- Over 35 million ETH are actually staked, locking greater than $100B out of circulation

- Establishments and retail alike are staking extra because of improved accessibility

- The pattern boosts community safety and will push ETH value increased over time

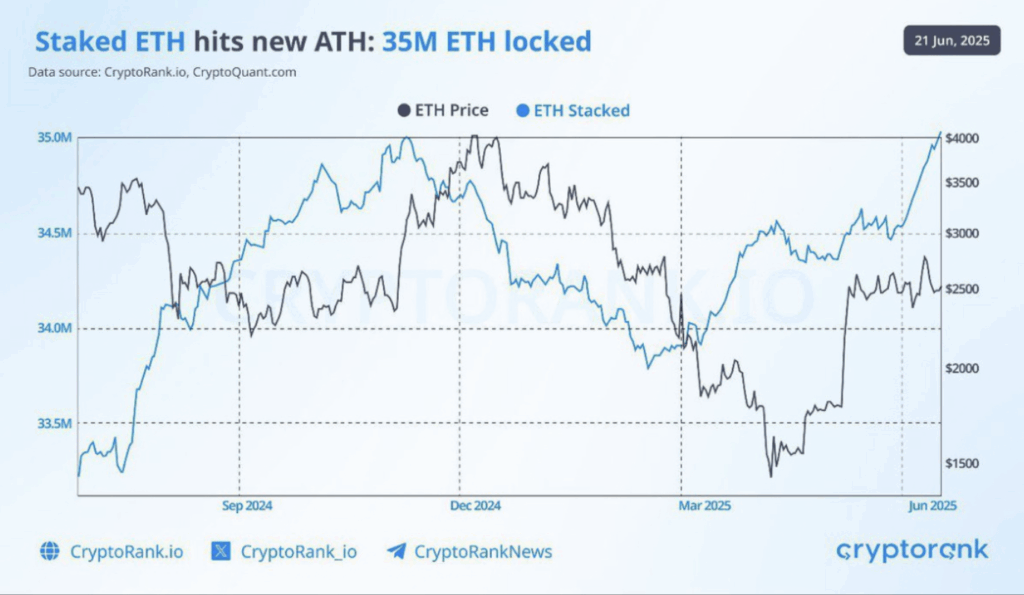

Ethereum simply crossed an enormous milestone. Over 35 million ETH are actually locked in staking contracts—yep, that’s an all-time excessive. The numbers got here from CryptoRank and CryptoQuant, shared on X by Merlijn The Dealer. When you have a look at the chart, it’s been a sluggish and regular climb over the past yr. No dramatic spikes—simply fixed buildup.

What’s fascinating is the timing. ETH has clawed its method again after dipping to round $1,500 earlier this yr. It’s buying and selling above $3,000 once more, and clearly, big-money gamers are paying consideration. Whereas retail’s nonetheless chasing candles, establishments are locking in tokens and enjoying the lengthy recreation.

Extra ETH Getting Staked, Much less ETH on the Market

Right here’s the factor—staked ETH doesn’t transfer. As soon as it’s in, it’s locked. And with 35 million ETH staked, we’re taking a look at over $100 billion pulled out of circulation at present costs. That type of provide squeeze? Fairly bullish if demand retains rising.

Since Ethereum switched to proof-of-stake again in September 2022, it’s ditched power-hungry mining. Now validators safe the community and earn yield—often between 3–6% yearly—by staking their ETH. So naturally, persons are leaping in. Confidence has grown, and what was once a distinct segment transfer is now a significant market habits.

Simpler Staking = Extra Members

What’s helped, too, is accessibility. Staking was once type of a trouble in case you weren’t tremendous techy. Now? You’ve received choices—exchanges, liquid staking platforms, wallets, all making it simpler for on a regular basis people to earn passive yield on their holdings.

This broader participation doesn’t simply lock up tokens. It additionally boosts the safety and decentralization of the community. That, in flip, makes Ethereum extra interesting for devs, which feeds proper again into the worth of the ecosystem. It’s a suggestions loop that’s lastly beginning to click on.

The place Does This Lead?

Trying forward, this pattern in all probability retains rolling. Establishments are wading deeper into crypto waters, and staking is a lovely option to earn regular returns with out buying and selling all day. As instruments enhance and consciousness spreads, we might see much more ETH going into staking. That provides long-term upward stress on value and helps solidify Ethereum as a real Web3 spine.

So yeah, the 35 million milestone? It’s not only a stat—it’s a sign that Ethereum is maturing quick, and the market’s taking discover.