequent directional break shall be up—doubtlessly so far as $4.13 earlier than the present cycle tops out.

Dogecoin Breakout Is Solely A Matter Of Time

The analyst begins by addressing sentiment. Retail remark threads have turned caustic, he notes, as a result of value has slipped from final autumn’s spike after which “finished nothing for months.” But such fatigue is exactly what bull-market retracements are supposed to produce: “Lots of people are getting actually bitter about Doge … that’s precisely how greater highs and better low kind conditions are speculated to get you all annoyed. That is nonetheless a bull pattern till confirmed in any other case.”

Associated Studying

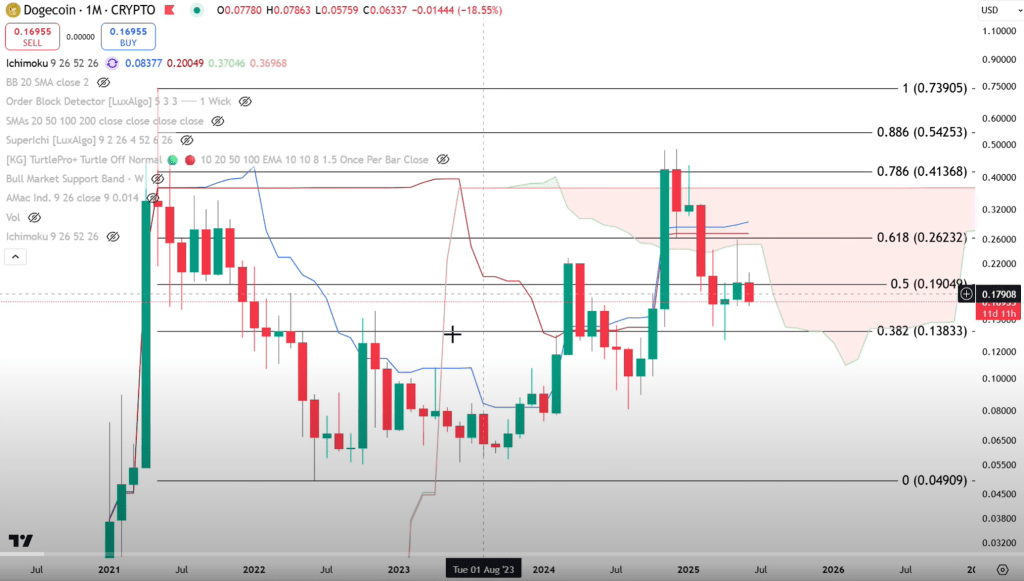

On the highest zoom degree, Dogecoin is tracing what he calls “nonetheless a cup and … nonetheless a deal with till confirmed in any other case.” The primary thrust of that deal with halted virtually precisely on the 0.786 Fibonacci retracement of the 2022–24 bear vary—“a vital fib degree right here.” As a result of preliminary makes an attempt not often pierce that resistance, he anticipated rejection. What issues is the place the pullback discovered help: “Within the case of Dogecoin, it determined to go all the way in which all the way down to 0.382, which is nothing uncommon … that is really a reasonably vital zone of this good Adam-and-Eve double backside.” The market is subsequently testing, not violating, an traditionally highly effective neckline.

Zooming to the month-to-month chart, Dogecoin sits beneath what the analyst calls “a reasonably thick Ichimoku cloud.” Two breakout makes an attempt have failed, producing a pair of wicks that look ominous to informal chart watchers. Cantonese Cat disagrees: “We had slightly little bit of a false breakout right here on the month-to-month … I feel a 3rd time goes to be the appeal.” Beneath the cloud, six consecutive month-to-month candles have nested totally contained in the tall inexperienced bar printed final November. He interprets the formation—six inside bars—as latency constructing for a violent transfer: “You’re speaking about consolidation with six inside candles forming a whole lot of power right here.”

That compression is mirrored on the weekly time-frame: “Should you additionally have a look at the weekly right here, it’s also possible to see that you’ve six inside candles over right here too … that tells me that there’s not a lot bearish power essentially left anymore. I feel we’re nearer to the underside than the highest.”

Key structural help is provided by a rising 20-month easy transferring common, now at $0.1737. Value at the moment ticks under it, however the slope continues to be constructive. Traditionally, such combos resolve in favour of the pattern: “In case you have a 20-month transferring common that’s up-sloping, more than likely that is simply going to be a wick.” He cites an earlier cycle when Dogecoin depraved beneath the identical metric earlier than staging a dramatic reversal.

Value motion, he argues, is meaningless with out context. “If I find yourself taking a look at Doge right here on Coinbase and I pull up the amount right here, it’s also possible to see that there is no such thing as a promoting quantity right here in any respect.” Binance, the world’s deepest Dogecoin market, exhibits equivalent inertia. “The promoting quantity is basically non-existent,” he says, concluding that provide overhang has vaporised and solely demand is required to propel a reversal. Twice earlier than—in July 2023 and February 2024—equivalent quantity droughts preceded V-shaped rallies: “Low promoting quantity over right here, reversal as soon as quantity is available in … low promoting quantity over right here, reversal as soon as quantity is available in.”

Associated Studying

Every day-chart oscillators are starting to corroborate the structural learn. Dogecoin has simply registered what Cantonese Cat labels a “treasure backside”—his time period for a localised capitulation whose candle physique is much smaller than its wick. Extra formally, the relative-strength index has exhibited bullish divergence: value has etched decrease lows whereas RSI turns greater. “Final time when you could have some bullish diversions was proper right here … that was the native backside proper there,” he says, pointing to the October 2023 reversal. The sample repeated in March 2024 and seems once more at the moment: “I feel that we is perhaps experiencing a pattern change right here comparatively quickly.”

DOGE Value Targets

Ought to quantity arrive and value claw again by means of the 0.5 and 0.618 retracements, Cantonese Cat’s Fibonacci ladders flag successive targets. From the Binance dataset, “$1.60, $2.26 and $4.13, all of those are chance for Dogecoin.” A composite feed of a number of exchanges tweaks the numbers to $1.50, $2.27 and $3.94. What he doesn’t foresee is a reprise of 2021’s parabolic blow-off, when Dogecoin tagged the two.272 extension and briefly prompt a trajectory in the direction of $23. “I feel that $23 doge is insane … I don’t assume that doge goes to finish up changing into, you recognize, like something like $3 trillion market cap.” 1 / 4- to half-trillion-dollar capitalisation, nonetheless—roughly the worth zone between three and 4 {dollars}—stays “one thing to consider” given present financial growth.

Cantonese Cat interprets the group’s malaise as a contrarian reward: “The market makers are giving us extra time to purchase whereas the sentiment is extraordinarily, extraordinarily poor.” Inside-bar ranges function a easy set off. An in depth above the six-month vary excessive would, in his studying, unlock the first up-trend’s subsequent leg. Conversely, an in depth under the 20-month common may delay—however not essentially invalidate—the thesis, offered the transferring common itself retains rising.

Throughout each lens—the macro cup-and-handle, the Adam-and-Eve neckline check, Ichimoku resistance, 20-month transferring common help, quantity exhaustion, day by day bullish divergence—the burden of proof converges on a bullish final result. Timing, he concedes, is unknowable: “When is that going to be? I don’t know.” But not one of the information justify capitulation. He closes with the maxim he repeats 3 times within the broadcast: “The pattern is your buddy, and the pattern is up.” If that view holds, Dogecoin’s dormant coil could ultimately unwind towards the analyst’s most formidable extension at $4.13—a degree unthinkable to at the moment’s demoralised sellers, and exactly for that motive, he argues, nonetheless inside attain.

At press time, DOGE traded at $0.171.

Featured picture created with DALL.E, chart from TradingView.com