- Solana breaks under key help following U.S. strike on Iran; worth down 20% from Could highs.

- A accomplished Head and Shoulders sample factors to a doable transfer towards $106.

- SOL should reclaim $149 to shift short-term construction—till then, bears keep in management.

Solana’s taken a tough hit—there’s no sugarcoating it. After information broke of a U.S. navy strike on Iranian nuclear websites, the market spiraled into chaos. And altcoins? Yeah, they felt it the worst. Solana, which had been buying and selling close to $185 not too way back, tumbled quick—now hovering round $148, a full 20% drop from its Could excessive.

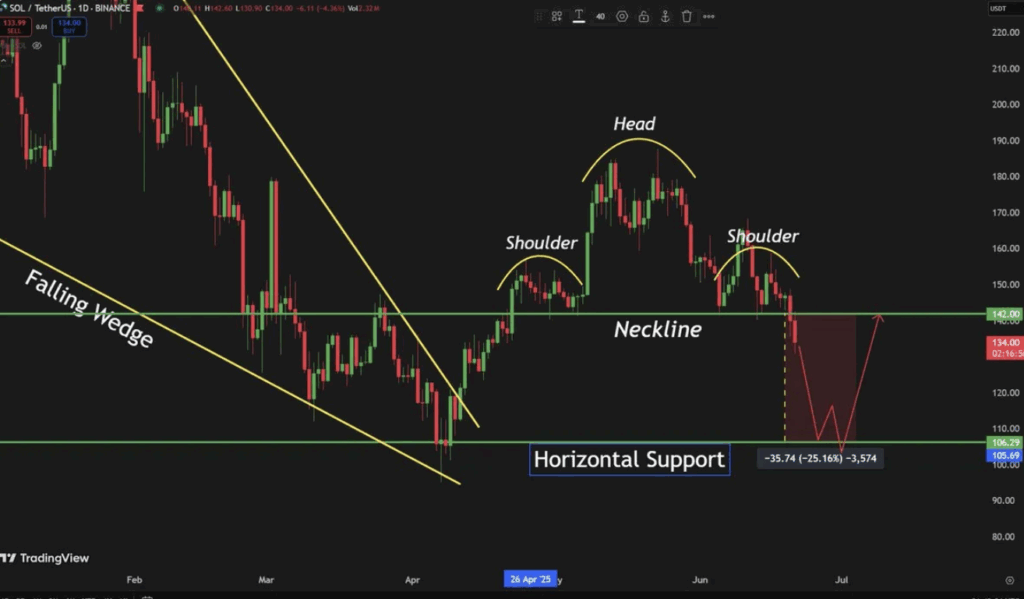

This breakdown just about confirms what many feared: Solana’s uptrend has misplaced steam. High analyst Carl Runefelt flagged a Head and Shoulders formation on the chart—a bearish sample that tends to spell bother. The neckline? Damaged. And when that cracks, extra draw back is normally only a matter of time.

Bulls on the Ropes as Help Evaporates

Each bounce has been met with rejection. Solana hasn’t been in a position to claw again to its earlier help ranges, and momentum indicators are flashing pink throughout the board. With broader sentiment shaky and macro rigidity ramping up, a quick restoration looks like an extended shot—except one thing main adjustments.

The bullish run from late 2024 is now a distant reminiscence. Solana’s worth motion has shifted sharply. Decrease highs, damaged trendlines, fading confidence. It’s now buying and selling over 50% under its all-time excessive, and the Head and Shoulders breakdown? That units up a doable drop towards $106.30—a degree we haven’t seen since February.

Market Rotates Away from Danger — SOL Caught within the Crossfire

This isn’t only a Solana drawback. The complete altcoin market’s displaying indicators of weak spot. Traders are pulling capital out of riskier performs and rotating into Bitcoin and stablecoins. That long-hoped-for altseason? Doesn’t seem like it’s taking place—not but, at the very least.

Solana’s failure to set greater lows or reclaim key resistance zones exhibits a market dropping its footing. Except bulls mount a severe push, we’re taking a look at extra consolidation… or worse, a deeper leg down.

SOL Worth Dips Under 200-Day SMA — Not a Nice Signal

Worth simply cracked under the 200-day SMA—round $149.54—which had been appearing as dynamic help. That transfer alerts a shift in momentum, and never in a great way. SOL’s presently buying and selling close to $135.99, down 3% on the day and sliding quick from its current highs.

The rejection on the 100-day SMA didn’t assist both. With worth now below each the 50- and 200-day averages, and quantity piling up on the pink candles, it’s clear sellers are in management. This isn’t simply noise—it’s conviction.

If the bleeding continues, eyes are on the $120–$125 vary. That zone acted as help earlier this yr, and would possibly—would possibly—supply a brief ground. However the macro image? Nonetheless messy. The geopolitical rigidity from the U.S.–Iran strike has added a thick layer of uncertainty, and on this surroundings, danger property like Solana are likely to take the hit.

What Must Occur Now?

A each day shut above $149 would go a good distance in calming issues down and will shift sentiment again towards impartial. Till that occurs, although, bears are holding the pen—and so they’re nonetheless writing the story.