Key Takeaways

- Bitcoin’s worth trades round key help, as the value may undergo a possible decline.

- Crypto consultants query the present Bitcoin rally, regardless of the value buying and selling above $ 100,000 and the presence of institutional traders.

- The Bitcoin rally lacks actual on-chain presence, as information means that main actions are happening on centralized exchanges.

Bitcoin is at the moment holding above $100,000 following its sturdy rally to new all-time highs across the $111,700 area. Nonetheless, the piece has struggled, hitting an 8% worth decline, as the value of Bitcoin prior to now few days has struggled to indicate bullish worth motion, buying and selling round the important thing help zone.

Regardless of such worth motion in the previous couple of weeks, consultants and merchants have expressed displeasure over the numerous drop in exercise on the Bitcoin community, highlighting an unusually quiet state regardless of hitting new highs and buying and selling above $100,000.

The transaction quantity on the Bitcoin community, when in comparison with 2023 and 2024, has dropped considerably in comparison with previous actions, from over 734,000 per day to a spread of 320,000 to 500,000, a notable distinction in comparison with previous crypto bull cycles.

Though the value of Bitcoin seems sturdy, above $100,000, and institutional curiosity continues to rally, crypto consultants imagine the market continues to be buying and selling surprisingly. Allow us to discover key elements.

On-chain Quantity Decline

The latest decline in on-chain actions, with many Bitcoin spot and perpetual trades happening on centralized exchanges, has highlighted a maturing marketplace for Bitcoin, in line with crypto consultants. As institutional traders focus extra on buying and selling Bitcoin on centralized exchanges, a stark distinction is obvious when in comparison with previous bull cycles, which witnessed sturdy quantity in on-chain actions.

Moreover, crypto consultants have recognized a drop in Bitcoin social quantity in comparison with previous crypto bull runs, which generally noticed rising social quantity as a result of Bitcoin’s power in creating new highs or rallies. Nonetheless, the present bull market has lacked such elements.

Whereas these elements have contributed to the latest worth decline, some crypto consultants imagine the market shouldn’t be in a bull market due to the fixed wrestle for Bitcoin in latest weeks. This worth motion could possibly be replicating Bitcoin’s historic worth struggles in June, as BTC has didn’t carry out in the identical month.

Bitcoin Value Evaluation

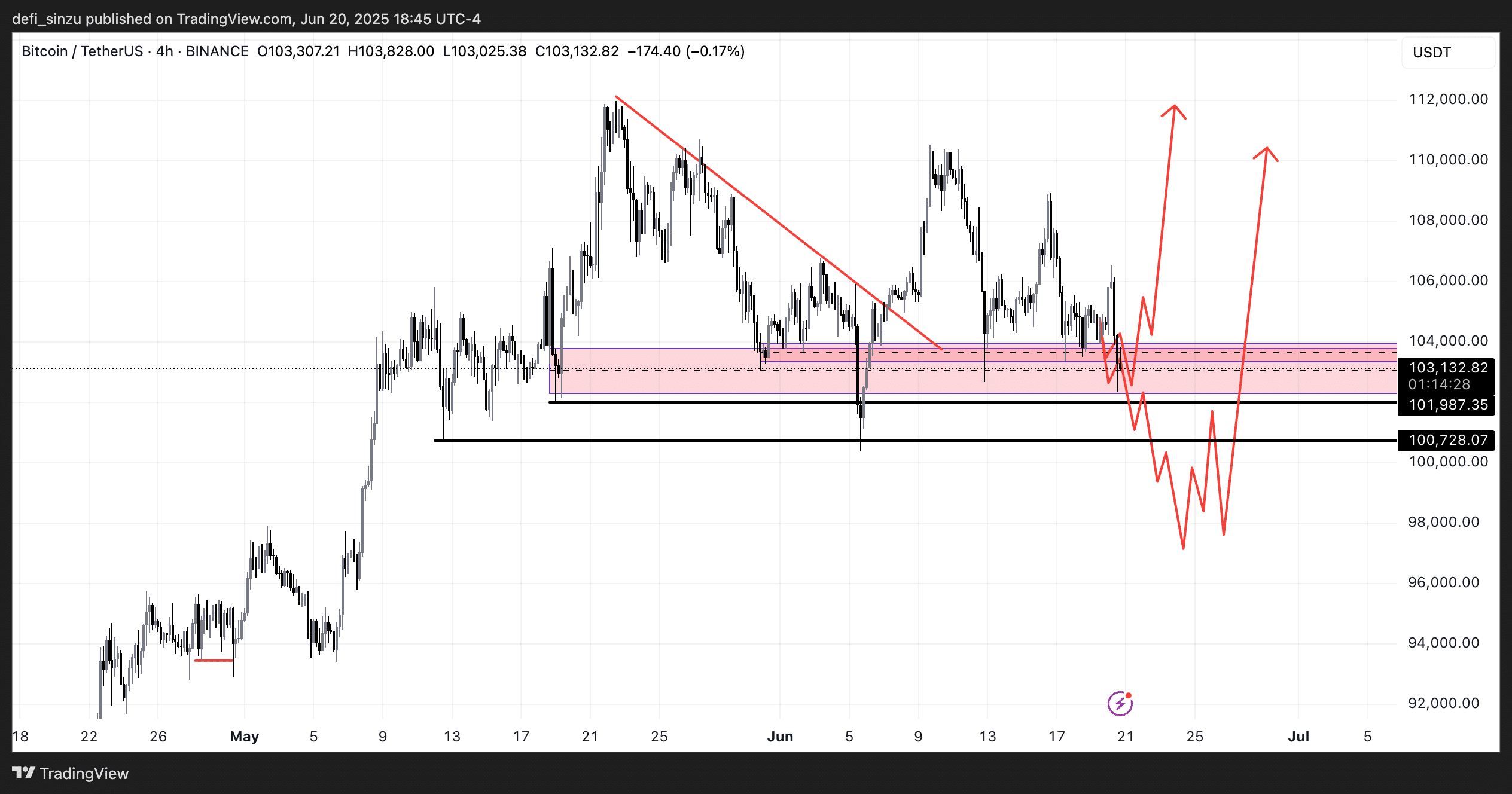

Supply – BTC Value Chart From TradingView

Bitcoin’s worth struggles proceed, creating setbacks for altcoins as the value fell from a area of $106,000 to a area of $102,500. A worth has retested its key help zone on a number of events, and the value may probably break to the draw back.

Whereas the value has traded again into its key zone, there’s a potential for the value to interrupt down into decrease areas, as good cash seeks to seize liquidity in these areas earlier than forming a brand new bullish construction for a possible worth rally to the upside.

With worth headed into the weekend and low quantity, crypto consultants and traders will probably be listening to Bitcoin forward of the approaching week.