Khushi V Rangdhol

Jun 18, 2025 02:38

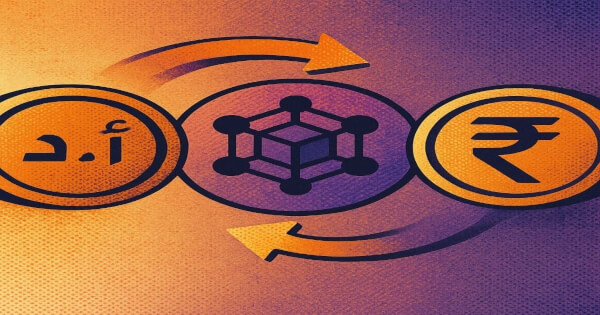

Migrant staff in India are utilizing a crypto path to ship remittances, lowering prices to underneath 2% in comparison with conventional strategies, difficult regulatory frameworks.

India is the world’s high vacation spot for international remittances. The World Financial institution’s newest Migration & Improvement Transient reveals inflows touched US $129 billion in 2024. A lot of that cash arrives from Gulf states—particularly the United Arab Emirates—via conventional money-transfer operators. Within the March-quarter of 2025, sending a US $200 fee from the UAE to India through licensed channels price a median 3.45 % as soon as charges and foreign-exchange mark-ups had been added.

Over the previous yr, nonetheless, migrant staff and small over-the-counter (OTC) brokers have begun routing a part of this circulate via a four-step crypto loop:

-

Dirhams to USDC on an alternate resembling BitOasis.

-

Token switch (normally on the low-fee Tron community) to a dealer pockets in India.

-

Native liquidation of USDC for rupees on a home alternate that also enjoys financial institution entry—usually through a non-bank finance firm (NBFC).

-

Instantaneous payout to the ultimate recipient via India’s IMPS/UPI rails.

Public price tables at BitOasis and two different UAE exchanges present spreads close to 0.3 % for the primary hop, whereas Tron community charges are negligible. Brokers interviewed by The Financial Instances (20 Could 2025) quote an extra 0.6–1 % to transform and distribute rupees through UPI. Taken collectively, the crypto route usually lands under 2 %—lower than two-thirds of the standard hall’s price—although no audited nationwide common exists.

A Blind Spot in Present Guidelines

-

International-exchange regulation. India’s International Trade Administration Act (FEMA) doesn’t point out stable-coins. As a result of the outward leg is settled in tokens, it by no means passes via an authorised-dealer financial institution or generates a Type A2 declaration.

-

Revenue-tax therapy. Part 194S of the Finance Act 2022 imposes a 1 % tax deducted at supply (TDS) on beneficial properties from “digital digital belongings.” When a remitter buys and sells USDC at par, brokers argue no “achieve” arises, so no TDS is triggered.

-

Anti-money-laundering threat. The Enforcement Directorate (ED) has begun taking discover. A November 2024 press launch particulars the freezing of balances in 92 financial institution accounts value ₹5.67 crore tied to crypto-funded betting rings. In Could 2025 the company additionally seized ₹6.3 crore in money from hawala operators who admitted changing proceeds into USDT earlier than off-ramping in India. Whereas these instances weren’t purely remittance-driven, they present regulators tracing crypto routes into home funds.

What Is at Stake

-

Family influence. On a US $6 000 annual remittance, shifting from a 3.45 % price to a sub-2 % crypto route can save a migrant household greater than ₹8 000 a yr—roughly one month of meals bills in lots of Indian cities.

-

Information opacity. If even 5 per cent of 2024’s influx (≈US $6 billion) strikes via unreported stable-coin channels, the RBI loses line-of-sight over a quantity bigger than the web international portfolio funding of some quarters.

-

Systemic threat. A sudden banking-channel shutdown—for instance, if an NBFC’s accomplice financial institution terminates service—may freeze 1000’s of pending payouts with out authorized recourse.

Coverage Choices Beneath Dialogue

Though no round has but been printed, Reserve Financial institution officers have mentioned publicly that crypto-denominated outward transfers are underneath evaluate for the present fiscal yr. Based mostly on precedents in different jurisdictions, three predominant avenues can be found:

-

Make clear and License. Amend FEMA so any stable-coin switch destined for India should circulate via authorised sellers, with the identical KYC and limits that apply to standard remittances.

-

Monitor and Flag. Concern steering requiring banks and fee gateways to flag UPI credit linked to identified high-volume stable-coin liquidation accounts.

-

Present a Compliant Various. Speed up pilots such because the BIS-led mBridge cross-border CBDC venture, or allow a tightly supervised e-rupee hall, to match crypto-level prices whereas preserving transaction visibility.

Outlook

For now, the USDC-to-UPI shortcut stays a authorized gray zone: not expressly prohibited, but clearly exterior the framework that governs the US $129 billion remittance financial system. Its enchantment—decrease charges and near-real-time settlement—is plain. Whether or not the RBI chooses to embrace, compete with, or shut down the follow will decide how a lot of the world’s largest remittance circulate migrates completely to non-public, dollar-linked blockchains.

Picture supply: Shutterstock