Crypto markets will witness $3.42 billion in Bitcoin and Ethereum choices contracts expire at the moment. The huge expiration might trigger a short-term value influence, notably as markets wait expectantly for Bitcoin to tag $100,000.

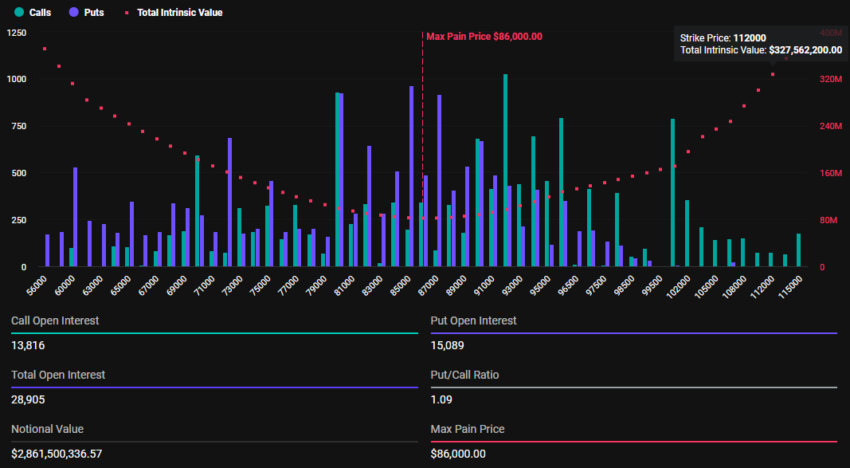

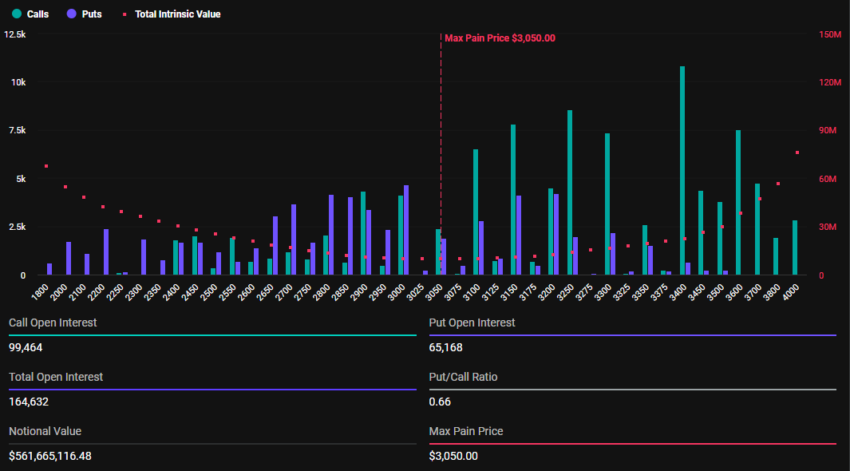

With Bitcoin choices valued at $2.86 billion and Ethereum at $561.66 million, merchants are bracing for potential volatility.

Not like Ethereum, Merchants Wager On Bitcoin Value Pullback

There was a major enhance in Bitcoin (BTC) and Ethereum (ETH) contracts due for expiry at the moment in comparison with final week. In line with Deribit information, 28,905 Bitcoin choices contracts will expire on Friday with a put-to-call ratio of 1.09 and a most ache level of $86,000.

Alternatively, 164,687 Ethereum contracts are due for expiry at the moment, with a put-to-call ratio of 0.66 and a most ache level of $3,050.

Bitcoin’s Put-to-call ratio stands above 1, indicating a typically bearish sentiment regardless of BTC’s whales and long-term holders fueling its current development. As compared, Ethereum counterparts have a put-to-call ratio of 0.66, reflecting a typically bullish market outlook.

The put-to-call ratio gauges market sentiment. Put choices characterize bets on value declines, whereas name choices level to bets on value will increase.

When this ratio is above 1, it suggests an absence of optimism out there, with extra merchants betting on value decreases. Alternatively, a put-to-call ratio beneath 1 suggests optimism out there, and extra merchants are betting on value will increase.

Bitcoin’s Put-to-Name Ratio, Implications for BTC

As choices close to expiration, merchants are betting on BTC costs dropping and ETH costs rising. In line with the Max Ache Concept in choices buying and selling, BTC and ETH might every pull towards their most ache factors (strike costs) of $86,000 and $3,050, respectively. Right here, the most important variety of contracts — each calls and places — would expire nugatory.

Notably, value strain for each property will ease after Deribit settles contracts at 08:00 UTC at the moment. On the time of writing, nonetheless, BTC was buying and selling for $98,876, whereas ETH was exchanging palms for $3,389. In the meantime, consistent with put-to-call ratios, analysts at Greeks.dwell anticipate an prolonged transfer north for ETH and say BTC is on the cusp of a correction.

“With about 8% of positions expiring this week, the large rally in Ethereum has led to a major enhance in ETH main time period choices IV [implied volatility], whereas BTC main time period choices IV has remained comparatively steady. The market sentiment stays extraordinarily optimistic at this level,” Greeks.dwell analysts stated.

The analysts additionally observe that whereas Bitcoin dangers a correction, the generalized market rally retains this potential pullback at bay. They ascribe the constructive sentiment out there to vital capital inflows into ETFs (exchange-traded funds), particularly BlackRock’s IBIT choices, which began to commerce solely lately alongside a strongly pushed spot bull market.

However, with at the moment’s high-volume expiration, merchants ought to anticipate fluctuations in Bitcoin and Ethereum costs that would form their short-term developments.

Disclaimer

In adherence to the Belief Challenge pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nonetheless, readers are suggested to confirm info independently and seek the advice of with knowledgeable earlier than making any choices based mostly on this content material. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.