Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

On-chain knowledge exhibits Tron (TRX) noticed a big profit-taking spike earlier within the month. Which kind of holder was accountable for the transfer?

Tron SOPR Noticed A Large Spike Earlier In The Month

In a CryptoQuant Quicktake put up, analyst Maartunn has talked concerning the current development within the Spent Output Revenue Ratio (SOPR) of Tron. The SOPR refers to an on-chain indicator that tells us about whether or not the TRX buyers are transferring or promoting their cash at a revenue or loss.

The indicator works by going by the switch historical past of every coin being moved to see what worth it was final transacted at. Cash which have this price foundation above the present spot worth are contributing to loss realization, whereas these with the other setup to revenue realization.

Associated Studying

The SOPR takes the ratio between the spent worth and price foundation, and sums it up for all cash being bought on the blockchain to discover a web state of affairs for the market as a complete.

When the worth of the indicator is larger than 1, it means the buyers are, on common, realizing a revenue by their transactions. Alternatively, the metric being below this threshold suggests the dominance of loss realization available in the market.

Now, right here is the chart shared by the quant that exhibits the development within the Tron SOPR over the previous 12 months:

As displayed within the above graph, the Tron SOPR noticed an enormous spike above the 1 mark earlier within the month, implying buyers took half in a major quantity of profit-taking.

From the chart, it’s additionally seen that there have been different revenue realization spikes in the course of the previous 12 months, however the present one stands out for its scale. The most recent peak within the metric noticed its worth go to 4.74, similar to a revenue margin of 374%.

“With TRX priced at $0.268 on the time, the common acquisition worth for these cash would have been round $0.0566,” explains Maartunn. Curiously, Tron hasn’t seen prolonged intervals round this worth mark since late 2022, that means that the tokens would have been held for an excellent whereas earlier than being lastly transacted this month.

Often, when dormant arms break their silence, it’s prone to be for selling-related functions. That mentioned, it’s not the one purpose they could achieve this. “The exercise may very well be tied to early buyers realizing positive aspects, inside transfers, or reallocation selections,” notes the analyst.

Associated Studying

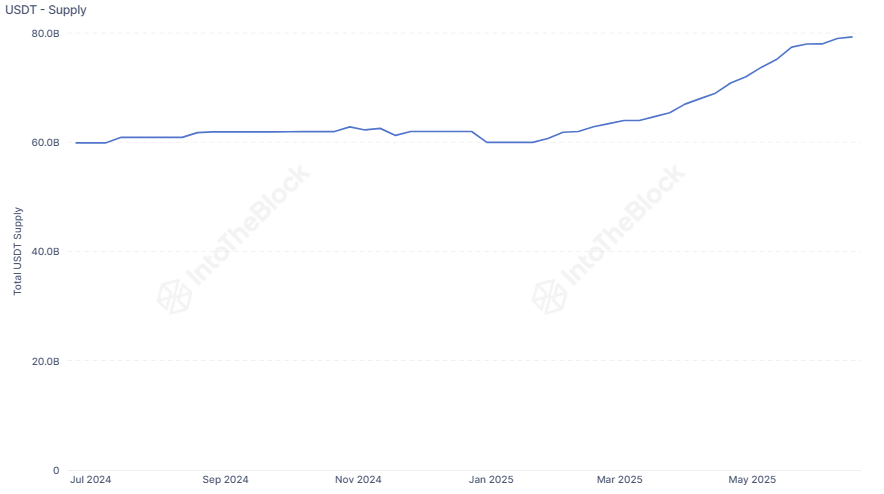

In another information, the USDT provide on the Tron community has reached a brand new milestone, as institutional DeFi options supplier Sentora (previously IntoTheBlock) has identified in an X put up.

There may be now over $80 billion in USDT provide circulating on Tron, the second-most out of any cryptocurrency community.

TRX Worth

On the time of writing, Tron is buying and selling round $0.273, up 0.5% during the last 24 hours.

Featured picture from Dall-E, IntoTheBlock.com, CryptoQuant.com, chart from TradingView.com