Bullish stress is returning to the crypto market as Bitcoin, the biggest digital asset, rebounded strongly after dropping under the $100,000 mark throughout the weekend. The current pullback seems to have influenced the sentiment of short-term traders as indicated by a unfavourable MVRV studying.

Bitcoin’s Quick-Time period Traders Flip Cautious

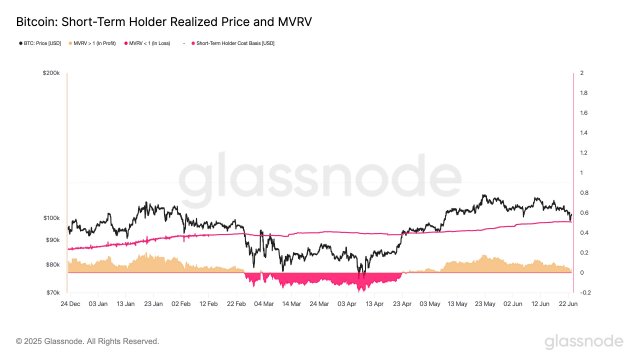

Whereas Bitcoin and the market are slowly turning inexperienced, a number of key metrics are nonetheless in a bearish state. A current report from Glassnode, a world-leading monetary and on-chain platform, highlights a unfavourable pattern amongst short-term BTC holders.

The Bitcoin short-term holder Market Worth to Realized Worth (MVRV) ratio has declined sharply. Particularly, this metric is often used to evaluate sentiment and profitability amongst more moderen market individuals.

Subsequently, this notable drop in the important thing STH MVRV metric displays the rising unease of current traders as a result of ongoing volatility of BTC’s value. It additionally factors to weakening conviction sentiment amongst short-term holders.

Beginning with the BTC Quick-Time period Holders Realized Value, Glassnode famous that the asset has persistently discovered assist within the vary since April. In keeping with the platform, this vary can be the fee foundation of traders holding BTC for greater than 155 days.

Although this vary has held strongly, the short-term holders’ MVRV is at present reducing and is located at simply 0.03, a degree that reveals rising stress on newer traders with solely 3% unrealized features.

It’s value noting that BTC Quick-Time period Holders Realized Value is at present positioned on the $98,100 value mark. Through the weekend, Bitcoin retested this degree as a result of heightened volatility noticed throughout the crypto market.

Although current corrections have rebounded near this degree, Glassnode famous that the Price Foundation Distribution signifies a denser provide barely under, at about $97,000 to $98,000. Within the meantime, this zone would possibly function a real pivot within the following drawdown as stress builds up on newer BTC holders.

Habits Of BTC Traders

In one other X submit, Glassnode has outlined the present motion of BTC traders following an evaluation of the Bitcoin Provide By Investor Habits metric. The metric is usually used to find out the exercise of traders, whether or not they’re promoting or holding.

Glassnode’s essential space of focus on this essential metric is the Loss Sellers, which is noticed to have risen considerably up to now few days. Sometimes, this uptick in loss sellers indicators rising uncertainty and frustration amongst gamers who bought BTC at larger value ranges. Knowledge from the platform reveals that this cohort has grown from 74,000 to 95,600, representing a rise of over 29% since June 10.

Whereas stress on weak palms has spiked, Conviction Consumers additionally witnessed a notable improve. An increase in Conviction Consumers means that sentiment shouldn’t be collapsing. Presently, some are lowering losses whereas others are actively lowering their price foundation.

Featured picture from Pixabay, chart from Tradingview.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our group of prime know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.