- Stablecoins already drive as much as 30% of Ethereum’s charge quantity.

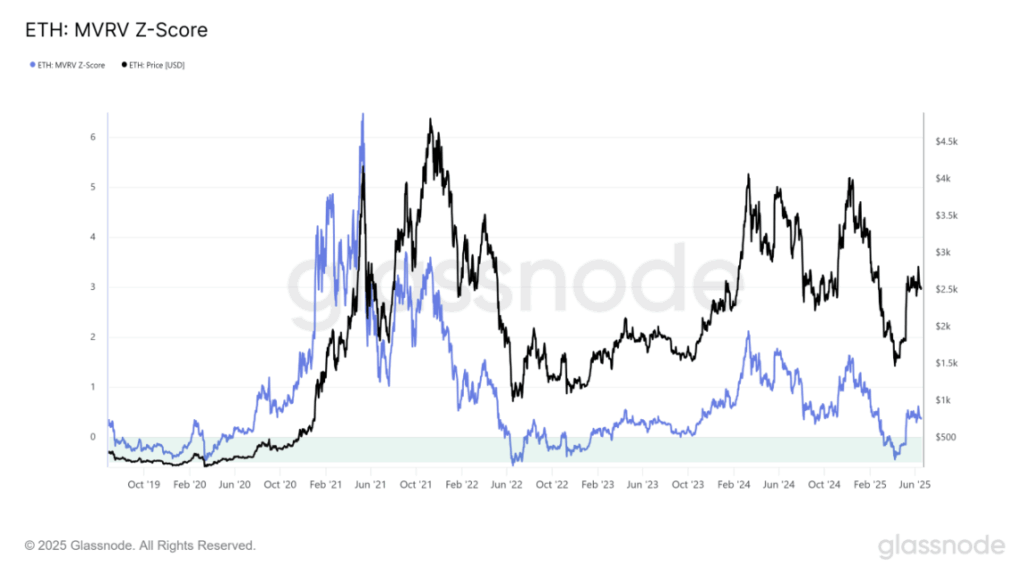

- ETH’s MVRV Z-score suggests it’s undervalued at $2.5k.

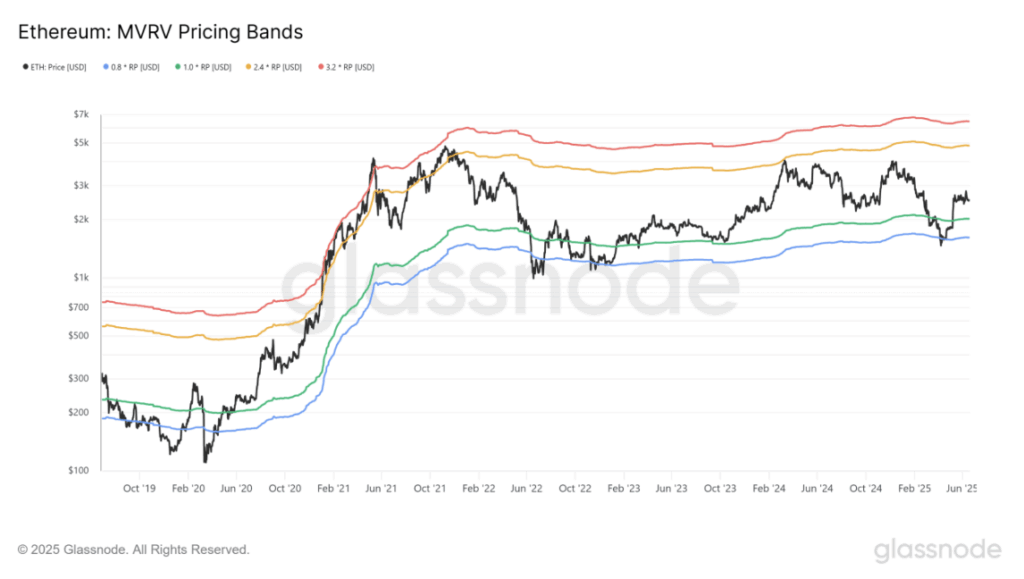

- If stablecoin adoption explodes, Ethereum may push towards $4.8k and even $6.4k this cycle.

Ethereum may very well be majorly undervalued proper now—like, far more than folks assume—if the stablecoin market actually does balloon to $3.7 trillion by 2030. That’s the large take from Tom Lee, Fundstrat’s Chief Analyst. He chimed in after U.S. Treasury Secretary Scott Bessent dropped a daring prediction: stablecoins surging 15x by the tip of the last decade.

Lee didn’t maintain again. He identified that stablecoins like USDT and USDC already make up someplace round 25% to 30% of all Ethereum community charges. That’s not small. He added that if this sort of development occurs, “Ethereum is a direct beneficiary of the GENIUS Act and the approaching surge in stablecoins.” His phrases, not ours—however he is likely to be onto one thing.

ETH Didn’t Pump… But

Right here’s the bizarre half. Even after the GENIUS Act handed, ETH didn’t precisely bounce out of its seat. Costs stayed fairly flat. In the meantime, Circle’s CRCL and Coinbase’s COIN each went flying—double-digit positive aspects, straightforward. ETH simply form of stood nonetheless, which feels off contemplating it’s the spine of all this.

Perhaps the dearth of pleasure got here right down to timing. The market had its eyes glued to larger stuff—rising tensions between Israel and Iran took over the headlines. Individuals weren’t taking note of payments and tokens. It occurs.

Nonetheless, Lee’s level about Ethereum raking in stablecoin-related charges holds up. Over the previous 30 days, Circle and Tether mixed poured greater than $700 million into Ethereum charges. And who topped the chart? Yep—Tether, Circle, and Ethena. All stablecoin giants.

So, Is ETH Grime Low cost Proper Now?

If stablecoins do go full rocket mode, Ethereum may get flooded with new community visitors. Extra utilization = extra charges. That’s form of the entire worth driver. And proper now? ETH’s sitting at about $2.5k. Which… is likely to be low, truthfully.

The MVRV Z-score—principally a option to spot undervalued or overhyped moments—sits at 0.4. That’s low. Actually low. Traditionally, when that rating hits 2 or 1.5, ETH peaks. On this cycle, that might land the value someplace round $4k. Perhaps extra.

However wait—Glassnode’s pricing bands add a bit extra spice. If ETH follows previous tendencies, it may prime out nearer to $4.8k… and even $6.4k. Yeah, that’s a giant leap. However not unimaginable.

Stablecoins May Be ETH’s Hidden Ace

So the place does that go away us? If the stablecoin market explodes like Lee and Bessent are forecasting, ETH won’t simply experience the wave—it may assist energy it. The GENIUS Act is only one piece, but when USDC and USDT maintain dominating charges, and if these numbers scale with a $3.7T market cap? Ethereum received’t keep this low-cost for lengthy.