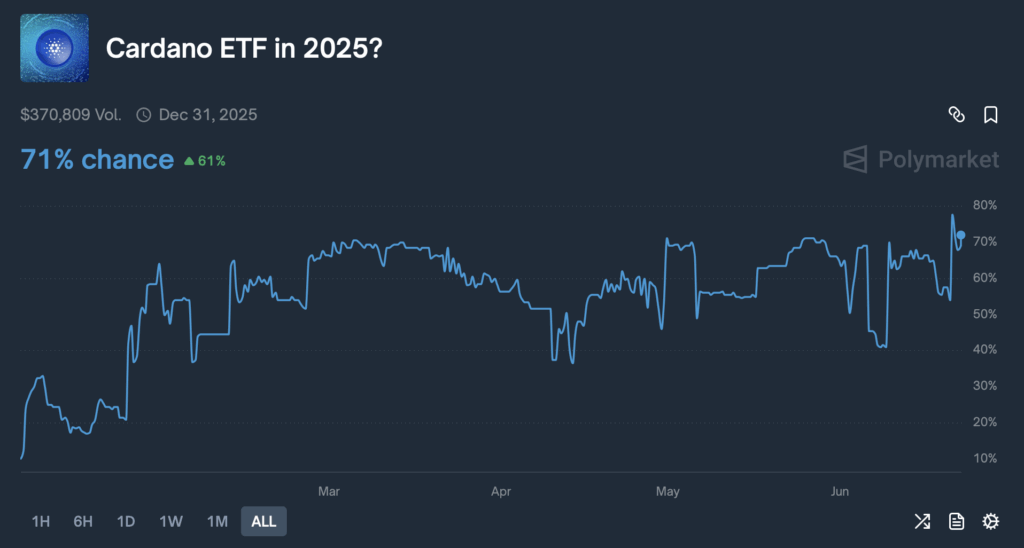

- Polymarket now provides ADA a 79% probability of ETF approval, backed by bullish Bloomberg analysts.

- ADA worth is oversold, with technicals hinting at a potential short-term rebound.

- ETF buzz follows BlackRock’s $70B Bitcoin fund success, triggering altcoin fund optimism.

Issues are heating up for Cardano. Polymarket merchants have now bumped the percentages of a spot ADA ETF approval to 79%, the very best degree ever seen for the token on the prediction platform. The renewed optimism? It principally follows a contemporary spherical of bullish projections from Bloomberg’s Eric Balchunas and James Seyffart, who’ve slapped a 90% approval probability on it.

That’s… an enormous soar.

And the temper’s contagious. Confidence is rising due to what appears to be like like some productive back-and-forth between ETF issuers and the SEC. Grayscale, which already handles Bitcoin and Ethereum funds, filed an ETF proposal for Cardano earlier this 12 months through NYSE Arca. Apparently, the vibes are shifting—analysts are beginning to consider the SEC is warming as much as altcoin ETFs.

“Good Temper” on the SEC? Balchunas Thinks So

Balchunas took to X not too long ago, saying the possibilities of ETFs for ADA, Dogecoin, and XRP are all wanting higher than ever. In line with him, the SEC’s tone has modified—for the higher. He and Seyffart are additionally placing 95% odds on approvals for Avalanche, Polkadot, and Litecoin funds.

Their case? Properly, Bitcoin ETFs paved the best way. Simply take a look at BlackRock’s iShares Bitcoin Belief (IBIT). It pulled in $70 billion in belongings in simply 341 days, changing into the biggest U.S. ETF launch of all time. Yeah. That’s arduous to disregard.

ADA Value Dips, However Chart Exhibits a Doable Reversal Brewing

As of now, ADA’s buying and selling at $0.5768, down about 3.85% on the day. Not essentially the most thrilling quantity… however there’s extra to the story. Buying and selling quantity has spiked 61%, hitting $745.2 million, which is often an indication that one thing’s shifting below the floor.

The RSI is deep in oversold territory at 29.91, and ADA’s brushing the decrease fringe of the Bollinger Bands—particularly at $0.5668. Up to now, that’s the form of setup that tends to snap again arduous. Merchants are on watch.

Zooming out, ADA’s nonetheless sitting inside a broad ascending wedge on the day by day chart. And that wedge? It’s been the launchpad for previous 200–300% rallies. Analysts are eyeing a potential retest of the $2.40 zone if assist holds and ETF hype retains constructing.

Bitcoin ETF Growth Units the Stage for Altcoin Funds

With Bitcoin ETFs killing it, everybody’s making an attempt to bottle that magic. BlackRock’s IBIT noticed over a month straight of inflows in June—severely, 31 consecutive days. And it’s barely a 12 months previous. The demand may be very actual.

However Ethereum ETFs? Not fairly the identical story. Since launching in July 2024, inflows have been lukewarm. In line with Glassnode, the typical Ethereum ETF investor was nonetheless “considerably underwater” via Might. Ouch.

Ultimate Ideas

ETF fever is spreading, and Cardano is likely to be subsequent in line for a breakout second. With Polymarket odds at document highs, quantity surging, and technicals hinting at a reversal, the setup’s wanting spicy.

Nonetheless, as at all times—it’s crypto. Keep sharp.